Global Automatic Hog Feeders Market - Key Trends & Drivers Summarized

Why Are Automatic Hog Feeders Central to Precision Livestock Feeding, Labor Efficiency, and Animal Health Optimization?

Automatic hog feeders are gaining widespread adoption across both commercial and mid-scale swine production operations as producers prioritize precision feeding, consistent growth rates, and resource efficiency. These systems enable controlled, ad libitum, or scheduled feed delivery with minimal human intervention, ensuring pigs have continuous access to properly rationed feed while significantly reducing manual labor and feed wastage. The mechanization of feeding processes is a key component of modern pig farming infrastructure, especially in high-throughput finishing units and breeding facilities.Consistent and timely feed access is directly linked to swine productivity metrics, including average daily gain (ADG), feed conversion ratios (FCR), and uniformity in weight classes. Automatic feeders promote healthy eating behavior, minimize aggression over food resources, and help prevent underfeeding or overfeeding - conditions that can impair growth performance or trigger metabolic issues. With growing pressure to meet protein demand sustainably, precision feeding via automated systems plays a critical role in maximizing yield per animal while minimizing environmental impact and cost per unit of meat produced.

Moreover, automatic hog feeders align with growing biosecurity and animal welfare requirements. By reducing direct human contact and allowing for controlled, clean feed delivery, these systems lower the risk of pathogen transmission and improve hygiene in swine housing. They also support consistent feed presentation, which is particularly important for young pigs transitioning through critical growth stages. As regulatory and market expectations around animal husbandry intensify, automatic feeders are emerging as a strategic investment in long-term farm performance and compliance.

How Are Technological Enhancements, Design Modularity, and Data Integration Improving System Value?

Technological innovation is expanding the capabilities of automatic hog feeders beyond basic feed delivery. Modern systems feature electronic feed sensors, programmable timers, and integrated weighing modules that enable precision portioning and customizable feeding schedules based on pig age, weight, or performance targets. In smart farming operations, feeders are being equipped with wireless connectivity and IoT sensors to monitor feed levels, detect blockages, and transmit real-time consumption data to centralized farm management software.Modular design is another advancement reshaping feeder deployment strategies. Adjustable feed trough sizes, feed flow regulators, and customizable hopper capacities allow for flexibility in feeder configuration to accommodate different pig sizes and production stages - nursery, grower, or finisher. Dry and wet-dry feeder variants are available to match feed types and animal preferences, while anti-bridging mechanisms and corrosion-resistant materials extend equipment life in high-humidity or corrosive barn environments. Wall-mounted or freestanding options are enabling space optimization across barn layouts.

Data integration is becoming a core value driver, especially in technologically advanced operations focused on precision livestock farming. When linked with electronic ID systems or camera-based monitoring, automatic feeders can track individual pig intake behavior, identify feeding anomalies, and alert managers to early signs of illness or underperformance. This data-driven approach enables proactive interventions, feed optimization, and health monitoring at scale, supporting both economic and welfare-oriented goals. Some systems also support remote calibration and diagnostics, streamlining maintenance and reducing downtime.

Which Farm Profiles and Regional Markets Are Accelerating Adoption of Automatic Hog Feeders?

Large-scale commercial hog producers are the primary adopters of automatic feeders, particularly in North America, Western Europe, and East Asia, where operations prioritize throughput, traceability, and regulatory compliance. These farms often manage thousands of pigs across integrated breeding, farrowing, and finishing systems, and rely on automation to reduce labor costs, ensure feed consistency, and streamline operations across geographically distributed units.Mid-sized and emerging farms are increasingly adopting entry-level or semi-automated feeding systems, particularly in Latin America, Eastern Europe, and Southeast Asia. As swine production intensifies in these regions to meet growing pork demand, governments and agritech providers are promoting feeder automation as part of broader livestock modernization initiatives. These markets value feeders that balance affordability with durability, often favoring hybrid systems that allow phased automation and gradual integration with farm digitization tools.

In smallholder contexts, cooperative and contract farming models are supporting feeder adoption through shared infrastructure investment and technical training. Portable and scalable feeder systems are enabling deployment in low-tech environments, while mobile-enabled feeder management platforms are helping first-time adopters monitor performance metrics and align feeding with veterinary protocols. Across all farm sizes, the consistent driver remains the need to enhance feed efficiency, improve herd health, and reduce operational complexity.

How Are Feed Waste Reduction, Hygiene Compliance, and ROI Metrics Influencing Buyer Decisions?

Feed accounts for the largest cost component in hog production - often exceeding 60% of total operational expenses - making feed efficiency a decisive factor in profitability. Automatic feeders reduce spillage, prevent feed contamination, and enable consistent rationing, directly contributing to reduced feed conversion ratios (FCRs). Features such as adjustable flow rates, anti-spill rims, and feed level indicators help ensure that feed is consumed efficiently and not lost to floor waste or overdispensing.Hygiene and biosecurity compliance are essential in modern swine production, particularly in light of diseases such as African Swine Fever (ASF) and Porcine Epidemic Diarrhea Virus (PEDv). Automatic feeders with sealed hoppers, smooth-surface troughs, and easy-clean designs reduce the risk of microbial buildup and feedborne contamination. Routine disinfection and material resilience are critical in maintaining sanitary conditions in high-density pens - key to both disease prevention and regulatory adherence.

Return on investment (ROI) is a strong influencing factor in feeder procurement decisions. Buyers assess ROI based on feed cost savings, labor reduction, growth rate improvements, and reduced mortality or illness linked to consistent nutrition. Vendors are addressing this through bundled offerings, scalable product lines, and technical support packages that improve post-installation performance. Financing options and co-investment programs are also expanding access for medium-sized farms, allowing broader penetration of automation in regions where capital intensity has historically been a barrier.

What Are the Factors Driving Growth in the Automatic Hog Feeders Market?

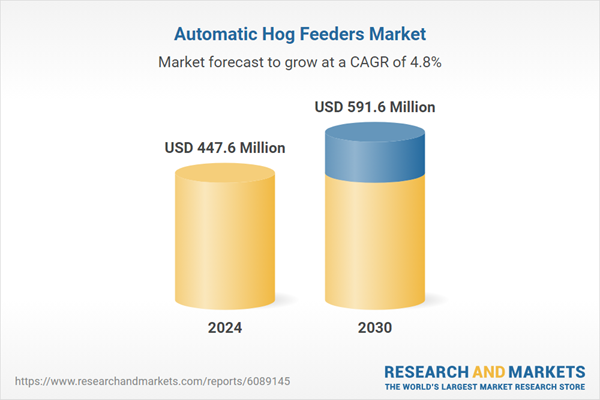

The automatic hog feeders market is expanding steadily as producers seek to enhance feed efficiency, reduce manual labor, and improve overall swine productivity through precision-driven solutions. These systems are transitioning from optional upgrades to core infrastructure in commercial swine operations.Key growth drivers include rising global pork demand, labor shortages in agriculture, increasing feed costs, and heightened focus on biosecure, welfare-compliant farming practices. Technological advancements in feeder monitoring, modular design, and integration with digital farm platforms are further accelerating adoption.

Looking ahead, the market's trajectory will depend on how effectively vendors align feeder functionality with farm-scale variability, climate-specific challenges, and digitization strategies. As precision livestock farming gains momentum, could automatic hog feeders become the linchpin of integrated, data-informed swine production systems?

Report Scope

The report analyzes the Automatic Hog Feeders market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Infant Feeders, Adult Feeders); Material (Stainless Steel, Mild Steel, Other Materials); Application (Hunting, Domestic Farm, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Infant Feeders segment, which is expected to reach US$335 Million by 2030 with a CAGR of a 3.7%. The Adult Feeders segment is also set to grow at 6.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $121.9 Million in 2024, and China, forecasted to grow at an impressive 7.4% CAGR to reach $115.3 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automatic Hog Feeders Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automatic Hog Feeders Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automatic Hog Feeders Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Cangzhou Phoenix Breeding Equipment Co., Ltd., Cobett Company, Drinking Post Waterer, Fisher Alvin Limited, Gallagher Animal Management and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Automatic Hog Feeders market report include:

- ACO Funki A/S

- Big Dutchman AG

- Canarm Ltd.

- Cangzhou Phoenix Breeding Equipment Co., Ltd.

- Fancom BV

- Gallagher Group Limited

- Hightop Swine Equipment

- Hog Slat, Inc.

- horizont group gmbh

- KANE Manufacturing Company, Inc.

- Luco Manufacturing Co.

- MIK International GmbH & Co. KG

- Miller Manufacturing Company

- Ningbo Joygen Machinery Co., Ltd.

- Ningbo New Glory International Trading Co., Ltd.

- Osborne Industries, Inc.

- Petersen Waterers

- Priefert Manufacturing Co.

- Qingdao Chima Asia Machinery Co., Ltd.

- Qingdao Deba Brother Machinery Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ACO Funki A/S

- Big Dutchman AG

- Canarm Ltd.

- Cangzhou Phoenix Breeding Equipment Co., Ltd.

- Fancom BV

- Gallagher Group Limited

- Hightop Swine Equipment

- Hog Slat, Inc.

- horizont group gmbh

- KANE Manufacturing Company, Inc.

- Luco Manufacturing Co.

- MIK International GmbH & Co. KG

- Miller Manufacturing Company

- Ningbo Joygen Machinery Co., Ltd.

- Ningbo New Glory International Trading Co., Ltd.

- Osborne Industries, Inc.

- Petersen Waterers

- Priefert Manufacturing Co.

- Qingdao Chima Asia Machinery Co., Ltd.

- Qingdao Deba Brother Machinery Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 364 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 447.6 Million |

| Forecasted Market Value ( USD | $ 591.6 Million |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |