Global Automotive Seat Massage Systems Market - Key Trends & Drivers Summarized

Why Are Seat Massage Systems Emerging as Flagship Comfort and Wellness Features in Modern Automotive Interiors?

Automotive seat massage systems are gaining prominence as automakers elevate cabin comfort and occupant well-being as key differentiators in vehicle design. Once exclusive to premium luxury vehicles, massage-enabled seating is now making its way into mid-range and even upper-entry models as part of advanced comfort packages. These systems deliver targeted muscle stimulation, improved circulation, and fatigue reduction - benefits that enhance the driving and riding experience, particularly during long commutes or extended highway travel.Consumer expectations around wellness and personalized in-cabin experiences are driving demand for integrated massage functionality in both front and rear seating configurations. Massage seats are being positioned not only as a luxury upgrade but also as a health-focused feature that supports physical well-being, postural support, and stress reduction. With growing time spent inside vehicles, especially in urban congestion or long-haul transport, automotive interiors are increasingly viewed as extensions of the living or working environment - accelerating adoption of comfort-enhancing features.

OEMs are leveraging seat massage systems to reinforce brand perception and competitive positioning. These systems are bundled with premium upholstery, ventilation, lumbar support, and memory functions, creating high-margin upgrade opportunities within vehicle trim lines. As automakers seek to differentiate passenger experience, massage seats are becoming a tangible expression of interior sophistication - supporting higher ASPs and enhancing customer satisfaction indices in luxury and lifestyle segments.

How Are Mechatronic Integration, Intelligent Control, and Ergonomic Design Enhancing System Capabilities?

Modern seat massage systems combine precision electromechanical actuation with ergonomic foam architecture and programmable control units. Actuators - typically pneumatic or motorized - are embedded within seat cushions and backrests, delivering adjustable massage patterns such as rolling, kneading, tapping, or wave modes. These modules are designed for quiet operation, durability, and seamless integration within slim seat profiles, ensuring that comfort features do not compromise seat weight or spatial efficiency.Intelligent control systems are a key enabler of personalization and user convenience. Via touchscreen infotainment systems, center consoles, or mobile apps, users can select intensity levels, zone targeting (e.g., upper back, lumbar, thighs), massage sequences, and duration. Some high-end systems are integrated with memory profiles, automatically adjusting settings to the preferences of individual drivers or passengers. In EVs and autonomous vehicles, extended idle times are increasing usage frequency, making responsive and adaptable massage functions more relevant than ever.

System design is becoming more ergonomic and health-oriented, with a focus on spinal alignment, pressure point stimulation, and posture support. Collaborations with physiotherapists and wellness experts are informing actuator placement and motion algorithms to maximize therapeutic benefits. Integration with temperature-controlled seating, vibration modules, and ambient lighting further enhances the sensory experience. These multi-modal systems are creating immersive comfort zones that mirror spa-like wellness environments inside the vehicle cabin.

Which Vehicle Segments and Usage Models Are Driving Demand for Seat Massage Systems?

Luxury sedans, executive SUVs, and premium electric vehicles are at the forefront of massage seat adoption. These segments cater to consumers who prioritize comfort, technology, and long-distance travel experience. OEMs are positioning massage seats as standard or optional features in top-tier trims, especially for flagship models targeting chauffeur-driven clientele or business travelers. Rear-seat massage systems are increasingly offered to reinforce exclusivity and rear-occupant engagement.Electric vehicles (EVs) represent a rapidly growing application area, as their quieter cabins, advanced interior designs, and longer dwell times make them ideal platforms for enhanced in-cabin wellness features. Seat massage systems in EVs are often paired with zero-gravity recline modes, nap functions, and entertainment systems to support driver and passenger relaxation during charging sessions or autonomous travel. As the EV segment becomes more competitive, wellness-based features are contributing to vehicle differentiation.

Shared mobility services, ride-hailing platforms, and long-distance travel operators are beginning to explore massage systems in premium fleet segments. Vehicles used for airport transfers, luxury rentals, or executive shuttles are offering massage-enabled seats as a premium upsell or loyalty feature. In emerging markets, rising disposable income and aspirational purchasing patterns are also driving demand for comfort features previously reserved for imported or high-specification models.

How Are Regional Consumer Preferences, Luxury Trends, and OEM Strategies Influencing Market Penetration?

Europe leads in integration of massage seats, particularly in Germany, the UK, and Scandinavian countries, where comfort features are deeply embedded into premium automotive DNA. German OEMs such as Mercedes-Benz, Audi, and BMW offer sophisticated multi-contour seat systems with active massage programs across both sedans and SUVs. European consumers associate massage functionality with quality, ergonomic design, and driving wellness, contributing to steady demand across luxury segments.In North America, demand is rising across full-size trucks, SUVs, and luxury EVs, driven by consumer preferences for comfort and in-vehicle feature richness. U.S. buyers are increasingly opting for top-trim configurations that include massaging seats as part of bundled luxury or tech packages. Extended road travel, long daily commutes, and a strong market for pickup trucks with premium interiors are reinforcing OEM incentives to offer massage features more broadly.

Asia-Pacific is witnessing rapid growth, led by China and South Korea, where premium vehicle sales and consumer willingness to pay for high-end features are accelerating. Chinese OEMs are integrating massage seats into high-value EVs and intelligent cockpit systems as part of aggressive differentiation strategies. Meanwhile, Japan's automotive ecosystem is exploring wellness innovations aligned with aging populations, ergonomic needs, and stress-reduction technologies - setting the stage for greater inclusion of therapeutic seat features in compact and mass-market vehicles.

What Role Do Health Tech Collaboration, Modular System Design, and Connected Cabin Ecosystems Play in Market Development?

Collaborations between automotive suppliers, health-tech firms, and wellness specialists are influencing how massage systems are designed and validated. Sensor-enabled seats that monitor posture, fatigue, or muscle tension are under development, enabling adaptive massage that responds to biometric feedback. Such convergence is positioning massage systems not only as luxury features but also as health-supportive technologies, especially in the context of autonomous driving and long-distance EV usage.Modular design approaches are making seat massage systems more scalable and cost-effective for OEMs. Standardized actuator modules, integrated control units, and flexible harnessing enable easy customization across vehicle classes without re-engineering seat frames. This scalability is encouraging automakers to extend massage functionality into mid-tier offerings, enhancing accessibility while preserving assembly efficiency and interior design flexibility.

Connected cabin ecosystems are enhancing the utility and appeal of massage seats through cloud integration, voice assistants, and app-based control. Personalized seat settings can now be stored in user profiles, synchronized across multiple vehicles, and adjusted based on driving mode or trip duration. Integration with digital wellbeing dashboards and in-cabin AI is enabling contextual recommendations - such as suggesting a massage cycle during heavy traffic or a rest break - paving the way for intelligent, wellness-aware vehicle environments.

What Are the Factors Driving Growth in the Automotive Seat Massage Systems Market?

The automotive seat massage systems market is expanding as interior wellness, digital customization, and premium experience delivery become defining themes in next-generation mobility. What was once a high-end novelty is evolving into a strategic interior feature that supports both luxury positioning and passenger well-being.Key growth drivers include rising consumer demand for comfort and personalization, OEM focus on wellness-centric design, electrification-led interior innovation, and growing adoption across vehicle segments beyond luxury. Technological advances in actuator design, intelligent control, and health-driven ergonomics are reinforcing product appeal, while modular integration and digital configurability are enabling broader market penetration.

As wellness, personalization, and vehicle intelligence converge, could massage-enabled seating emerge as a core differentiator that reshapes how comfort and well-being are experienced within the automotive cabin?

Report Scope

The report analyzes the Automotive Seat Massage Systems market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Vehicle Type (Luxury Cars, SUVs, Mid-Size Cars, Small Cars, LCVs); Sales Channel (OEM, Aftermarket).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Luxury Cars segment, which is expected to reach US$22 Billion by 2030 with a CAGR of a 1.9%. The SUVs segment is also set to grow at 1.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $12.9 Billion in 2024, and China, forecasted to grow at an impressive 3.1% CAGR to reach $9.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive Seat Massage Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive Seat Massage Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive Seat Massage Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M Company, Arlon Graphics LLC, Avery Dennison Corporation, Benecke-Kaliko AG, CCL Industries Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Automotive Seat Massage Systems market report include:

- Adient plc

- AKEE Industrial Co., Ltd.

- Alba Automotive Services BV

- Alfmeier Präzision SE

- Brose Fahrzeugteile SE & Co. KG

- Champion Auto Systems

- Chongqing Huixinyi Technology Co., Ltd.

- Continental AG

- DONMAR Enterprises Inc.

- Embitel Technologies (Cariad SE)

- Erickson Auto Trim Inc.

- Faurecia SE

- Gentherm Incorporated

- Hebei Zhaoxiang Trade Co., Ltd.

- InSeat Solutions LLC

- KAB Seating Ltd.

- Katzkin Leather, Inc.

- Kongsberg Automotive ASA

- Laxon (Dr. Well)

- Lear Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Adient plc

- AKEE Industrial Co., Ltd.

- Alba Automotive Services BV

- Alfmeier Präzision SE

- Brose Fahrzeugteile SE & Co. KG

- Champion Auto Systems

- Chongqing Huixinyi Technology Co., Ltd.

- Continental AG

- DONMAR Enterprises Inc.

- Embitel Technologies (Cariad SE)

- Erickson Auto Trim Inc.

- Faurecia SE

- Gentherm Incorporated

- Hebei Zhaoxiang Trade Co., Ltd.

- InSeat Solutions LLC

- KAB Seating Ltd.

- Katzkin Leather, Inc.

- Kongsberg Automotive ASA

- Laxon (Dr. Well)

- Lear Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 276 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

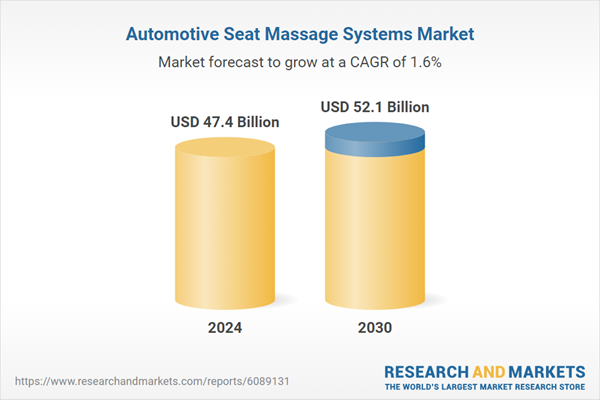

| Estimated Market Value ( USD | $ 47.4 Billion |

| Forecasted Market Value ( USD | $ 52.1 Billion |

| Compound Annual Growth Rate | 1.6% |

| Regions Covered | Global |