Global Digestive Health Food and Drinks Market - Key Trends & Drivers Summarized

Why Are Digestive Health Products Becoming a Core Focus in Functional Nutrition?

Digestive health food and drinks have surged into mainstream consumer consciousness as global interest in wellness, gut health, and preventative nutrition continues to rise. Consumers are increasingly aware of the critical link between the digestive system and overall health, with emerging scientific consensus highlighting the gut's influence on immunity, mood, energy levels, and even mental health through the gut-brain axis. This has led to a substantial uptick in demand for food and beverages formulated with prebiotics, probiotics, postbiotics, dietary fiber, and fermented ingredients. Products like yogurt, kefir, kombucha, fortified juices, high-fiber cereals, and functional snack bars are gaining market share, not just for their taste or convenience but for their perceived ability to support digestive balance and reduce gastrointestinal discomfort such as bloating, irregularity, or heartburn. The appeal extends across demographics, from young adults focused on wellness trends to older consumers managing age-related digestive issues. Meanwhile, increasing diagnoses of irritable bowel syndrome (IBS), lactose intolerance, gluten sensitivity, and other digestive disorders are pushing consumers toward gut-friendly alternatives that are gentle yet effective. As the global population becomes more proactive about long-term health maintenance, digestive health products are no longer viewed as niche or therapeutic - they're becoming a staple in everyday diets.How Is Innovation Shaping the Future of Digestive Health Food and Beverage Formulations?

Innovation in ingredients, delivery formats, and product development is redefining the landscape of digestive health food and drink, enabling brands to meet consumer demands for functionality, convenience, and sensory appeal. Ingredient technologies have evolved beyond traditional probiotics and fiber to include heat-stable probiotics, resistant starches, polyphenols, and enzymatic blends that enhance nutrient absorption and gut flora diversity. Food scientists are also exploring synbiotics - combinations of probiotics and prebiotics that work synergistically - as well as next-generation postbiotics, which offer gut benefits without the need for live organisms. These advances are allowing for the creation of shelf-stable, ambient-temperature products that maintain efficacy without refrigeration, widening their market potential. Functional beverages now include non-dairy probiotic shots, sparkling gut-health sodas, and botanical-infused elixirs, while snack formats incorporate seeds, pulses, and high-fiber grains to deliver digestive benefits in convenient, grab-and-go packaging. Meanwhile, clean label and plant-based trends are driving demand for digestive health products made with minimal processing, natural ingredients, and transparent sourcing. Brands are leveraging AI and microbiome data to personalize offerings based on consumer needs, preferences, and even genetic profiles. This constant cycle of innovation is reshaping how digestive wellness is perceived - not as a corrective approach to discomfort, but as a proactive, enjoyable part of daily nutrition.Why Is Consumer Awareness and Lifestyle Shifts Fueling Market Growth for Digestive Health Products?

The growth of the digestive health food and drinks market is underpinned by a profound shift in consumer attitudes toward proactive health management and holistic wellness. As consumers become more educated about the role of gut microbiota and the long-term effects of digestive imbalances, they are actively seeking out products that not only alleviate symptoms but also enhance daily wellbeing. Lifestyle trends such as clean eating, flexitarianism, and low-FODMAP or gluten-free diets are driving greater label scrutiny and influencing purchasing behavior. A growing segment of consumers now prioritizes functional benefits over indulgence, especially among millennials and Gen Z, who view food as medicine and expect tangible outcomes from their dietary choices. In urban settings and health-conscious communities, digestive health is increasingly tied to beauty (via skin clarity), fitness (via nutrient absorption), and cognitive function (via the gut-brain link). Additionally, the COVID-19 pandemic has heightened awareness of immunity, prompting more people to explore gut-supportive products that also claim immune benefits. Influencer marketing, social media wellness trends, and digital health platforms are playing a significant role in spreading awareness and driving trial of new functional products. These lifestyle shifts are not fleeting fads but part of a deeper reorientation toward self-care and sustainable health, ensuring long-term momentum for the digestive health segment.What Are the Key Drivers Powering the Global Growth of the Digestive Health Food and Drinks Market?

The growth in the digestive health food and drinks market is propelled by a combination of scientific validation, shifting demographics, retail expansion, and strategic industry investment. One of the most influential drivers is the growing body of clinical research validating the impact of gut health on immunity, metabolism, and mood, which has reinforced consumer trust and broadened the market beyond digestive disorders. The rising prevalence of gastrointestinal issues, food intolerances, and stress-related digestion problems, especially in industrialized nations, has increased reliance on dietary interventions over pharmaceutical solutions. Aging populations in developed markets are also contributing, as digestive efficiency tends to decline with age, creating steady demand for fiber-rich and probiotic-fortified options. On the supply side, major food and beverage companies are investing heavily in functional product lines, often through acquisitions of health-focused startups or in-house innovation labs dedicated to gut wellness. Retailers, both brick-and-mortar and e-commerce, are expanding their assortments of gut-health products, often with curated wellness aisles and personalized nutrition platforms. Government recommendations and global health organizations are advocating for increased fiber intake and probiotic consumption, further supporting market expansion. With heightened demand for transparency, quality, and efficacy, brands that can deliver clinically supported, consumer-friendly digestive health solutions are positioned to thrive in a market that shows no sign of slowing down.Report Scope

The report analyzes the Digestive Health Food and Drinks market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product (Fermented Dairy Product, Probiotics, Prebiotics, Digestive Fruit Beverages, Food Enzymes, Other Products); End-Use (Dairy Products, Bakery & Cereals, Non-Alcoholic Beverages, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Fermented Dairy Product segment, which is expected to reach US$10.1 Billion by 2030 with a CAGR of a 4.5%. The Probiotics segment is also set to grow at 4.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $7.2 Billion in 2024, and China, forecasted to grow at an impressive 8.8% CAGR to reach $7.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Digestive Health Food and Drinks Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Digestive Health Food and Drinks Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Digestive Health Food and Drinks Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aegle Nutrition, American Pharma MFG, Inc., Atlantic Essential Products, Inc., BioCorp Nutrition Labs, Canyonside Labs and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 39 companies featured in this Digestive Health Food and Drinks market report include:

- Abbott Laboratories

- Activia (Danone)

- Arla Foods Ingredients Group

- BioGaia AB

- Chobani LLC

- Coca-Cola Company

- Danone S.A.

- DuPont de Nemours, Inc.

- Fonterra Co-operative Group Ltd.

- General Mills Inc.

- Glanbia plc

- Kerry Group plc

- Lallemand Inc.

- Lifeway Foods, Inc.

- Nestlé S.A.

- Olipop

- PepsiCo, Inc.

- Poppi (acquired by PepsiCo)

- Probi AB

- Yakult Honsha Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Laboratories

- Activia (Danone)

- Arla Foods Ingredients Group

- BioGaia AB

- Chobani LLC

- Coca-Cola Company

- Danone S.A.

- DuPont de Nemours, Inc.

- Fonterra Co-operative Group Ltd.

- General Mills Inc.

- Glanbia plc

- Kerry Group plc

- Lallemand Inc.

- Lifeway Foods, Inc.

- Nestlé S.A.

- Olipop

- PepsiCo, Inc.

- Poppi (acquired by PepsiCo)

- Probi AB

- Yakult Honsha Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 288 |

| Published | February 2026 |

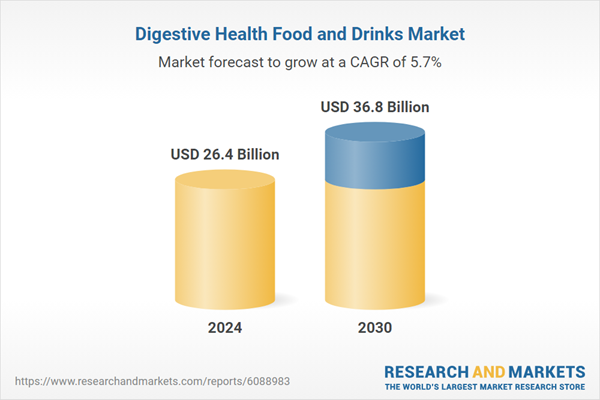

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 26.4 Billion |

| Forecasted Market Value ( USD | $ 36.8 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |