Global Dairy Nutrition Market - Key Trends & Drivers Summarized

Why Is Dairy Nutrition More Relevant Than Ever in Today's Health-Conscious World?

Dairy nutrition continues to be a cornerstone of human health, offering a naturally dense source of essential macronutrients and micronutrients such as protein, calcium, phosphorus, potassium, vitamin D, and B vitamins. With the global shift toward preventive health and functional foods, dairy products are increasingly being recognized not just for their foundational nutritional value, but also for their role in supporting immunity, muscle function, bone density, and metabolic health. In both developed and emerging markets, consumer preferences are rapidly evolving in favor of nutrient-rich, high-protein diets, particularly in the wake of the COVID-19 pandemic, which heightened awareness around health, immunity, and lifestyle diseases. Dairy-based products such as Greek yogurt, fortified milk, protein-enriched cheese, and probiotic drinks have surged in popularity as consumers seek functional benefits in everyday foods. Moreover, dairy nutrition plays a vital role in addressing malnutrition in vulnerable populations, offering cost-effective nourishment for children, elderly individuals, and low-income households. Programs backed by governments and international health organizations frequently use dairy as a delivery vehicle for essential nutrients in school feeding and maternal care initiatives. As consumers become more label-conscious and informed, the demand for clean-label, naturally fortified, and scientifically substantiated dairy products is elevating the importance of dairy in modern nutritional frameworks.How Are Innovation and Functional Fortification Redefining Dairy Products?

Innovation in dairy nutrition has moved far beyond traditional milk and cheese, expanding into a wide array of fortified, functional, and performance-oriented products. With a growing consumer base seeking specific health outcomes - such as improved digestion, enhanced energy levels, or weight management - dairy manufacturers are investing heavily in R&D to develop products that address these targeted needs. The addition of ingredients such as probiotics, prebiotics, omega-3 fatty acids, collagen, and plant-based fibers into dairy matrices has created a new category of functional dairy products that bridge the gap between food and medicine. High-protein formulations such as whey- or casein-enriched yogurts, RTD protein shakes, and recovery drinks cater to fitness enthusiasts and aging populations alike. Lactose-free and A2 milk variants are rising in demand as digestive wellness becomes a central concern. Furthermore, advances in processing technologies - like ultra-filtration, microfiltration, and cold pasteurization - are enabling the creation of nutrient-rich, long shelf-life products without compromising on taste or texture. The fusion of dairy with botanicals, adaptogens, and natural sweeteners is also gaining popularity, allowing brands to innovate while maintaining a natural and health-forward identity. These developments reflect a broader industry trend toward personalized nutrition, where consumers demand customized solutions tailored to their individual dietary and lifestyle needs, firmly positioning dairy as a vehicle for health optimization.What Role Do Sustainability and Ethical Sourcing Play in Shaping Consumer Choices?

In today's conscientious consumer landscape, sustainability and ethical sourcing are pivotal factors influencing dairy nutrition purchasing decisions. Consumers are no longer focused solely on the nutritional content of their dairy - they're also examining how it's produced, where it comes from, and its impact on animal welfare and the environment. As a result, dairy producers are under increasing pressure to demonstrate responsible farming practices, including reduced greenhouse gas emissions, sustainable feed sourcing, regenerative grazing, water conservation, and humane animal treatment. The rise of certifications such as USDA Organic, Animal Welfare Approved, and carbon-neutral labeling has made these values more visible and integral to brand differentiation. Moreover, transparency in the supply chain - from farm to shelf - is becoming a competitive advantage, with brands offering traceability apps, QR code scanning, and open access to farming practices. Packaging innovation is also part of this movement, with more companies adopting biodegradable, recyclable, or reusable containers to align with consumer environmental values. Retailers are further supporting this shift by dedicating shelf space to sustainable and locally sourced dairy brands. As climate change concerns and ethical food production gain traction, the convergence of nutrition, environmental stewardship, and social responsibility is shaping the future of the dairy nutrition market, making sustainability not just a trend, but a business imperative.What Are the Key Growth Drivers Behind the Global Dairy Nutrition Surge?

The growth in the dairy nutrition market is driven by several factors rooted in evolving dietary patterns, scientific advancements, demographic shifts, and industry transformation. One of the most significant drivers is the rising global demand for protein, especially in regions experiencing rapid urbanization and income growth, where consumers are actively upgrading from carbohydrate-heavy staples to more balanced, nutrient-dense diets. Additionally, aging populations in Europe, North America, and parts of Asia are seeking bone-strengthening and muscle-preserving nutrition, with dairy products positioned as natural and effective sources. The surge in sports and fitness culture, along with the expansion of gym chains, e-commerce platforms, and wellness influencers, has driven up demand for dairy-based performance products like whey protein powders, shakes, and yogurts. Technological innovations in cold chain logistics and packaging have improved access to high-quality dairy nutrition in rural and export markets. Moreover, government dietary guidelines and school feeding programs continue to endorse dairy as a core component of balanced nutrition, further institutionalizing its demand. The rise of personalized and medical nutrition sectors has opened new doors for tailored dairy solutions for diabetics, pregnant women, children, and clinical patients. Simultaneously, strategic partnerships between dairy cooperatives, biotech firms, and food tech startups are accelerating product development and global reach. These multi-dimensional drivers are converging to power a robust and resilient expansion of the dairy nutrition market across consumer categories and geographic regions.Report Scope

The report analyzes the Dairy Nutrition market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Ingredient (Whey Protein, Casein Protein, Prebiotics, Vitamins & Minerals, Colostrum, Nucleotides); Application (Functional Foods, Infant Formula & Clinical, Dairy Products, Bakery & Confectionary, Personal Care).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Whey Protein segment, which is expected to reach US$8 Billion by 2030 with a CAGR of a 8.5%. The Casein Protein segment is also set to grow at 7.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $4.8 Billion in 2024, and China, forecasted to grow at an impressive 11.2% CAGR to reach $5.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Dairy Nutrition Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Dairy Nutrition Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Dairy Nutrition Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Applied Medical, Asensus Surgical, Avatera Medical, CMR Surgical, Corindus Vascular Robotics and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Dairy Nutrition market report include:

- Agropur Cooperative

- Arla Foods

- Dairy Farmers of America

- Danone S.A.

- DMK Deutsches Milchkontor

- Fonterra Co-operative Group

- FrieslandCampina

- Glanbia plc

- Groupe Lactalis

- Inner Mongolia Yili Industrial Group

- Meiji Holdings Co., Ltd.

- Mengniu Dairy Company Limited

- Müller Group

- Nestlé S.A.

- Saputo Inc.

- Savencia Fromage & Dairy

- Schreiber Foods Inc.

- Sodiaal Cooperative

- Synlait Milk Limited

- Unilever PLC

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Agropur Cooperative

- Arla Foods

- Dairy Farmers of America

- Danone S.A.

- DMK Deutsches Milchkontor

- Fonterra Co-operative Group

- FrieslandCampina

- Glanbia plc

- Groupe Lactalis

- Inner Mongolia Yili Industrial Group

- Meiji Holdings Co., Ltd.

- Mengniu Dairy Company Limited

- Müller Group

- Nestlé S.A.

- Saputo Inc.

- Savencia Fromage & Dairy

- Schreiber Foods Inc.

- Sodiaal Cooperative

- Synlait Milk Limited

- Unilever PLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 300 |

| Published | February 2026 |

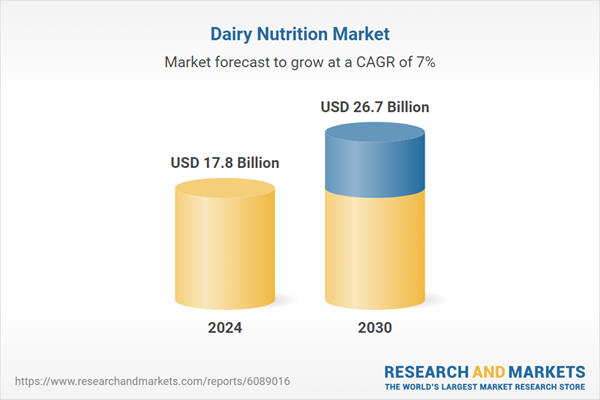

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 17.8 Billion |

| Forecasted Market Value ( USD | $ 26.7 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |