Global Cysteine Market - Key Trends & Drivers Summarized

Why Is Cysteine Gaining Prominence in Diverse Industrial Applications?

Cysteine, a sulfur-containing semi-essential amino acid, has garnered increasing attention for its multifunctional properties and cross-industry relevance. Initially recognized for its critical role in protein structure and metabolic processes, cysteine has evolved into a high-demand compound with applications spanning pharmaceuticals, food processing, cosmetics, and animal nutrition. In the food industry, cysteine is widely used as a dough conditioner in bakery products due to its ability to reduce the mixing time of flour and improve elasticity. It is particularly essential in commercial baking processes where efficiency and product consistency are paramount. Additionally, cysteine is a precursor in the production of flavors like meat-like or savory umami notes through the Maillard reaction, making it a crucial ingredient in instant noodles, snacks, and processed meals. In pharmaceuticals, cysteine's antioxidant properties - derived from its thiol side chain - enable its use in respiratory treatments, detoxification therapies, and paracetamol (acetaminophen) overdose management. Moreover, in the cosmetic industry, it is utilized in hair care formulations to strengthen keratin structures and in skin treatments for its capacity to combat oxidative stress. The broadening of cysteine's industrial utility, underpinned by biochemical versatility and market adaptability, continues to elevate its status as a valuable functional ingredient in global manufacturing ecosystems.Is Biotechnology Revolutionizing Cysteine Production Methods?

A significant transformation in the cysteine market is being driven by the transition from traditional extraction methods to more sustainable, biotechnological production pathways. Historically, cysteine was extracted from human hair or poultry feathers using acid hydrolysis, a process that was not only labor-intensive but also raised ethical and contamination concerns. However, modern biotechnology has ushered in a new era of fermentation-based synthesis using genetically engineered microbes such as Escherichia coli and Corynebacterium glutamicum. These microbial fermentation techniques offer higher yield, purity, and consistency, while also aligning with the rising demand for non-animal, halal, and kosher-certified ingredients. This shift is particularly critical for pharmaceutical and food industries, where traceability, safety, and regulatory compliance are paramount. Additionally, advancements in synthetic biology and metabolic engineering have allowed producers to fine-tune microbial strains for optimized cysteine production, reducing costs and environmental impact. Countries with strong biotech sectors - like China, Germany, and the U.S. - are at the forefront of these innovations, investing in R&D and scaling industrial fermentation capacities. This evolution in production methodology not only supports more ethical sourcing but also ensures supply chain stability amid fluctuating raw material availability, making cysteine more scalable and sustainable than ever before.How Are Emerging Sectors Redefining Demand for Cysteine?

The demand for cysteine is expanding rapidly due to its integration into emerging sectors that value its biochemical and structural properties. In the animal nutrition segment, cysteine is being increasingly adopted in feed formulations to enhance protein synthesis and improve immune function in poultry, swine, and aquaculture. This is particularly significant as the livestock industry seeks to optimize growth rates and feed conversion ratios while reducing antibiotic use. In the realm of personal care and cosmetics, cysteine is gaining traction as a key ingredient in hair strengthening and skin lightening products due to its role in keratin formation and melanin inhibition. Anti-aging creams and detoxifying treatments are increasingly leveraging cysteine's antioxidative capabilities to appeal to consumers focused on wellness and clean beauty. Another emerging use is in biopharmaceuticals, where cysteine is vital in the synthesis of biologics and peptide drugs that demand precise disulfide bond formations for proper protein folding and activity. Moreover, the burgeoning market for dietary supplements and functional foods is seeing a rise in demand for N-acetylcysteine (NAC), a derivative of cysteine known for its liver support, antioxidant activity, and respiratory health benefits. These emerging applications reflect a broader trend toward biologically active compounds that offer multifunctionality across both health and industrial platforms, further deepening cysteine's global market footprint.What Are the Key Factors Fueling Global Market Growth?

The growth in the cysteine market is driven by several factors rooted in industrial diversification, consumer health trends, and technological evolution. One of the most prominent drivers is the escalating demand from the processed food sector, where cysteine is used extensively to enhance flavor and texture while complying with clean-label and efficiency mandates. Similarly, in the pharmaceutical industry, the increasing incidence of chronic respiratory disorders, liver ailments, and oxidative stress-related conditions is fueling demand for NAC and other cysteine-based formulations. The shift toward preventive healthcare and wellness, especially in North America, Europe, and parts of Asia, is leading consumers to embrace functional supplements that include cysteine for its antioxidant and detoxifying properties. Technological advancements in microbial fermentation are making production more cost-effective and environmentally sustainable, attracting investment from biotech firms and contract manufacturing organizations. The cosmetics industry, driven by rising disposable incomes and beauty consciousness, is also contributing to demand, particularly in regions like Southeast Asia and Latin America. Furthermore, the expansion of the animal feed industry - driven by global meat consumption and aquaculture intensification - is incorporating cysteine to optimize animal growth and health outcomes. Regulatory support for bio-based ingredients and increasing adoption of non-GMO and allergen-free labels are further validating cysteine's inclusion across product categories. These interconnected factors, spanning health, ethics, and technology, are collectively propelling the cysteine market into a high-growth phase.Report Scope

The report analyzes the Cysteine market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Production Process (Natural, Synthetic); Application (Conditioner, Flavor Enhancer, Reducing Agent, Human Insulin Production, Other Applications); End-Use (Food & Beverage, Pharmaceutical, Cosmetic, Animal Feed, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Natural Cysteine segment, which is expected to reach US$263.8 Million by 2030 with a CAGR of a 2%. The Synthetic Cysteine segment is also set to grow at 4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $102.7 Million in 2024, and China, forecasted to grow at an impressive 5.1% CAGR to reach $85.3 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Cysteine Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Cysteine Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Cysteine Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ADAMA Ltd., BASF SE, Bayer AG, Bharat Group, CIE Chemical Co., Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Cysteine market report include:

- Ajinomoto Co., Inc.

- Anant Pharmaceuticals Pvt. Ltd.

- Bachem AG

- CJ CheilJedang Corp.

- Daily Manufacturing

- Donboo Amino Acid Co., Ltd.

- Evonik Industries AG

- FabriChem, Inc.

- Fengchen Group Co., Ltd.

- Glentham Life Sciences Ltd.

- Graham Chemical Corporation

- Hubei Bafeng Pharmaceuticals Co., Ltd.

- Merck KGaA

- Nippon Rika Co., Ltd.

- Shine Star (Hubei) Biological Engineering Co., Ltd.

- Taenaka Kogyo Co., Ltd.

- Wacker Chemie AG

- Wego Chemical Group Inc.

- Wuhan Grand Hoyo Co., Ltd.

- Wuxi Bikang Bioengineering Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ajinomoto Co., Inc.

- Anant Pharmaceuticals Pvt. Ltd.

- Bachem AG

- CJ CheilJedang Corp.

- Daily Manufacturing

- Donboo Amino Acid Co., Ltd.

- Evonik Industries AG

- FabriChem, Inc.

- Fengchen Group Co., Ltd.

- Glentham Life Sciences Ltd.

- Graham Chemical Corporation

- Hubei Bafeng Pharmaceuticals Co., Ltd.

- Merck KGaA

- Nippon Rika Co., Ltd.

- Shine Star (Hubei) Biological Engineering Co., Ltd.

- Taenaka Kogyo Co., Ltd.

- Wacker Chemie AG

- Wego Chemical Group Inc.

- Wuhan Grand Hoyo Co., Ltd.

- Wuxi Bikang Bioengineering Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 378 |

| Published | February 2026 |

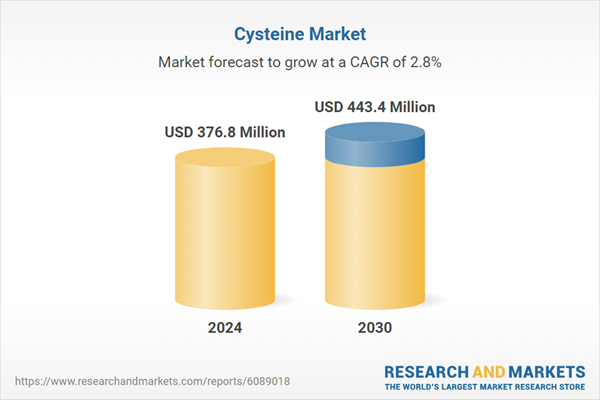

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 376.8 Million |

| Forecasted Market Value ( USD | $ 443.4 Million |

| Compound Annual Growth Rate | 2.8% |

| Regions Covered | Global |