Global Bladder Cancer Diagnostics Market - Key Trends & Drivers Summarized

Why Are Bladder Cancer Diagnostics Emerging as Critical Tools for Early Detection, Risk Stratification, and Long-Term Disease Monitoring?

Bladder cancer diagnostics are gaining strategic importance across oncology workflows due to the disease's high recurrence rate, clinical heterogeneity, and often asymptomatic early progression. Timely and accurate diagnosis is crucial for effective intervention, especially in high-risk populations such as older adults, smokers, and those with chronic occupational exposures. Diagnostic workflows typically integrate urine-based assays, imaging techniques, cytology, and cystoscopy to achieve comprehensive disease assessment, enabling early-stage detection and guiding therapy selection.Given that bladder cancer ranks among the most recurrent solid tumors, continuous monitoring is essential for patient management. This makes diagnostic platforms pivotal not just at the initial diagnosis stage, but also throughout the treatment continuum. Recurrence detection, post-treatment surveillance, and progression monitoring are all heavily reliant on robust diagnostic tools. Non-invasive testing, particularly via urine-based biomarkers, is gaining traction as a patient-friendly adjunct to invasive methods, helping to increase compliance and reduce reliance on repeated cystoscopic procedures.

As health systems globally shift toward value-based care, bladder cancer diagnostics are being evaluated not only for sensitivity and specificity, but also for their impact on clinical decision-making, patient quality of life, and cost-effectiveness. These diagnostics are enabling earlier intervention, more tailored therapeutic planning, and improved risk stratification - all of which are critical to reducing long-term disease burden and healthcare utilization in both high- and low-resource settings.

How Are Biomarker Discoveries, Advanced Imaging, and Molecular Profiling Expanding Diagnostic Accuracy and Clinical Utility?

The diagnostic landscape is being reshaped by biomarker innovation, with urinary and tissue-based assays targeting proteins, DNA mutations, RNA transcripts, methylation patterns, and exosomal content specific to urothelial malignancies. Technologies such as next-generation sequencing (NGS), PCR-based assays, and multiplex ELISA platforms are enabling earlier and more precise detection of bladder cancer, especially in low-grade or occult cases. These tools are increasingly used to supplement or, in some cases, partially replace cytology, particularly in surveillance settings.Advanced imaging modalities - such as CT urography, MRI with diffusion-weighted imaging, and blue light cystoscopy - are improving lesion detection, anatomical mapping, and tumor staging. These technologies support more accurate surgical planning and contribute to early therapeutic decision-making. Blue light-enhanced cystoscopy, for instance, is improving visualization of flat or early-stage tumors, which are often missed by conventional white light examination.

Molecular profiling is also emerging as a cornerstone of diagnostic precision, particularly in guiding treatment strategies for muscle-invasive and metastatic bladder cancer. Companion diagnostics for FGFR mutations, PD-L1 expression, and other actionable biomarkers are enabling clinicians to match patients with targeted therapies and immuno-oncology regimens. These advances are reinforcing the role of diagnostics not only in detection, but in aligning disease characterization with therapeutic innovation across the care continuum.

Which Healthcare Systems, Diagnostic Channels, and Innovation Ecosystems Are Driving Market Expansion for Bladder Cancer Diagnostics?

Hospital systems, urology clinics, diagnostic laboratories, and outpatient cancer centers form the primary channels for bladder cancer diagnostic services. The expansion of decentralized care delivery, particularly in post-pandemic healthcare environments, is driving greater use of urine-based molecular diagnostics and portable cystoscopy tools for remote and community-based care settings. As awareness increases, direct-to-consumer screening programs are also emerging, particularly for high-risk demographics.North America and Europe dominate in terms of technology adoption, reimbursement maturity, and clinical integration, supported by early detection programs, high diagnostic infrastructure density, and strong alignment between guideline bodies and diagnostic developers. Asia-Pacific is witnessing accelerated demand, driven by rising cancer incidence, growing urology capacity, and expanding national screening initiatives. Regional players are investing in domestic biomarker innovation and strategic localization of testing platforms to enhance affordability and access.

Diagnostic innovation ecosystems - spanning medtech, molecular diagnostics, and academic research - are advancing rapidly through public-private collaborations, oncology consortia, and clinical trial networks. Companies are partnering with pharma firms to co-develop companion diagnostics, and with health systems to validate real-world utility across diverse patient populations. As competitive intensity rises, market differentiation is shifting toward platform versatility, integration with clinical workflows, and real-time decision support capabilities.

What Are the Factors Driving Growth in the Bladder Cancer Diagnostics Market?

The bladder cancer diagnostics market is expanding as healthcare systems demand earlier detection, more precise risk stratification, and improved surveillance mechanisms for managing a high-recurrence, high-burden malignancy. Diagnostic platforms are now integral to shaping outcomes, therapeutic decisions, and care efficiency.Key growth drivers include biomarker-based assay innovation, increased availability of advanced imaging modalities, growth in companion diagnostic use, and global expansion of oncology infrastructure. Rising awareness, patient-centric testing models, and supportive reimbursement dynamics are further accelerating adoption across clinical settings.

As diagnostic precision becomes inseparable from therapeutic effectiveness, could bladder cancer diagnostics emerge as the central node in a more personalized, proactive, and outcomes-aligned model of cancer care - redefining early intervention strategies and long-term survivorship pathways?

Report Scope

The report analyzes the Bladder Cancer Diagnostics market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Test Type (Urine Lab Tests, Cystoscopy, Biopsy, Imaging Tests); Cancer Type (Transitional Cell Bladder Cancer, Squamous Cell Bladder Cancer, Other Cancer Types); End-Use (Hospitals End-Use, Clinics End-Use, Cancer Centers End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Urine Lab Tests segment, which is expected to reach US$2.2 Billion by 2030 with a CAGR of a 8.3%. The Cystoscopy segment is also set to grow at 4.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $808.4 Million in 2024, and China, forecasted to grow at an impressive 11.1% CAGR to reach $936.1 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Bladder Cancer Diagnostics Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Bladder Cancer Diagnostics Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Bladder Cancer Diagnostics Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abbott Laboratories, Abingdon Health, Alfa Scientific Designs, Ameritek, Inc., Celnovte Biotechnology Co., Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 39 companies featured in this Bladder Cancer Diagnostics market report include:

- Abbott Laboratories

- AdvanCell

- AstraZeneca

- Bristol-Myers Squibb Company

- Celgene Corporation

- CG Oncology

- Eli Lilly and Company

- Exact Sciences

- Francis Medical

- GlaxoSmithKline

- Hoffmann-La Roche

- Johnson & Johnson

- KDx Diagnostics Inc.

- MDxHealth

- NeoGenomics Laboratories, Inc.

- Nucleix

- Pacific Edge Limited

- Photocure ASA

- Veracyte

- Vesica Health

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Laboratories

- AdvanCell

- AstraZeneca

- Bristol-Myers Squibb Company

- Celgene Corporation

- CG Oncology

- Eli Lilly and Company

- Exact Sciences

- Francis Medical

- GlaxoSmithKline

- Hoffmann-La Roche

- Johnson & Johnson

- KDx Diagnostics Inc.

- MDxHealth

- NeoGenomics Laboratories, Inc.

- Nucleix

- Pacific Edge Limited

- Photocure ASA

- Veracyte

- Vesica Health

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 378 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

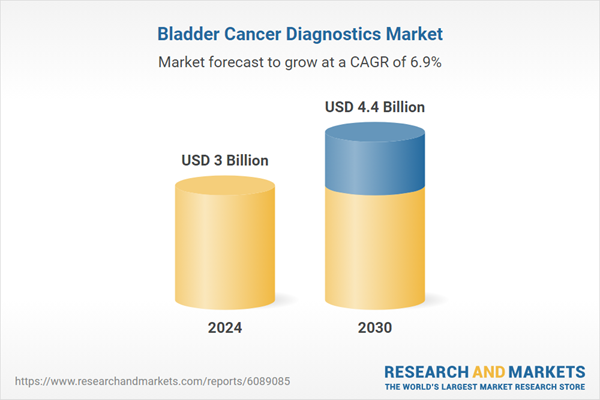

| Estimated Market Value ( USD | $ 3 Billion |

| Forecasted Market Value ( USD | $ 4.4 Billion |

| Compound Annual Growth Rate | 6.9% |

| Regions Covered | Global |