Global Dietary Fibers in Food Additives Market - Key Trends & Drivers Summarized

Why Are Dietary Fibers Gaining Prominence as Functional Food Additives?

Dietary fibers have emerged as one of the most sought-after food additives in the global food industry due to their dual role in enhancing product texture and delivering scientifically backed health benefits. These indigestible carbohydrates, derived from plant-based sources such as fruits, vegetables, legumes, cereals, and novel raw materials like seaweed and fungi, are increasingly incorporated into a wide array of processed foods and beverages to enrich their nutritional profile. As consumers become more health-conscious and better informed about the role of gut health, heart disease prevention, and blood sugar management, the demand for high-fiber formulations has surged. Food manufacturers are responding by fortifying bakery products, dairy alternatives, snacks, cereals, and meal replacements with soluble and insoluble fiber variants to meet market expectations for both clean labels and wellness benefits. Soluble fibers such as inulin, beta-glucan, and psyllium contribute to viscosity and prebiotic effects, while insoluble fibers like cellulose and lignin add bulking capacity and improve digestive regularity. Regulatory bodies around the world are also increasingly recognizing dietary fibers for their role in disease prevention, leading to favorable labeling regulations and nutritional claims. As a result, dietary fibers are no longer just supplementary ingredients but have become strategic components in functional food innovation, helping brands align with consumer values and health-driven purchasing decisions.How Are Technological Advances Expanding the Use of Dietary Fibers in Food Additive Applications?

Advances in food processing technologies and ingredient engineering are significantly broadening the application scope and functionality of dietary fibers as food additives. Modern extraction and purification methods, such as enzymatic treatment, fermentation, and membrane filtration, have enabled the development of highly refined, soluble fibers with minimal flavor impact and excellent water-binding, emulsifying, and gelling properties. These attributes allow dietary fibers to act as fat replacers in reduced-calorie formulations, sugar substitutes in low-glycemic index products, and texture enhancers in gluten-free and plant-based alternatives. Additionally, microencapsulation and nano-structuring technologies are being used to improve fiber bioavailability and compatibility with heat-sensitive food systems, such as soups, beverages, and ready-to-eat meals. The rise of multifunctional fibers - capable of delivering both sensory improvement and nutritional enrichment - is prompting their integration into more complex formulations without compromising mouthfeel or shelf stability. Furthermore, smart labeling technologies and digital traceability tools are giving consumers more transparency about fiber sources and functionalities, enhancing product trust. With growing interest in personalized nutrition and digestive health, fibers are being engineered to target specific gut microbiota profiles, offering differentiated benefits tailored to individual dietary needs. These technological advancements are transforming dietary fibers from passive bulking agents into intelligent, multifunctional ingredients at the forefront of next-gen food design.Why Is Consumer Demand and Health Awareness Driving Fiber-Enriched Food Product Innovation?

The surge in consumer awareness around nutrition, gut health, and chronic disease prevention is one of the most powerful forces reshaping food product development, and dietary fibers are at the center of this transformation. Consumers are increasingly prioritizing functional foods that deliver tangible health benefits, such as improved digestion, sustained energy, cholesterol management, and enhanced immunity - goals that dietary fibers are well-positioned to support. Trends such as the gut-brain axis, microbiome optimization, and low-FODMAP diets are making fiber content a key purchasing criterion, particularly among millennials, Gen Z, and health-focused adults. Social media, fitness influencers, and mobile health apps are also contributing to this shift by educating the public on fiber's role in maintaining metabolic health, controlling weight, and reducing the risk of conditions such as type 2 diabetes, colorectal cancer, and heart disease. As a result, food and beverage companies are innovating aggressively, launching high-fiber variants of traditional products like breads, yogurts, protein bars, and smoothies. Clean label and plant-based positioning further bolster fiber-fortified products' appeal, especially when coupled with organic, non-GMO, and allergen-free claims. Retailers and e-commerce platforms are also curating “fiber-rich” categories to meet the growing interest in digestive wellness. This consumer-driven momentum is compelling brands to integrate dietary fibers not just as a nutritional bonus but as a core feature of their value proposition.What Are the Key Drivers Fueling the Global Expansion of Dietary Fibers in Food Additives?

The growth in the dietary fibers in food additives market is propelled by an intersection of consumer health trends, regulatory support, technological innovation, and expanding applications across global food systems. One of the primary drivers is the rising prevalence of lifestyle-related diseases, which has elevated public and clinical interest in fiber-rich diets as a preventive healthcare strategy. Governments and health organizations are promoting fiber intake through public campaigns and updated nutritional guidelines, incentivizing manufacturers to formulate compliant and health-forward products. Simultaneously, the growing market for plant-based and vegan foods has increased demand for natural fiber sources that enhance mouthfeel and replace textural roles typically served by animal-based ingredients. Cost-efficiency and functional versatility also make dietary fibers attractive to manufacturers aiming to improve product shelf life, reduce formulation costs, and enhance nutritional labeling. Expanding agricultural supply chains and investment in ingredient innovation - especially in regions like Asia-Pacific and Latin America - are improving global access to high-quality fiber inputs. Moreover, mergers, acquisitions, and collaborations between food tech companies and agricultural producers are accelerating the commercialization of novel fiber blends tailored to specific food categories. With increasing consumer preference for functional foods, clearer labeling laws, and a global pivot toward preventive nutrition, dietary fibers are poised to become a cornerstone of sustainable and health-conscious food formulation for years to come.Report Scope

The report analyzes the Dietary Fibers in Food Additives market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Fruits & Vegetables, Cereals & Grains, Nuts & Seeds, Legumes); Type (Insoluble Fiber, Soluble Fiber); Application (Beverages, Bakery & Confectionery, Convenience Foods, Frozen Desserts & Dairy, Sauces & Dressings, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Fruits & Vegetables segment, which is expected to reach US$1.4 Billion by 2030 with a CAGR of a 8.5%. The Cereals & Grains segment is also set to grow at 11.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $922.9 Million in 2024, and China, forecasted to grow at an impressive 13.1% CAGR to reach $1.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Dietary Fibers in Food Additives Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Dietary Fibers in Food Additives Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Dietary Fibers in Food Additives Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ACE Mould, Adval Tech Holding AG, Arburg GmbH + Co KG, DMG Mori Aktiengesellschaft, Dongguan Sincere Tech and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Dietary Fibers in Food Additives market report include:

- ADM (Archer Daniels Midland Company)

- AGT Food and Ingredients

- Batory Foods

- BENEO GmbH

- Cargill, Incorporated

- CFF GmbH & Co. KG

- DuPont de Nemours, Inc.

- Emsland Group

- Frutarom

- General Mills

- Grain Processing Corporation

- Ingredion Incorporated

- Kerry Group plc

- Lonza Group

- Nexira

- Procter & Gamble

- Roquette Frères

- Sudzucker AG

- Taiyo International

- Tate & Lyle plc

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ADM (Archer Daniels Midland Company)

- AGT Food and Ingredients

- Batory Foods

- BENEO GmbH

- Cargill, Incorporated

- CFF GmbH & Co. KG

- DuPont de Nemours, Inc.

- Emsland Group

- Frutarom

- General Mills

- Grain Processing Corporation

- Ingredion Incorporated

- Kerry Group plc

- Lonza Group

- Nexira

- Procter & Gamble

- Roquette Frères

- Sudzucker AG

- Taiyo International

- Tate & Lyle plc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 289 |

| Published | February 2026 |

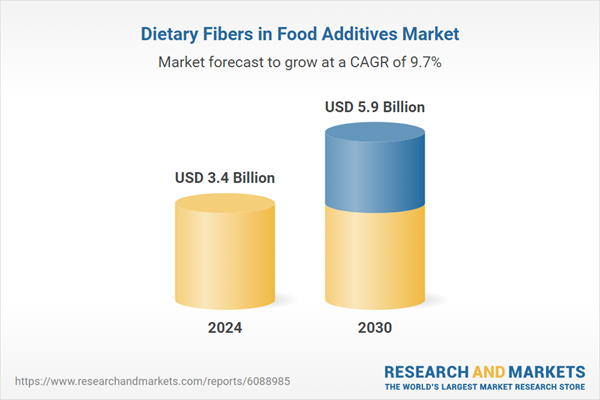

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.4 Billion |

| Forecasted Market Value ( USD | $ 5.9 Billion |

| Compound Annual Growth Rate | 9.7% |

| Regions Covered | Global |