Global Blast Resistant and Bulletproof Buildings Market - Key Trends & Drivers Summarized

Why Are Blast Resistant and Bulletproof Buildings Gaining Strategic Importance in High-Risk Infrastructure, Security-Critical Installations, and Industrial Hazard Zones?

Blast resistant and bulletproof buildings are emerging as essential components of physical risk mitigation strategies across government, defense, energy, and high-value commercial sectors. These structures are engineered to withstand explosive force, ballistic threats, and forced intrusion attempts - minimizing casualties, asset loss, and operational disruption. As global security threats, geopolitical tensions, and industrial accident risks escalate, demand is rising for purpose-built or retrofitted structures that offer resilience against both targeted attacks and accidental high-pressure events.Key application areas include military bases, embassies, petrochemical plants, refineries, data centers, and airport infrastructure - where mission continuity and occupant protection are non-negotiable. In the oil & gas sector, blast resistant buildings are used to house critical control rooms and personnel near hazardous process units, protecting against overpressure, fireballs, and flying debris from potential explosions. Similarly, in urban security and critical infrastructure protection, bulletproof installations are being adopted for banks, government buildings, and border control stations to defend against small arms fire and coordinated assaults.

As threat environments evolve, there is a growing focus on integrated building safety - where blast and ballistic resistance are engineered into architectural design, HVAC systems, structural components, and glazing solutions. These buildings serve both as deterrents and as defensive barriers, enabling continued operation under high-risk conditions. The convergence of safety, continuity, and regulatory compliance is reinforcing the role of such fortified structures in global risk management architectures.

How Are Material Innovation, Modular Construction, and Testing Standards Enhancing Performance and Deployment Efficiency?

Advancements in high-performance materials - such as ultra-high-performance concrete (UHPC), laminated ballistic glass, composite steel panels, and energy-absorbing polymers - are significantly improving the blast and ballistic resistance of structural envelopes. These materials are engineered to dissipate kinetic energy, resist fragmentation, and prevent progressive collapse, while also supporting modern architectural requirements for flexibility, insulation, and aesthetics. High-strength interlayers and steel-reinforced frames in windows and facades are enabling multi-threat resistance without sacrificing transparency or design versatility.Modular and prefabricated construction techniques are gaining traction, particularly in the oil & gas and military sectors, where speed of deployment, scalability, and cost control are critical. Modular blast resistant units (BRUs) are being used for temporary or relocatable shelters, command centers, and critical utility enclosures, offering both rapid installation and high protection levels. These units are factory-tested for blast loads, fire exposure, and impact resistance, ensuring performance consistency and regulatory compliance across global project sites.

Global standardization and third-party certification are reinforcing product credibility and buyer confidence. International guidelines such as UFC (Unified Facilities Criteria), ASTM F2927, EN 1063, ISO 16933, and NATO STANAG protocols are defining benchmark performance criteria for structural integrity under explosive or ballistic loads. Suppliers are increasingly offering simulation-based design services, shockwave modeling, and full-scale validation testing to meet the technical requirements of high-security projects and insurance-backed infrastructure risk assessments.

Which End-Use Sectors, Geographic Markets, and Procurement Models Are Accelerating Demand for Blast and Bullet Resistant Buildings?

Energy, defense, government, and industrial manufacturing remain the largest end-use sectors, with increasing overlap into transport hubs, financial institutions, high-risk retail locations, and international event venues. In petrochemical and refining operations, blast resistant buildings are now standard safety infrastructure, often mandated by HAZOP and QRA-driven facility design. In defense and law enforcement, bulletproof installations are being deployed to protect command posts, checkpoints, and weapons storage facilities from external threat vectors.The Middle East, North America, and select regions of Asia-Pacific are driving demand due to concentrated high-risk assets, active threat scenarios, and national security mandates. In the U.S., federal agencies and energy companies are major buyers, supported by regulatory requirements and DHS/OSHA guidelines for personnel safety in explosion-prone zones. GCC countries are investing heavily in fortified infrastructure to protect both critical energy facilities and strategic civil installations. Meanwhile, regions like Southeast Asia and Sub-Saharan Africa are witnessing increasing demand for mobile, modular units for mining, embassy, and field-based use.

Procurement models are evolving toward turnkey solutions that integrate architectural design, threat modeling, materials engineering, and post-installation validation. Buyers increasingly require lifecycle services, including maintenance, retrofitting, and performance reassessment following operational changes. Strategic partnerships between architects, security consultants, and specialized manufacturers are becoming common to deliver fit-for-purpose solutions tailored to threat profiles, operational needs, and compliance expectations.

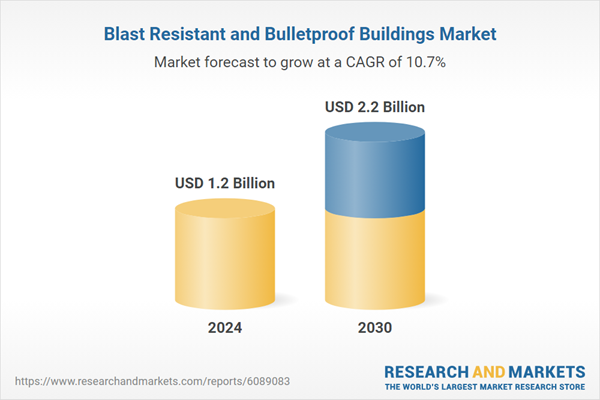

What Are the Factors Driving Growth in the Blast Resistant and Bulletproof Buildings Market?

The blast resistant and bulletproof buildings market is expanding as infrastructure protection becomes a strategic priority across industrial, defense, and civic domains. These structures are enabling continuity, resilience, and safety in environments facing elevated threat exposure and regulatory scrutiny.Key growth drivers include increasing geopolitical risk, industrial hazard mitigation mandates, advanced material availability, growth in modular construction, and expanded adoption in civil and commercial sectors. Regulatory frameworks and insurance-driven risk standards are further propelling market formalization and investment.

As physical threat landscapes grow more complex and infrastructure becomes more interconnected, could blast resistant and bulletproof buildings redefine how critical facilities are secured - positioning structural resilience as a core component of global risk management and operational continuity planning?

Report Scope

The report analyzes the Blast Resistant and Bulletproof Buildings market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Protection Type (Blast Resistant Buildings, Bulletproof Buildings); Construction Material (Ballistic Steel, Reinforced Concrete, Ballistic Glass, Composite Materials); End-Use (Government & Military, Commercial, Critical Infrastructure, Educational Institutions, Healthcare, Residential).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Blast Resistant Buildings segment, which is expected to reach US$1.5 Billion by 2030 with a CAGR of a 11.8%. The Bulletproof Buildings segment is also set to grow at 8.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $312.8 Million in 2024, and China, forecasted to grow at an impressive 9.7% CAGR to reach $335.6 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Blast Resistant and Bulletproof Buildings Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Blast Resistant and Bulletproof Buildings Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Blast Resistant and Bulletproof Buildings Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AbbVie Inc., Amgen Inc., Anavex Life Sciences Corp., AstraZeneca, Biogen Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Blast Resistant and Bulletproof Buildings market report include:

- Alfred Miller Contracting

- Anchor Modular Buildings

- ATCO Structures & Logistics

- BOXX Modular

- Bulletproof Building Ltd

- Craig International Ballistics

- Eurotrade S.A.

- GigaCrete, Inc.

- IKM Consulting Ltd

- Modular Security Systems Inc.

- MSSI - Modular Security Systems Inc.

- Norsafe AS

- Par-Kut International

- Perimeter Security Group

- Portadam, Inc.

- RedGuard

- Safe Haven Defense

- Space Projects Ltd

- Specialist Services Group

- US Bullet Proofing, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alfred Miller Contracting

- Anchor Modular Buildings

- ATCO Structures & Logistics

- BOXX Modular

- Bulletproof Building Ltd

- Craig International Ballistics

- Eurotrade S.A.

- GigaCrete, Inc.

- IKM Consulting Ltd

- Modular Security Systems Inc.

- MSSI - Modular Security Systems Inc.

- Norsafe AS

- Par-Kut International

- Perimeter Security Group

- Portadam, Inc.

- RedGuard

- Safe Haven Defense

- Space Projects Ltd

- Specialist Services Group

- US Bullet Proofing, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 236 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.2 Billion |

| Forecasted Market Value ( USD | $ 2.2 Billion |

| Compound Annual Growth Rate | 10.7% |

| Regions Covered | Global |