Global Computer and Networking OSAT Market - Key Trends & Drivers Summarized

Why Is OSAT Becoming Critical to the Future of Computer and Networking Hardware?

Outsourced Semiconductor Assembly and Test (OSAT) providers are playing an increasingly central role in the evolution of computer and networking systems as demand grows for high-performance, miniaturized, and power-efficient hardware. OSAT firms are responsible for the back-end processes of semiconductor manufacturing - specifically packaging, assembly, and final testing - which are crucial to the functionality, reliability, and performance of integrated circuits used in data centers, servers, routers, edge devices, and consumer computing. With the proliferation of cloud computing, AI workloads, 5G infrastructure, and edge analytics, chips must be optimized for higher bandwidth, lower latency, and energy efficiency, placing unprecedented complexity on the packaging phase. OSAT providers are filling this critical gap by offering advanced packaging solutions such as fan-out wafer-level packaging (FOWLP), 2.5D/3D IC integration, and system-in-package (SiP) technologies. These innovations allow for heterogeneous integration of logic, memory, and I/O components, drastically improving interconnect density and thermal management - key performance metrics for next-gen computing and networking devices. As fabless semiconductor companies and even integrated device manufacturers (IDMs) increasingly rely on specialized partners to meet aggressive time-to-market goals, OSAT is becoming a linchpin of the computing ecosystem.How Are Market Demands from Data Centers and Networking Infrastructures Transforming OSAT Services?

The exponential growth of data traffic, driven by hyperscale cloud services, AI/ML model training, and IoT device connectivity, is putting immense pressure on the hardware that powers data centers and network infrastructure. To support this, chipsets used in networking switches, CPUs, GPUs, and network interface cards (NICs) must deliver higher speed and bandwidth with smaller form factors and tighter power budgets. This need is significantly influencing the services offered by OSAT companies, who are increasingly investing in high-density interconnect packaging, chiplet integration, and thermal optimization solutions. With disaggregated architectures becoming more common, OSAT providers are tasked with enabling complex die-to-die interconnections that maintain signal integrity and power efficiency. Furthermore, the demand for low-latency, high-throughput networking solutions - particularly in telecom, edge computing, and enterprise-grade routers - is driving packaging innovation that enhances signal routing and reduces parasitic resistance. High-frequency testing, signal probing at finer nodes (sub-7nm), and reliability verification are becoming key service differentiators among OSAT firms. Additionally, the growing deployment of AI-enabled software-defined networks (SDNs) requires chip packaging that supports rapid memory access and parallel processing. These specialized requirements are pushing OSAT companies to deepen their collaboration with chip designers, EDA tool vendors, and foundries, forming a tightly integrated supply chain optimized for high-performance networking demands.What Technological Innovations Are Enabling OSAT Providers to Meet Advanced Computing Needs?

The OSAT industry is undergoing a rapid technological transformation, driven by the demand for more complex and compact semiconductor packages that can sustain the workload of next-gen computing systems. One of the most significant developments is the emergence of advanced 2.5D and 3D packaging technologies, which stack or place multiple dies side by side on an interposer to reduce space and improve performance. These technologies are essential for applications requiring massive parallel processing, such as GPU-based deep learning or high-frequency trading systems. Chiplet-based architectures, where different functional units are fabricated separately and then integrated via advanced packaging, are gaining traction, offering performance gains and design flexibility. Embedded die packaging, wafer-level fan-out, and through-silicon via (TSV) integration are enabling denser interconnects, higher yields, and better power efficiency. On the testing side, OSAT firms are integrating AI and machine learning into automated test equipment (ATE) to predict failure rates, enhance yield learning, and optimize binning processes. The use of digital twins and data analytics is also improving quality assurance, reducing rework, and accelerating time-to-volume. As process nodes shrink and system requirements grow, OSAT providers are becoming technology partners rather than just service vendors - co-developing innovations with chipmakers to ensure that packaging and testing don't bottleneck the advancement of computing technologies.What Are the Core Market Drivers Fueling Global OSAT Growth in the Computer and Networking Segment?

The growth in the computer and networking OSAT market is driven by several key factors related to evolving semiconductor architectures, data-centric application demands, and innovation across the digital infrastructure spectrum. A primary driver is the relentless expansion of cloud computing and hyperscale data centers, which require increasingly advanced semiconductor packages to manage enormous computational loads. The shift toward AI and machine learning applications - where performance, thermal control, and power density are critical - is amplifying the need for high-performance packaging and robust testing methodologies. Additionally, the rise of edge computing, IoT, and 5G deployment is creating demand for smaller, more integrated chipsets that can be reliably assembled and tested at scale. From a technological standpoint, the migration to chiplet and heterogeneous integration models is pushing chipmakers to collaborate closely with OSAT firms to design and deliver complex multi-die packages. This is particularly evident in the networking domain, where ultra-low-latency and high-bandwidth connectivity necessitate compact, thermally optimized semiconductor solutions. On the supply side, as wafer fabrication becomes more specialized and expensive, many fabless and IDM players are outsourcing back-end processes to OSAT providers for flexibility, scalability, and cost efficiency. Moreover, increasing regulatory scrutiny around quality and reliability - especially for chips used in telecom and cloud infrastructure - is reinforcing the importance of rigorous testing and traceability, services that OSAT providers are uniquely positioned to deliver. Together, these forces are driving strong, sustained growth in the global computer and networking OSAT market, solidifying its role at the heart of next-gen digital infrastructure.Report Scope

The report analyzes the Computer and Networking OSAT market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Service Type (Assembly & Packaging, Testing); Packaging Type (Wire Bond, Flip Chips, Wafer Level, Other Packaging Types).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Assembly & Packaging Service segment, which is expected to reach US$7.9 Billion by 2030 with a CAGR of a 19.7%. The Testing Service segment is also set to grow at 15% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.1 Billion in 2024, and China, forecasted to grow at an impressive 24.1% CAGR to reach $2.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Computer and Networking OSAT Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Computer and Networking OSAT Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Computer and Networking OSAT Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Armastek, Aslan FRP (Owens Corning), Basanite Industries, LLC, Black Bar™, Commercial Metals Company (CMC) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Computer and Networking OSAT market report include:

- Advanced Semiconductor Engineering (ASE)

- Amkor Technology, Inc.

- Chipbond Technology Corporation

- ChipMOS Technologies Inc.

- Formosa Advanced Technologies Co., Ltd.

- Hana Micron Inc.

- Huatian Technology Co., Ltd.

- Integra Technologies

- Jiangsu Changjiang Electronics Technology Co., Ltd. (JCET)

- King Yuan Electronics Co., Ltd. (KYEC)

- Lingsen Precision Industries, Ltd.

- Powertech Technology Inc. (PTI)

- Signetics Corporation

- Siliconware Precision Industries Co., Ltd. (SPIL)

- STATS ChipPAC Ltd.

- Tianshui Huatian Technology Co., Ltd.

- Tongfu Microelectronics Co., Ltd.

- Unisem Group

- UTAC Holdings Ltd.

- Walton Advanced Engineering, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Advanced Semiconductor Engineering (ASE)

- Amkor Technology, Inc.

- Chipbond Technology Corporation

- ChipMOS Technologies Inc.

- Formosa Advanced Technologies Co., Ltd.

- Hana Micron Inc.

- Huatian Technology Co., Ltd.

- Integra Technologies

- Jiangsu Changjiang Electronics Technology Co., Ltd. (JCET)

- King Yuan Electronics Co., Ltd. (KYEC)

- Lingsen Precision Industries, Ltd.

- Powertech Technology Inc. (PTI)

- Signetics Corporation

- Siliconware Precision Industries Co., Ltd. (SPIL)

- STATS ChipPAC Ltd.

- Tianshui Huatian Technology Co., Ltd.

- Tongfu Microelectronics Co., Ltd.

- Unisem Group

- UTAC Holdings Ltd.

- Walton Advanced Engineering, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 279 |

| Published | January 2026 |

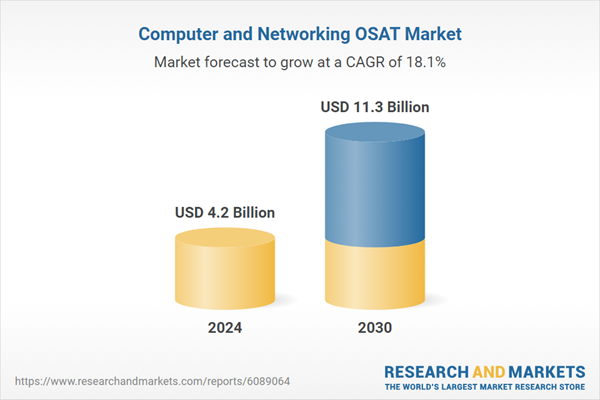

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.2 Billion |

| Forecasted Market Value ( USD | $ 11.3 Billion |

| Compound Annual Growth Rate | 18.1% |

| Regions Covered | Global |