Global Digital Adoption Platforms Market - Key Trends & Drivers Summarized

Why Are Digital Adoption Platforms Emerging as Critical Tools in Enterprise Software Utilization?

Digital Adoption Platforms (DAPs) have rapidly evolved from optional tools to essential infrastructure within enterprise IT ecosystems, addressing one of the most persistent challenges in digital transformation - ensuring users effectively adopt and utilize complex software systems. As businesses increasingly invest in enterprise applications like CRMs, ERPs, HRIS, and collaborative tools, the ROI of these investments hinges on user engagement and proficiency. DAPs act as intelligent, in-app guidance layers that overlay on top of software interfaces, providing real-time support, onboarding walkthroughs, tooltips, and contextual help to guide users through tasks. This proactive, embedded training model reduces reliance on traditional manuals or classroom sessions, streamlining workflows and reducing support ticket volumes. By enabling seamless user experiences and minimizing learning curves, DAPs significantly increase software usage rates, data accuracy, and overall productivity. They also cater to a wide range of user personas - from digital natives to technophobic users - making them valuable across departments and user demographics. In a hybrid and remote-first work environment, where users often lack on-site IT support or peer coaching, the role of DAPs becomes even more critical. Enterprises that once struggled with software underutilization and user resistance now view digital adoption as a strategic lever for maximizing digital transformation success and operational agility.How Are Technological Advancements Expanding the Scope and Capabilities of DAPs?

The capabilities of Digital Adoption Platforms are expanding rapidly, fueled by advancements in AI, analytics, automation, and integration frameworks. Modern DAPs leverage machine learning algorithms to personalize user guidance based on individual behaviors, role-based needs, and usage patterns, making onboarding and training dynamically responsive. AI-driven insights can detect where users drop off, struggle, or bypass certain features, allowing organizations to refine user flows and eliminate friction points in real time. Natural Language Processing (NLP) is being integrated to power intelligent search and conversational interfaces, enhancing self-service capabilities within the platform. Additionally, robust analytics dashboards offer granular visibility into feature adoption, user engagement, and software ROI - helping IT and business leaders make data-informed decisions about their technology stacks. Integration capabilities have also improved, with DAPs now supporting a wide range of SaaS platforms, legacy systems, and even mobile and custom-built enterprise applications. Low-code and no-code configurations enable rapid deployment and maintenance, reducing IT dependency and accelerating time to value. Furthermore, multilingual support and accessibility compliance are being built into DAPs, making them more inclusive and scalable for global organizations. These technological enhancements are transforming DAPs from simple training overlays into strategic platforms that optimize the entire digital experience lifecycle across an organization.Why Is Enterprise Demand for Digital Adoption Platforms Surging Across Industries?

Enterprise demand for Digital Adoption Platforms is witnessing explosive growth across industries as companies grapple with accelerating digital transformation initiatives and increasingly complex software environments. In sectors such as finance, healthcare, retail, manufacturing, and government, compliance requirements, employee turnover, and evolving user roles necessitate continuous training and seamless adaptation to new systems - needs that DAPs are uniquely positioned to meet. In customer-facing operations like call centers or sales teams, rapid onboarding and knowledge retention are crucial for service consistency, while DAPs help reduce ramp-up time and boost employee confidence. Similarly, in back-office functions like HR, procurement, or IT, where software complexity can hinder efficiency, DAPs provide just-in-time guidance to improve data quality and process compliance. As global enterprises scale their software ecosystems across geographies and teams, DAPs ensure consistent user experiences and reduce the burden on centralized support teams. The shift to remote and hybrid work models has further amplified demand, as traditional training formats have become less feasible, and in-app learning offers a more agile alternative. Moreover, mergers, acquisitions, and new technology rollouts often lead to user disruption, which DAPs help mitigate through change management and continuous enablement. Across all verticals, enterprises are recognizing that user adoption is not just a training issue - it's a strategic determinant of software success and business outcomes.What Are the Key Drivers Fueling the Global Growth of the Digital Adoption Platforms Market?

The growth in the Digital Adoption Platforms market is driven by a convergence of business, technological, and workforce-related dynamics that underscore the urgency of user-centric digital enablement. A key driver is the increasing volume and complexity of enterprise software deployments, as companies adopt multiple SaaS applications and seek to integrate them into cohesive digital workflows. Despite heavy investments in these platforms, organizations often struggle with underutilization, inefficiency, and poor user experiences - challenges that DAPs are designed to solve. Another major factor is the shift toward remote and hybrid work, which has eliminated many traditional forms of peer-based learning and in-person support, heightening the need for embedded, on-demand guidance tools. The rising focus on employee experience and productivity - especially amid labor shortages and digital skill gaps - is also prompting HR and L&D leaders to adopt DAPs as part of broader talent enablement strategies. On the customer side, companies are deploying DAPs to support users navigating complex digital interfaces, reducing churn, and enhancing satisfaction. Regulatory and security compliance concerns are further contributing to DAP adoption, as they ensure process adherence without increasing training overhead. Venture capital investment, vendor innovation, and a maturing ecosystem of platform providers are accelerating the adoption curve. As digital transformation becomes a non-negotiable imperative, DAPs are emerging as the connective tissue between technology investment and user performance - making them a critical asset in the global digital economy.Report Scope

The report analyzes the Digital Adoption Platforms market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Deployment (Cloud, On-Premise); Application (User Onboarding, Customer Support, Product Training, Employee Onboarding, Change Management, Other Applications); End-User (BFSI, Manufacturing, IT & Telecom, Retail & Consumer Goods, Government & Public Sector, Healthcare, Other End-Users).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Cloud Deployment segment, which is expected to reach US$1.8 Billion by 2030 with a CAGR of a 23.9%. The On-Premise Deployment segment is also set to grow at 16.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $215.8 Million in 2024, and China, forecasted to grow at an impressive 29.2% CAGR to reach $619 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Digital Adoption Platforms Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Digital Adoption Platforms Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Digital Adoption Platforms Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as accessiBe Inc., AccessibilityChecker.org INC, Acquia Inc., Adobe Inc., AudioEye, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Digital Adoption Platforms market report include:

- Appcues

- AppLearn

- Apty

- Chameleon

- Inline Manual

- Newired

- Pendo

- Spekit

- Stonly

- Toonimo

- Userflow

- UserGuiding

- UserIQ

- Userlane

- Userpilot

- VisualSP

- WalkMe

- Whatfix

- Zeal Digital Adoption Platform

- Zingtree

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Appcues

- AppLearn

- Apty

- Chameleon

- Inline Manual

- Newired

- Pendo

- Spekit

- Stonly

- Toonimo

- Userflow

- UserGuiding

- UserIQ

- Userlane

- Userpilot

- VisualSP

- WalkMe

- Whatfix

- Zeal Digital Adoption Platform

- Zingtree

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 395 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

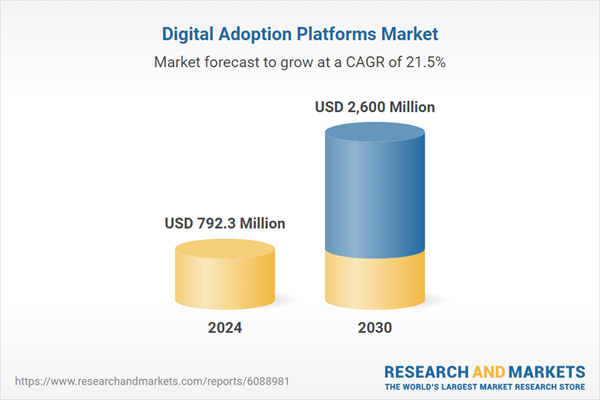

| Estimated Market Value ( USD | $ 792.3 Million |

| Forecasted Market Value ( USD | $ 2600 Million |

| Compound Annual Growth Rate | 21.5% |

| Regions Covered | Global |

![Microplastic Analysis Market by Analyte [Polyethylene, Polystyrene, Polypropylene], Product [Microscopy (Optical, Electron), Spectroscopy (FTIR, Raman, GC-MS, LC-MS), Software, Consumables], Application [Water, Soil, Air], End User - Global Forecast to 2030 - Product Image](http://www.researchandmarkets.com/product_images/12871/12871296_60px_jpg/microplastic_analysis_market.jpg)