Global Dense Wavelength Division Multiplexing (DWDM) Systems Market - Key Trends & Drivers Summarized

Why Are DWDM Systems the Backbone of Modern High-Capacity Networks?

Dense Wavelength Division Multiplexing (DWDM) systems have become the cornerstone of modern optical networking infrastructure due to their unparalleled ability to maximize data transmission capacity over existing fiber networks. By allowing multiple data streams to be transmitted simultaneously over a single optical fiber using different light wavelengths, DWDM systems exponentially increase bandwidth without the need for additional fiber installation - a costly and time-intensive endeavor. This technology is especially critical in a data-driven world where video streaming, cloud computing, 5G connectivity, and IoT applications are placing unprecedented demands on telecom networks and data centers. Enterprises and telecom operators rely on DWDM systems to facilitate high-speed, long-distance communication while maintaining scalability and efficiency. These systems are capable of transmitting terabits of data over hundreds of kilometers with minimal signal degradation, thanks to integrated optical amplifiers and dispersion compensation technologies. DWDM's high spectral efficiency also makes it ideal for backbone, metro, and long-haul networks that require both performance and reliability. As global internet penetration rises and digital transformation accelerates across industries, DWDM systems are playing an indispensable role in enabling next-generation network infrastructure that is robust, scalable, and future-ready.How Are Technological Advancements Enhancing the Capabilities of DWDM Systems?

Technological innovation is driving the evolution of DWDM systems, significantly expanding their performance, flexibility, and intelligence. One of the most notable advancements is the shift toward coherent optical transmission, which uses sophisticated modulation formats and digital signal processing (DSP) to enable higher data rates per channel and greater tolerance for fiber impairments. Coherent DWDM systems can now support 400G, 600G, and even 800G per wavelength, allowing service providers to meet exploding bandwidth demands while minimizing equipment footprint and power consumption. Additionally, tunable lasers and reconfigurable optical add-drop multiplexers (ROADMs) are making DWDM networks more dynamic, allowing for remote wavelength provisioning, automated rerouting, and seamless scalability. Software-defined networking (SDN) integration is also playing a transformative role by enabling centralized network control, real-time analytics, and automated fault recovery. Artificial intelligence and machine learning are being leveraged to optimize wavelength allocation, predict equipment failures, and reduce operational complexity. These innovations are especially crucial in supporting cloud-native architectures and latency-sensitive applications like autonomous vehicles, telemedicine, and industrial automation. With continuous R&D investment and strategic vendor partnerships, DWDM technology is evolving beyond traditional telecom use cases to power ultra-resilient, high-capacity transport layers across diverse digital ecosystems.Why Is the Demand for DWDM Systems Surging Across Sectors and Geographies?

The widespread adoption of cloud services, mobile broadband, and video streaming is driving explosive growth in data traffic, propelling demand for DWDM systems across both developed and emerging markets. In North America and Europe, the expansion of hyperscale data centers and edge computing infrastructure has created a pressing need for scalable, high-throughput backbone solutions - making DWDM an essential technology for inter-data center connectivity. In the Asia-Pacific region, where rapid urbanization and digital inclusion initiatives are underway, governments and telecom operators are investing heavily in fiber-optic infrastructure that relies on DWDM for long-haul and metro connectivity. The rollout of 5G networks further accelerates demand, as DWDM systems are used to backhaul massive volumes of wireless traffic with ultra-low latency. Additionally, sectors like finance, healthcare, education, and government are deploying private DWDM networks to support mission-critical applications requiring high security, speed, and redundancy. International submarine cable networks, which are integral to global internet connectivity, also utilize DWDM to optimize transmission capacity across vast distances. The ability of DWDM systems to adapt to diverse topologies - point-to-point, ring, or mesh - adds to their appeal, making them suitable for everything from national backbones to enterprise campus networks. With growing reliance on digital infrastructure and the rise of smart cities, the global demand for DWDM technology is not only increasing in volume but also in strategic importance.What Are the Key Drivers Powering the Global Expansion of DWDM Systems?

The growth in the DWDM systems market is driven by a combination of macroeconomic, technological, and strategic factors that collectively underscore the urgency for robust optical transport infrastructure. First and foremost is the insatiable demand for bandwidth, fueled by video conferencing, online education, cloud gaming, and 4K/8K content consumption - all of which require high-speed, uninterrupted data flow. Telecom operators are under immense pressure to upgrade their core and access networks to handle this surge, and DWDM provides a scalable and cost-efficient solution. Second, the global rollout of 5G networks necessitates ultra-low latency and high-capacity transport solutions, for which DWDM is uniquely suited as a backhaul and fronthaul enabler. Third, the decentralization of data through edge computing requires reliable, high-speed links between central data hubs and distributed edge nodes - another application where DWDM excels. Additionally, the push toward green data centers and energy-efficient networking is promoting adoption of DWDM technologies that reduce power consumption per transmitted bit. Competitive pricing, component miniaturization, and open optical networking standards are lowering entry barriers, enabling broader adoption across small and mid-tier operators. Finally, national broadband policies and global initiatives to bridge the digital divide are injecting public and private capital into fiber-based infrastructure, with DWDM systems positioned at the heart of this transformation. As global connectivity becomes a critical enabler of economic and social progress, DWDM systems will continue to be a foundational pillar in the architecture of high-performance, next-generation networks.Report Scope

The report analyzes the Dense Wave Digital Multiplexing Systems market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product (Synchronous Optical Network Data, Internet Protocol, Asynchronous Transfer Mode, Other Products); Application (BFSI, IT & Telecommunication, Healthcare & Life Sciences, Automotive, Manufacturing, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Synchronous Optical Network Data segment, which is expected to reach US$425.3 Million by 2030 with a CAGR of a 1.5%. The Internet Protocol segment is also set to grow at 1.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $215 Million in 2024, and China, forecasted to grow at an impressive 3.5% CAGR to reach $162.8 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Dense Wave Digital Multiplexing Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Dense Wave Digital Multiplexing Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Dense Wave Digital Multiplexing Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aarvee Denims & Exports Ltd., Artistic Denim Mills, Arvind Limited, Beximco Denims Ltd., Canatiba and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Dense Wave Digital Multiplexing Systems market report include:

- ADVA Optical Networking

- Alphion Corporation

- C-DOT (Centre for Development of Telematics)

- Ciena Corporation

- Cisco Systems, Inc.

- CommScope Inc.

- Coriant

- Ericsson

- Fujitsu Limited

- Huawei Technologies Co., Ltd.

- Infinera Corporation

- Juniper Networks, Inc.

- Nokia Corporation

- OptiWorks Inc.

- Precision Optical Technologies

- Solid Optics

- T8 LLC

- TYTEC AB

- UfiSpace Co., Ltd.

- ZTE Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ADVA Optical Networking

- Alphion Corporation

- C-DOT (Centre for Development of Telematics)

- Ciena Corporation

- Cisco Systems, Inc.

- CommScope Inc.

- Coriant

- Ericsson

- Fujitsu Limited

- Huawei Technologies Co., Ltd.

- Infinera Corporation

- Juniper Networks, Inc.

- Nokia Corporation

- OptiWorks Inc.

- Precision Optical Technologies

- Solid Optics

- T8 LLC

- TYTEC AB

- UfiSpace Co., Ltd.

- ZTE Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 291 |

| Published | January 2026 |

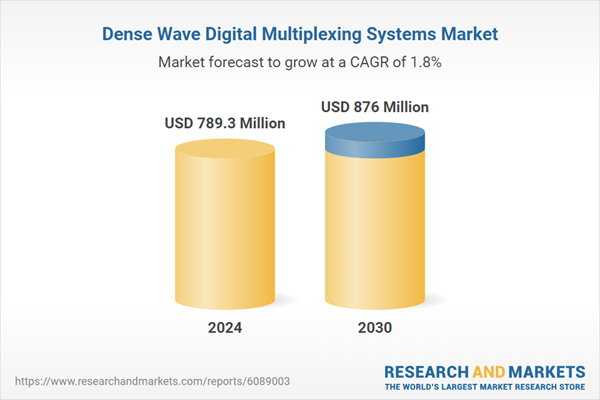

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 789.3 Million |

| Forecasted Market Value ( USD | $ 876 Million |

| Compound Annual Growth Rate | 1.8% |

| Regions Covered | Global |