Global Bio-based Material Market - Key Trends & Drivers Summarized

Why Are Bio-based Materials Gaining Ground as Strategic Enablers of Circularity, Carbon Reduction, and Sustainable Industrial Innovation?

Bio-based materials are increasingly viewed as critical to decarbonizing supply chains and advancing circular economy objectives across multiple sectors - including packaging, automotive, construction, consumer goods, and textiles. Derived from renewable biological sources such as starch, cellulose, lignin, and natural oils, these materials offer a lower environmental footprint compared to fossil-derived counterparts while enabling comparable or superior performance characteristics in selected applications. Their ability to reduce reliance on non-renewable feedstocks aligns with escalating climate action mandates and corporate ESG commitments.Governments and multinational companies are integrating bio-based materials into long-term sustainability strategies, supported by green procurement policies, carbon taxation, and lifecycle emissions disclosures. These materials are becoming essential inputs in sustainable product design, helping brands differentiate through low-carbon labeling, biodegradability, and resource circularity. Applications range from bio-based plastics and polymers used in flexible packaging and electronics to structural composites, insulation panels, and resins used in green building and mobility platforms.

Growing consumer awareness and regulatory scrutiny around plastic pollution and carbon-intensive manufacturing are accelerating bio-based material demand in both B2B and B2C markets. As product lifecycles increasingly prioritize end-of-life outcomes, bio-based alternatives offer a compelling combination of renewability, functionality, and environmental compliance. Their role is evolving from niche alternatives to mainstream materials capable of redefining product and packaging systems at scale.

How Are Technological Advancements, Feedstock Diversification, and Certification Standards Enhancing Market Scalability and Trust?

Innovation in material science and process engineering is expanding the performance envelope of bio-based materials. Advanced polymerization techniques, fermentation pathways, and bio-refinery models are enabling the production of high-performance bio-based polyesters, polyamides, polyurethanes, and elastomers suitable for industrial, automotive, and consumer use. These materials now offer improved thermal stability, barrier properties, mechanical strength, and process compatibility, closing the gap with petroleum-based incumbents.Feedstock flexibility is becoming a critical advantage, with manufacturers sourcing bio-based inputs from agricultural residues, forestry byproducts, algae, and food industry waste. This shift supports land-use efficiency, reduces competition with food crops, and enhances regional supply chain resilience. Technologies such as enzymatic conversion, synthetic biology, and gas fermentation are enabling the upcycling of CO2, lignocellulose, and other low-value biomass into high-value bio-polymers and bio-composites.

Certification frameworks and traceability systems are reinforcing market credibility. Labels such as USDA Certified Biobased Product, EN 16785, and TÜV OK Biobased are becoming standard benchmarks for procurement and retail acceptance. Lifecycle assessments (LCAs), carbon footprint disclosures, and biodegradability testing are now integral to product validation and differentiation. These mechanisms support investor confidence, brand trust, and regulatory compliance - particularly in sectors with aggressive carbon neutrality timelines.

Which End-Use Industries, Regional Policies, and Procurement Shifts Are Driving Bio-based Material Adoption?

Packaging is currently the largest end-use sector, where bio-based materials are being deployed to replace conventional plastics in films, bottles, pouches, and rigid containers. FMCG brands are using these materials to meet recyclability targets, reduce Scope 3 emissions, and respond to consumer demand for plastic-free alternatives. The automotive sector is incorporating bio-composites and reinforced bio-resins in dashboards, interior trims, and under-the-hood applications to reduce vehicle weight and emissions without compromising durability.Construction and building materials represent a rapidly emerging opportunity, as regulations push for low-embodied carbon materials and green building certification. Bio-based insulation, flooring, wall panels, and adhesives are being used in LEED- and BREEAM-compliant projects across Europe and North America. Textiles and fashion are also integrating bio-based fibers, coatings, and dyes to align with circular fashion goals and reduce microplastic shedding from synthetic apparel.

Regionally, Europe leads in policy-driven adoption, backed by the EU's Green Deal, Single-Use Plastics Directive, and national-level mandates promoting bioeconomy development. North America is seeing steady growth via corporate-led sustainability initiatives and consumer demand for clean-label packaging. Asia-Pacific - particularly China, Japan, and South Korea - is investing in bio-refinery capacity and bio-based R&D to localize material production and reduce dependency on petrochemical imports. As global sourcing and procurement teams seek to decarbonize material inputs, bio-based alternatives are gaining share in vendor qualification, supplier ESG scoring, and sustainable procurement frameworks.

What Are the Factors Driving Growth in the Bio-based Material Market?

The bio-based material market is expanding as industries align around climate-smart sourcing, fossil-free manufacturing, and product lifecycle circularity. These materials are no longer peripheral substitutes but core components of next-generation material strategies across high-impact sectors.Key growth drivers include innovation in bio-refinery technology, policy mandates on carbon reduction and plastic replacement, growing institutional investor focus on sustainable inputs, and heightened consumer preference for renewable, biodegradable alternatives. Feedstock flexibility and certification standards are further enabling market maturity and scaling.

As global industries accelerate toward net-zero targets and sustainable design principles, could bio-based materials become the foundational layer of tomorrow's material economy - bridging ecological responsibility with industrial-grade performance across interconnected value chains?

Report Scope

The report analyzes the Bio-based Material market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Bio-Polycarbonate, Bio-based Polyethylene Terephthalate, Bio-based Polyethylene, Other Types); Application (Rigid Packaging, Flexible Packaging, Electrics & Electronics, Consumer Goods, Automotive & Transport, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Bio-Polycarbonate segment, which is expected to reach US$19 Billion by 2030 with a CAGR of a 17.1%. The Bio-based Polyethylene Terephthalate segment is also set to grow at 23.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $5.2 Billion in 2024, and China, forecasted to grow at an impressive 26.5% CAGR to reach $13.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Bio-based Material Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Bio-based Material Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Bio-based Material Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Azenta Life Sciences, Becton, Dickinson and Company (BD), Bio-Techne Corporation, Brooks Automation, Inc., Greiner Bio-One International GmbH and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Bio-based Material market report include:

- AMSilk GmbH

- Anellotech Inc.

- Arkema S.A.

- Avantium N.V.

- BASF SE

- Bloom Biorenewables SA

- Braskem S.A.

- Carbonwave

- Clariant AG

- Corbion N.V.

- Danimer Scientific

- DSM-Firmenich

- Eastman Chemical Company

- Ecovative Design LLC

- Evonik Industries AG

- Genomatica, Inc.

- Modern Meadow

- NatureWorks LLC

- Novamont S.p.A.

- Spinnova Plc

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AMSilk GmbH

- Anellotech Inc.

- Arkema S.A.

- Avantium N.V.

- BASF SE

- Bloom Biorenewables SA

- Braskem S.A.

- Carbonwave

- Clariant AG

- Corbion N.V.

- Danimer Scientific

- DSM-Firmenich

- Eastman Chemical Company

- Ecovative Design LLC

- Evonik Industries AG

- Genomatica, Inc.

- Modern Meadow

- NatureWorks LLC

- Novamont S.p.A.

- Spinnova Plc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 293 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

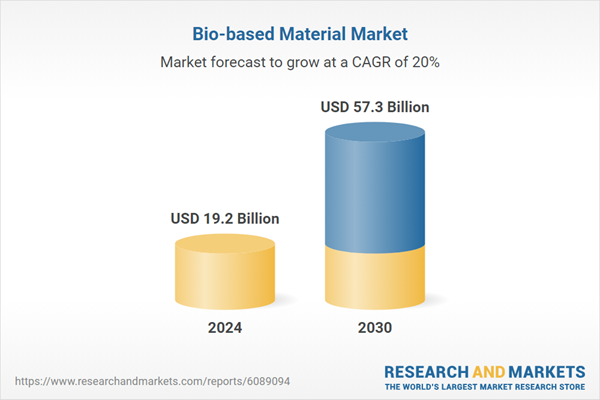

| Estimated Market Value ( USD | $ 19.2 Billion |

| Forecasted Market Value ( USD | $ 57.3 Billion |

| Compound Annual Growth Rate | 20.0% |

| Regions Covered | Global |