Global Digital Twin in Telecom Market - Key Trends & Drivers Summarized

Why Are Digital Twins Becoming Central to Telecom Network Optimization and Innovation?

Digital twin technology is quickly becoming a cornerstone in the evolution of the telecommunications industry, providing virtual replicas of physical networks, components, and systems that can be used to simulate, monitor, and optimize operations in real-time. As telecom providers face mounting pressure to manage sprawling 5G infrastructure, legacy systems, and heterogeneous service demands, digital twins offer a dynamic way to visualize and understand complex, multi-layered networks. These virtual models allow engineers and operators to test network changes, model traffic loads, simulate failures, and predict performance outcomes before making changes in the real-world environment - greatly reducing downtime, risks, and maintenance costs. With the rollout of 5G, digital twins play a pivotal role in supporting ultra-low latency applications, edge computing, and massive IoT deployments, where precision and agility are critical. The technology supports end-to-end visibility across core, edge, and radio access networks (RAN), enabling providers to conduct proactive maintenance, optimize energy consumption, and manage capacity in real-time. Additionally, digital twins facilitate faster innovation cycles by offering a sandbox for developing and deploying new services, protocols, or business models. By bridging the physical and digital worlds, they are transforming network management from reactive troubleshooting to predictive intelligence, reshaping how telecom operators approach both operations and strategic growth.How Are Emerging Technologies Powering the Evolution of Digital Twins in Telecom?

The rapid development of supporting technologies such as AI, machine learning, 5G, and edge computing is supercharging the capabilities of digital twins in telecom, enabling more sophisticated simulations, real-time analytics, and automated decision-making. Artificial Intelligence and ML algorithms process massive volumes of network data to recognize patterns, predict anomalies, and dynamically update digital twin models with a high degree of accuracy. These smart twins can simulate network performance under different scenarios - such as congestion, hardware failures, or cyberattacks - and recommend optimal responses in real time. Edge computing plays a critical role by bringing processing power closer to data sources, reducing latency and enabling faster feedback loops between physical networks and their digital counterparts. Cloud-native architectures and containerization make it easier to scale and deploy digital twins across global network environments. Moreover, advanced visualization tools, including AR/VR and 3D modeling, allow operators to interact with their networks in immersive formats, enhancing situational awareness and cross-team collaboration. Blockchain integration is also being explored to secure data exchange within and between twin models, especially in multi-vendor ecosystems. These technological advancements not only expand the functional capabilities of digital twins but also reduce the barriers to adoption, making them a viable solution for telecoms of all sizes seeking to accelerate digital transformation and network agility.Why Is Telecom Industry Demand for Digital Twin Technology Accelerating Globally?

The demand for digital twin technology in telecom is gaining momentum globally as service providers seek to deliver reliable, scalable, and differentiated services in an increasingly complex and competitive environment. The explosion of data traffic driven by video streaming, remote work, gaming, and IoT requires networks that are not only robust but also intelligent and self-optimizing. Digital twins empower telecoms to manage these evolving demands by continuously analyzing network behavior and enabling rapid reconfiguration in response to real-time events. As 5G becomes commercially available in more regions, network densification through small cells, beamforming, and dynamic spectrum sharing increases operational complexity - an area where digital twins excel. Additionally, the transition from legacy to virtualized and software-defined networks (SDNs and NFVs) is creating a hybrid infrastructure that demands real-time orchestration and visibility across layers. Enterprises, smart cities, and industrial clients are also demanding customized network slices with guaranteed performance, and digital twins help simulate and deliver these services effectively. Regulatory pressures and the need for sustainability are further fueling adoption, as twins assist in optimizing energy use and meeting compliance standards. As telecom providers strive to reduce churn, improve quality of service (QoS), and launch revenue-generating services more quickly, digital twins are proving to be strategic assets that bridge the gap between innovation and operational excellence.What Are the Key Drivers Fueling Global Growth in the Digital Twin in Telecom Market?

The growth in the digital twin in telecom market is driven by a convergence of strategic, technological, and operational imperatives that are reshaping how telecom operators design, deploy, and manage their networks. A primary driver is the global deployment of 5G and the parallel demand for ultra-reliable, low-latency networks capable of supporting diverse use cases ranging from autonomous vehicles to industrial automation. Digital twins facilitate faster and more cost-effective network planning, rollout, and management, significantly improving time-to-market for next-gen services. Another major driver is the increasing complexity of modern telecom networks, which span physical infrastructure, software layers, and multi-vendor environments. Digital twins offer a unified, real-time view that enhances transparency and control across these fragmented ecosystems. The rising importance of customer experience and network reliability in a hypercompetitive market is also compelling telecoms to adopt predictive maintenance and AI-driven optimization enabled by digital twins. Additionally, the growing availability of high-performance computing, real-time analytics platforms, and scalable cloud infrastructure is making it technically feasible and economically viable to deploy digital twin models at scale. Supportive government policies promoting digital infrastructure and smart city development are further encouraging investment in advanced telecom capabilities. Together, these drivers are positioning digital twins as a foundational technology in the telecom industry's evolution toward intelligent, autonomous, and customer-centric network operations.Report Scope

The report analyzes the Digital Twin in Telecom market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Component (Platform, Software, Services); Technology (Internet of Things, Artificial Intelligence, Big Data Analytics, Other Technologies); Deployment (Cloud-based, On-Premise, Hybrid); Organization Size (Large Enterprises, SMEs); End-User (Telecom Operators, Communication Service Providers, Mobile Network Operators, Internet Service Providers, Other End-Users).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Digital Twin Platform segment, which is expected to reach US$907.7 Billion by 2030 with a CAGR of a 23.9%. The Digital Twin Software segment is also set to grow at 17.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $116.3 Billion in 2024, and China, forecasted to grow at an impressive 20.3% CAGR to reach $217.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Digital Twin in Telecom Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Digital Twin in Telecom Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Digital Twin in Telecom Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Accenture PLC, Altair Engineering Inc., Amazon Web Services, Inc., ANSYS Inc., Atos SE and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Digital Twin in Telecom market report include:

- Akselos SA

- Cisco Systems Inc.

- Dassault Systèmes SE

- Digital Twin Sim LLC

- Ericsson AB

- General Electric Company

- Huawei Technologies Co., Ltd.

- IBM Corporation

- InterDigital Inc.

- Italtel S.p.A.

- Microsoft Corporation

- Nokia Corporation

- NTT Communications Corporation

- Oracle Corporation

- SAP SE

- Schneider Electric SE

- Siemens AG

- TPG Telecom Limited

- Vodafone Group plc

- ZTE Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Akselos SA

- Cisco Systems Inc.

- Dassault Systèmes SE

- Digital Twin Sim LLC

- Ericsson AB

- General Electric Company

- Huawei Technologies Co., Ltd.

- IBM Corporation

- InterDigital Inc.

- Italtel S.p.A.

- Microsoft Corporation

- Nokia Corporation

- NTT Communications Corporation

- Oracle Corporation

- SAP SE

- Schneider Electric SE

- Siemens AG

- TPG Telecom Limited

- Vodafone Group plc

- ZTE Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 232 |

| Published | February 2026 |

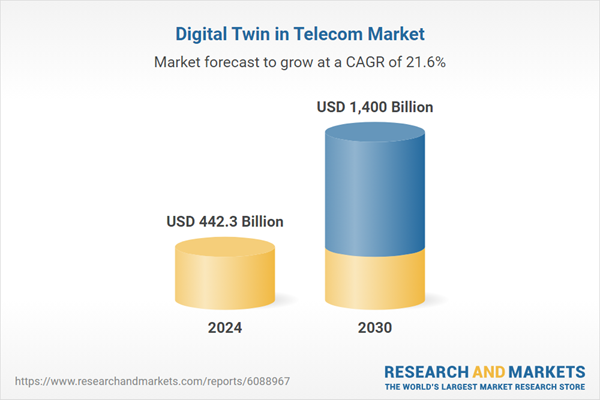

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 442.3 Billion |

| Forecasted Market Value ( USD | $ 1400 Billion |

| Compound Annual Growth Rate | 21.6% |

| Regions Covered | Global |