Global Bio Rational Fungicide Market - Key Trends & Drivers Summarized

Why Are Bio Rational Fungicides Emerging as Strategic Tools for Sustainable Crop Protection and Resistance Management?

Bio rational fungicides are gaining rapid traction as essential components in integrated disease management programs, offering targeted fungal control with minimal ecological disruption. Derived from naturally occurring sources such as beneficial microbes, plant extracts, or semiochemicals, these fungicides are designed to be both effective and environmentally benign. Their selective mode of action, biodegradability, and low toxicity make them especially valuable in high-value horticulture, organic farming, and export-oriented agriculture where chemical residue restrictions are stringent.As global agriculture pivots toward more sustainable inputs, bio rational fungicides provide a critical alternative to conventional synthetics that contribute to resistance buildup and environmental degradation. These products support rotational strategies aimed at prolonging the efficacy of synthetic fungicides by reducing pathogen selection pressure. Moreover, their compatibility with biological pest control agents and low re-entry intervals enhance field-level operational flexibility and labor safety, reinforcing their utility across diverse farm sizes and production models.

Bio rational fungicides are particularly suited to crops with short harvest cycles or frequent picking intervals - such as fruits, vegetables, ornamentals, and greenhouse produce - where residue-free protection is imperative. Their expanding role in proactive disease prevention, rather than solely curative control, is also shifting perceptions among growers and agronomists, who now view these fungicides as integral to long-term plant health and market access compliance.

How Are Product Innovations, Formulation Technologies, and Regulatory Dynamics Enhancing Market Competitiveness?

Innovation in microbial strain selection, fermentation processes, and formulation science is improving the performance and consistency of bio rational fungicides. Next-generation products incorporate highly specific Bacillus spp., Trichoderma spp., and beneficial yeast strains known for their antifungal metabolite production and competitive exclusion properties. These formulations offer enhanced spore stability, shelf life, and field performance under varying climatic conditions, enabling broader geographic deployment.Advanced formulations - such as microencapsulation, wettable powders, and oil-based emulsions - are extending residual activity and improving foliar adhesion, rainfastness, and compatibility with other agrochemicals. This enhances their integration into existing spray schedules and supports tank-mixing with synthetic fungicides, biostimulants, or adjuvants without compromising efficacy. Water-dispersible granules and ready-to-use liquid formulations are also improving ease of application, particularly for smallholder and precision agriculture users.

Regulatory support is accelerating market access, with agencies in the EU, US, and APAC streamlining registration pathways for bio-based fungicides under biopesticide-specific frameworks. Lower data requirements, exemptions from MRL (maximum residue limit) regulations, and growing alignment with organic certification bodies are encouraging both innovation and commercial deployment. These dynamics are positioning bio rational fungicides as a lower-barrier, higher-compliance solution for regions with increasing scrutiny on chemical inputs.

Which Crops, Regional Markets, and Distribution Strategies Are Driving Bio Rational Fungicide Adoption?

High-value crops such as grapes, strawberries, tomatoes, cucurbits, leafy greens, and ornamentals represent the largest demand base for bio rational fungicides due to their sensitivity to fungal pathogens and stringent export requirements. Greenhouse operations, vertical farms, and hydroponic systems are also increasing uptake, given the need for residue-free disease control in controlled environments. Use in tree nuts, coffee, and tropical fruits is expanding as growers seek MRL-compliant solutions to maintain access to regulated export markets.Asia-Pacific is a high-growth region, driven by rising horticultural exports, regulatory tightening on chemical fungicides, and government promotion of sustainable agri-inputs. Latin America - particularly Brazil, Mexico, and Chile - is also witnessing strong adoption, spurred by large-scale fruit exports and the need for resistance management in intensive production systems. In North America and Europe, adoption is focused on organic-certified operations, vineyard disease control, and specialty crop protection in high-retail-value supply chains.

Distribution strategies are evolving to emphasize technical advisory, field-level training, and integrated solutions. Agri-input companies are bundling bio rational fungicides with biostimulants and micronutrients to position them as part of holistic crop health platforms. Strategic partnerships with cooperatives, contract growers, and export consortia are helping scale market access, while digital advisory platforms are supporting precise, data-driven application of bio fungicides tailored to local disease pressure and phenological stages.

What Are the Factors Driving Growth in the Bio Rational Fungicide Market?

The bio rational fungicide market is expanding as growers, regulators, and input providers converge around the need for sustainable, residue-free, and resistance-mitigating disease control solutions. These fungicides offer a compelling alternative to synthetic actives across both conventional and organic production systems.Key growth drivers include rising demand for low-residue crop protection, tightening pesticide regulations, increased adoption of IPM frameworks, and continuous innovation in microbial and botanical actives. Market expansion is also supported by broader agricultural sustainability initiatives, trade-driven compliance requirements, and the scalability of precision biocontrol.

As global agriculture seeks to balance productivity with safety and sustainability, could bio rational fungicides emerge as the cornerstone of next-generation crop protection - enabling resilient, eco-aligned, and globally compliant farming systems across diverse climatic and regulatory environments?

Report Scope

The report analyzes the Bio Rational Fungicide market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Botanical, Microbial, Non-Organic); End-Use (Fruits, Vegetables, Cereals, Grains, Oil Seeds & Pulses, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Botanical Fungicide segment, which is expected to reach US$1.2 Billion by 2030 with a CAGR of a 9.6%. The Microbial Fungicide segment is also set to grow at 11.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $324.2 Million in 2024, and China, forecasted to grow at an impressive 14.1% CAGR to reach $441.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Bio Rational Fungicide Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Bio Rational Fungicide Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Bio Rational Fungicide Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as A.J. Plast Public Company Limited, AdvanSix Inc., Cangzhou Mingzhu Plastic Co., Ltd., CloudFlex Film, Domo Chemicals and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 37 companies featured in this Bio Rational Fungicide market report include:

- Andermatt Biocontrol AG

- BASF SE

- Bayer AG

- Bionema Ltd.

- Bioworks Inc.

- CAMSON Bio Technologies Pvt Ltd.

- Certis Belchim

- Corteva Agriscience

- Dow Inc.

- FMC Corporation

- Gowan Company

- Isagro S.p.A.

- Koppert Biological Systems

- Marrone Bio Innovations

- Novozymes A/S

- PI Industries Limited

- Russell IPM Ltd.

- Sumitomo Chemical Co., Ltd.

- Syngenta AG

- Valent BioSciences LLC

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Andermatt Biocontrol AG

- BASF SE

- Bayer AG

- Bionema Ltd.

- Bioworks Inc.

- CAMSON Bio Technologies Pvt Ltd.

- Certis Belchim

- Corteva Agriscience

- Dow Inc.

- FMC Corporation

- Gowan Company

- Isagro S.p.A.

- Koppert Biological Systems

- Marrone Bio Innovations

- Novozymes A/S

- PI Industries Limited

- Russell IPM Ltd.

- Sumitomo Chemical Co., Ltd.

- Syngenta AG

- Valent BioSciences LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 283 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

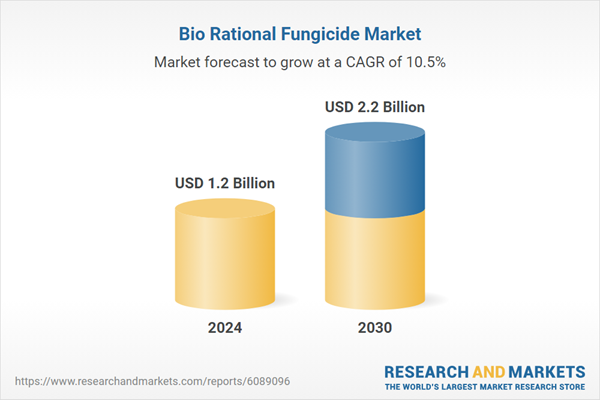

| Estimated Market Value ( USD | $ 1.2 Billion |

| Forecasted Market Value ( USD | $ 2.2 Billion |

| Compound Annual Growth Rate | 10.5% |

| Regions Covered | Global |