Global Automotive Airbag Fabric Market - Key Trends & Drivers Summarized

Why Is Automotive Airbag Fabric Critical to Vehicle Occupant Safety, Regulatory Compliance, and Lightweight Protection Systems?

Automotive airbag fabric plays a vital role in passive vehicle safety systems, serving as the foundational material for airbags deployed during collisions to cushion and protect occupants from severe injury. Engineered for strength, elasticity, and heat resistance, this specialized textile must withstand rapid inflation, high pressure, and mechanical stress without tearing or degrading. As global automotive manufacturers prioritize enhanced safety standards and crash survivability, demand for high-performance airbag fabric has become central to OEM and Tier 1 safety component strategies.The increasing inclusion of airbags across a wider range of vehicle models - spanning front, side, curtain, knee, and rear seat airbag types - is driving substantial volume growth in fabric consumption. Governments and safety regulators in North America, Europe, China, and India continue to mandate or incentivize airbag adoption, especially in budget and mid-range vehicles. This is further supported by consumer awareness of vehicle safety ratings and insurance incentives tied to advanced restraint systems, which encourage automakers to integrate more airbags into new vehicle platforms.

Additionally, the ongoing push toward vehicle lightweighting, driven by fuel efficiency and emissions compliance targets, has elevated the importance of high-strength, low-mass airbag fabrics. As automakers strive to reduce curb weight without compromising safety performance, technical textiles that offer strength-to-weight optimization are in high demand. The integration of compact, multi-chamber airbag designs for electric and autonomous vehicles is also prompting innovation in material form factors, flexibility, and deployment behavior, reinforcing fabric development as a core element of vehicle safety engineering.

How Are Material Advancements, Coating Technologies, and Production Efficiency Enhancing Fabric Performance and Market Scalability?

The majority of automotive airbag fabrics are produced using high-tenacity nylon 6,6 due to its superior tensile strength, thermal stability, and abrasion resistance. However, ongoing R&D is driving exploration of new materials - including polyester-based blends, aramid fibers, and next-generation bio-based polymers - to reduce costs, improve recyclability, and adapt to specialized deployment environments. Material selection is tailored based on airbag type, with side and curtain airbags often requiring higher flexibility and permeability control compared to frontal airbags.Coating technologies are a critical differentiator in fabric performance. Silicone and neoprene coatings are widely applied to enhance heat resistance and airtightness, ensuring reliable inflation and controlled deflation during deployment. Newer coating techniques aim to reduce VOC emissions during production, improve adhesion, and support thinner, lighter coatings without compromising mechanical properties. Some suppliers are also developing uncoated or single-layer fabrics using advanced weaving and finishing processes to eliminate additional coating steps and support recyclability goals.

Manufacturers are investing in production efficiency through high-speed looms, precision weaving, and real-time defect monitoring systems to ensure dimensional stability and zero-defect output. Airbag fabrics must meet stringent quality control standards, including burst pressure, tear resistance, elongation, and air permeability specifications. Innovations in warp-knitting, hybrid yarn integration, and continuous finishing are being adopted to reduce production downtime and achieve cost competitiveness. These efficiencies are especially critical as global vehicle production volumes recover and OEMs demand lean, just-in-time delivery of safety-critical materials.

Which Vehicle Segments and Regional Markets Are Driving Demand for Automotive Airbag Fabric Solutions?

Passenger vehicles represent the dominant application segment for automotive airbag fabric, with compact, mid-size, and premium sedans all contributing to demand across frontal, side, and curtain airbag configurations. SUVs and crossovers are witnessing increased integration of rollover and rear-seat airbags, further expanding fabric use per vehicle. In the commercial vehicle sector, regulatory mandates and fleet safety initiatives are prompting the adoption of airbags in light trucks, vans, and buses - particularly in developed markets focused on occupant and pedestrian safety.Geographically, Asia-Pacific leads global demand, with China and India representing major growth markets due to rising vehicle production, safety regulations, and increasing consumer expectations. Japan and South Korea remain hubs for airbag technology innovation and export. Europe and North America continue to generate steady demand, supported by mature automotive industries, stringent safety norms, and high airbag penetration per vehicle. Latin America and the Middle East are emerging markets, where gradual regulatory shifts and rising middle-class vehicle ownership are driving airbag system adoption and, by extension, fabric requirements.

Tier 1 airbag system suppliers - including Autoliv, ZF TRW, Joyson Safety Systems, and Toyoda Gosei - are key integrators and influencers of airbag fabric procurement. These players collaborate closely with textile manufacturers to develop application-specific fabric variants aligned with system architecture, vehicle design, and global compliance requirements. Strategic sourcing models, global manufacturing footprints, and vertically integrated supply chains are shaping how airbag fabric is distributed across regional production clusters and synchronized with OEM assembly schedules.

How Are Sustainability, Supply Chain Stability, and OEM Integration Shaping Strategic Priorities in the Market?

Sustainability is emerging as a strategic imperative in airbag fabric development, as automakers and suppliers seek to reduce the environmental impact of both raw materials and end-of-life airbag components. Initiatives are underway to develop recyclable fabrics, biodegradable coatings, and circular material flows that support vehicle disassembly and reuse targets. Lightweighting and minimalism in airbag design also support reduced material consumption without compromising occupant protection, aligning with OEM decarbonization goals.Supply chain stability has gained renewed attention post-pandemic and amid ongoing geopolitical disruptions. Securing reliable sources of nylon 6,6, ensuring redundancy in coating material supply, and maintaining manufacturing agility are now priorities for Tier 2 and Tier 3 suppliers. Companies are investing in regional production hubs, raw material diversification, and digital quality control systems to reduce lead times, avoid disruptions, and align with OEM just-in-time manufacturing models.

OEM integration strategies are increasingly driving collaboration between airbag fabric producers, airbag system designers, and automotive engineering teams. Fabric suppliers must meet co-development demands, rapid prototyping schedules, and stringent compliance standards in coordination with airbag module designers. Value-added services such as design simulation support, material testing, and regulatory documentation are becoming standard components of supplier qualification, particularly in premium and safety-first vehicle programs.

What Are the Factors Driving Growth in the Automotive Airbag Fabric Market?

The automotive airbag fabric market is growing steadily, fueled by rising global vehicle safety standards, increasing airbag counts per vehicle, and the continuous push for advanced occupant protection systems. As airbags evolve in design complexity and deployment zones, fabric specifications are becoming more varied and performance-driven.Key growth drivers include OEM adoption of multi-airbag configurations, regulatory mandates in emerging economies, innovations in lightweight and high-strength textile solutions, and enhanced collaboration across the automotive safety value chain. Material engineering, coating sustainability, and regional production scale-up are further propelling market competitiveness.

Looking ahead, the market's trajectory will depend on how effectively suppliers balance innovation, compliance, and cost efficiency while supporting OEMs' evolving safety architectures. As safety moves to the forefront of mobility innovation, could airbag fabrics become the next frontier of smart, sustainable occupant protection?

Report Scope

The report analyzes the Automotive Airbag Fabric market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Vehicle Type (Passenger Cars, Light Commercial Vehicles, Other Vehicle Types); Airbag Type (Front Airbags, Side Airbags, Knee Airbags, Curtain Airbags, Other Airbags).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Passenger Cars segment, which is expected to reach US$2.8 Billion by 2030 with a CAGR of a 6.3%. The Light Commercial Vehicles segment is also set to grow at 3.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $914.2 Million in 2024, and China, forecasted to grow at an impressive 8.5% CAGR to reach $920 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive Airbag Fabric Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive Airbag Fabric Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive Airbag Fabric Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Automotive Airbag Fabric market report include:

- Airbag Systems, Inc.

- Asahi Kasei Corporation

- Autoliv Inc.

- Continental AG

- Daewon Kangup Co., Ltd.

- East Joy Long Motor Airbag Co., Ltd.

- Esterline Technologies Corporation

- Faze Three Limited

- Global Safety Textiles (Hyosung)

- HMT (Xiamen) New Technical Materials

- Hoshino Kogyo Co., Ltd.

- Hyundai Mobis

- Indorama Ventures Public Company Ltd.

- Joyson Safety Systems

- Kolon Industries, Inc.

- KSS Abhishek Safety Systems Pvt. Ltd.

- Milliken & Company

- Ningbo Joyson Electronic Corp.

- Picanol Group

- Porcher Industries

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Airbag Systems, Inc.

- Asahi Kasei Corporation

- Autoliv Inc.

- Continental AG

- Daewon Kangup Co., Ltd.

- East Joy Long Motor Airbag Co., Ltd.

- Esterline Technologies Corporation

- Faze Three Limited

- Global Safety Textiles (Hyosung)

- HMT (Xiamen) New Technical Materials

- Hoshino Kogyo Co., Ltd.

- Hyundai Mobis

- Indorama Ventures Public Company Ltd.

- Joyson Safety Systems

- Kolon Industries, Inc.

- KSS Abhishek Safety Systems Pvt. Ltd.

- Milliken & Company

- Ningbo Joyson Electronic Corp.

- Picanol Group

- Porcher Industries

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 285 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

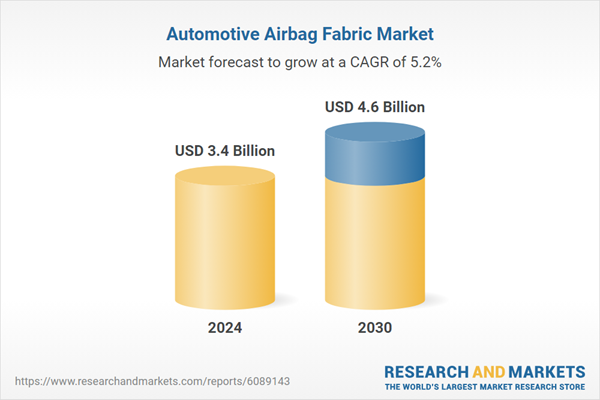

| Estimated Market Value ( USD | $ 3.4 Billion |

| Forecasted Market Value ( USD | $ 4.6 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |