Global Diagnostic Electrocardiograph (ECG) Market - Key Trends & Drivers Summarized

Why Is Diagnostic Electrocardiography Central to Cardiovascular Disease Management Today?

Diagnostic electrocardiography (ECG) has long been a foundational tool in the detection, diagnosis, and monitoring of cardiovascular conditions, serving as a first-line test in both routine checkups and emergency settings. With cardiovascular disease (CVD) remaining the leading cause of mortality worldwide, the importance of early, accurate, and non-invasive diagnostic techniques like ECG cannot be overstated. ECG devices record the electrical activity of the heart and help identify arrhythmias, myocardial infarction, ischemia, and other cardiac anomalies in real time. Their speed, accessibility, and diagnostic power make them indispensable in hospitals, ambulatory settings, intensive care units, and even in primary care clinics. Diagnostic ECGs guide critical decisions - from initiating life-saving interventions to referring patients for advanced imaging or surgery. Their role has only grown with aging populations, increasing sedentary lifestyles, and the global rise in hypertension, diabetes, and obesity - all of which heighten cardiovascular risk. Moreover, ECGs are pivotal in pre-operative evaluations and sports medicine, where cardiac health must be screened efficiently. As public health systems worldwide focus on preventive care, diagnostic ECGs are being adopted more widely for mass screenings and risk stratification, ensuring that heart conditions are detected early and managed effectively, thereby reducing long-term healthcare costs and improving patient outcomes.How Are Technological Advancements Revolutionizing Diagnostic ECG Devices?

Recent technological innovations are significantly transforming the functionality, accessibility, and user experience of diagnostic ECG devices, making them more accurate, portable, and integrated into broader healthcare ecosystems. Traditional 12-lead ECG machines have evolved into compact, wireless-enabled, and AI-assisted tools capable of performing high-resolution recordings and advanced signal interpretation. Machine learning algorithms are now being embedded into ECG software to assist clinicians in detecting subtle abnormalities, automating report generation, and reducing inter-reader variability. Some systems offer cloud-based storage and real-time transmission, enabling remote consultations and telecardiology services - an especially vital feature in rural and underserved regions. Wearable ECG monitors, such as smartwatches and patches, are also reshaping patient monitoring by allowing for continuous rhythm tracking and detection of transient arrhythmias like atrial fibrillation that might not appear during a standard ECG. Additionally, integration with electronic health records (EHR) and interoperability with other diagnostic systems allow ECG data to become part of a unified care continuum. Advances in sensor technology have enhanced signal clarity even in mobile or high-noise environments, making ECGs more reliable across use cases. These innovations are expanding the scope of diagnostic ECGs from hospital-centric devices to essential tools in personalized and preventive cardiovascular care.Why Is Demand for Diagnostic ECGs Increasing Across Healthcare Settings Globally?

The demand for diagnostic ECGs is on the rise across healthcare systems globally due to the escalating burden of heart disease, growing awareness of early detection, and expansion of health infrastructure in emerging markets. In high-income countries, aging demographics and widespread chronic disease are driving more frequent cardiac assessments, including baseline and follow-up ECGs as part of routine care. Meanwhile, in low- and middle-income countries, public health initiatives aimed at reducing non-communicable disease burdens are boosting investment in primary care diagnostics, with ECGs being among the most cost-effective tools. Emergency medical services and ambulances are increasingly equipped with portable ECG machines to enable immediate triage and transmission of cardiac data to hospitals, shortening door-to-treatment times for heart attack patients. Outpatient clinics, pharmacies, and mobile health units are also adopting ECGs for rapid risk assessment and referral. Furthermore, health insurers and employers are promoting cardiovascular screenings through workplace wellness programs, community outreach, and telemedicine platforms - many of which now include ECG capabilities. The demand is also fueled by educational institutions and sports organizations conducting mandatory cardiac screening to prevent sudden cardiac events among athletes and students. As access to healthcare expands and patients seek more personalized and proactive management, diagnostic ECGs are becoming a universal component of clinical and preventive healthcare delivery models.What Are the Key Drivers Accelerating Global Growth in the Diagnostic ECG Market?

The growth in the diagnostic electrocardiograph (ECG) market is propelled by a convergence of healthcare demands, technological innovation, regulatory support, and shifting consumer expectations. Foremost among these is the increasing prevalence of cardiovascular conditions, including arrhythmias, ischemic heart disease, and heart failure, which necessitate early diagnosis and continuous monitoring. The widespread adoption of point-of-care diagnostics and the decentralization of healthcare services have opened new avenues for ECG deployment in non-hospital environments. Additionally, the surge in telehealth adoption, catalyzed by the COVID-19 pandemic, has accelerated the demand for portable and remote ECG devices that integrate with virtual care platforms. Government initiatives aimed at improving rural and community-based healthcare - especially in populous countries like India, China, and Brazil - are further fueling ECG deployment in remote clinics and outreach programs. Reimbursement reforms and favorable policies in the U.S., Europe, and parts of Asia are making ECGs more accessible by reducing patient and provider costs. On the industry side, global manufacturers are investing heavily in R&D to produce AI-powered, user-friendly, and smartphone-compatible devices tailored for home use and clinical environments alike. These efforts are supported by collaborations between tech firms, cardiology associations, and digital health startups, all working to expand ECG's diagnostic reach. Together, these drivers are shaping a robust and rapidly expanding global market for diagnostic ECG devices, firmly positioning them as indispensable tools in the evolving landscape of cardiovascular care.Report Scope

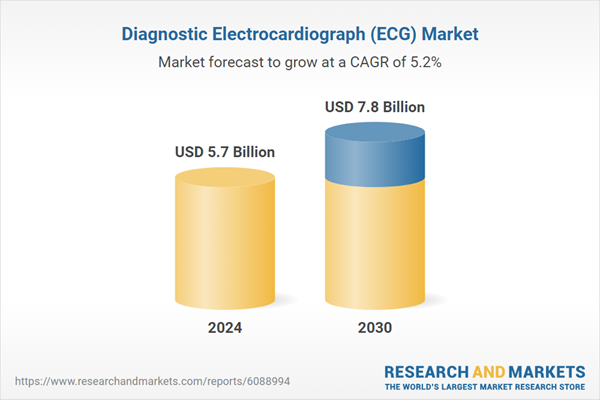

The report analyzes the Diagnostic Electrocardiograph (ECG) market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Resting ECG Systems, Stress ECG Systems, Holter Monitors, Event Monitors, Mobile Cardiac Telemetry Systems, Other Product Types); End-Use (Hospitals, Clinics, & Cardiac Centers, Ambulatory Surgery Centers, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Resting ECG Systems segment, which is expected to reach US$2 Billion by 2030 with a CAGR of a 3.9%. The Stress ECG Systems segment is also set to grow at 6.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.6 Billion in 2024, and China, forecasted to grow at an impressive 8% CAGR to reach $1.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Diagnostic Electrocardiograph (ECG) Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Diagnostic Electrocardiograph (ECG) Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Diagnostic Electrocardiograph (ECG) Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Diagnostic Electrocardiograph (ECG) market report include:

- ACS Diagnostics

- AliveCor, Inc.

- Allengers Medical Systems

- BPL Medical Technologies

- CardioNet (BioTelemetry)

- Compumed, Inc.

- Eko Health Inc.

- Fukuda Denshi Co., Ltd.

- GE HealthCare

- Hill-Rom Holdings, Inc.

- Johnson & Johnson Services, Inc.

- Koninklijke Philips N.V.

- Medtronic plc

- Mindray Medical International Limited

- Mortara Instrument, Inc.

- Nihon Kohden Corporation

- OSI Systems, Inc. (Spacelabs Healthcare)

- Schiller AG

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Welch Allyn (Hill-Rom Services)

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ACS Diagnostics

- AliveCor, Inc.

- Allengers Medical Systems

- BPL Medical Technologies

- CardioNet (BioTelemetry)

- Compumed, Inc.

- Eko Health Inc.

- Fukuda Denshi Co., Ltd.

- GE HealthCare

- Hill-Rom Holdings, Inc.

- Johnson & Johnson Services, Inc.

- Koninklijke Philips N.V.

- Medtronic plc

- Mindray Medical International Limited

- Mortara Instrument, Inc.

- Nihon Kohden Corporation

- OSI Systems, Inc. (Spacelabs Healthcare)

- Schiller AG

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Welch Allyn (Hill-Rom Services)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 296 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.7 Billion |

| Forecasted Market Value ( USD | $ 7.8 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |