Global Aseptic Fill Finish Market - Key Trends & Drivers Summarized

Why Is Aseptic Fill Finish Critical to Biopharmaceutical Sterility, Compliance, and Product Integrity?

Aseptic fill finish is a vital final step in the manufacturing of sterile biologics, vaccines, and injectable therapeutics. It involves the precise filling of sterile drug substances into sterile containers - such as vials, syringes, or cartridges - under aseptic conditions to prevent microbial contamination. As regulatory scrutiny intensifies and parenteral drugs dominate global pipelines, the demand for robust aseptic processing capabilities is escalating across the pharmaceutical manufacturing landscape.This process is especially important for biologics, which are sensitive to heat and cannot be terminally sterilized. Aseptic fill finish ensures that the sterility of the product is maintained post-filtration, preserving efficacy, safety, and shelf-life. The process also supports flexibility in dosage formats, allowing biopharmaceutical manufacturers to tailor delivery systems to patient needs, administration routes, and evolving therapeutic landscapes. Failures in fill finish operations carry high regulatory, clinical, and reputational risks, underscoring the need for precision-engineered, contamination-controlled environments.

Growing biologics and biosimilars markets, accelerated vaccine development, and personalized medicines are increasing the volume and complexity of aseptic fill finish operations. In parallel, the rise in lyophilized drug products, multi-dose formats, and dual-chamber syringes is adding demand for specialized filling systems that maintain sterility while handling highly viscous or sensitive formulations. For both small-batch clinical fills and commercial-scale production, aseptic fill finish is now central to supply chain continuity and regulatory approval readiness.

How Are Robotics, Isolator Technologies, and Digital Validation Advancing Aseptic Fill Finish Capabilities?

Automation is driving major advancements in aseptic fill finish by reducing human intervention - the primary source of contamination risk. Robotic filling lines equipped with vision inspection, real-time monitoring, and programmable accuracy are increasingly replacing manual processes. These systems provide consistent throughput, reduce downtime, and allow for sterile operations in high-containment environments, supporting the growing need for high-mix, low-volume production runs in cell and gene therapies.Isolator-based systems and restricted access barrier systems (RABS) are being widely adopted to enhance contamination control. Isolators create a completely sealed sterile zone around the fill finish line, using decontaminated air and integrated sterilization protocols. They offer a higher level of protection than traditional cleanroom environments and are particularly valuable in handling potent compounds, cytotoxics, and pandemic-response vaccines. Modular isolators also support fast reconfiguration for multi-product facilities.

Digital transformation is enhancing compliance and process validation across aseptic operations. Manufacturing Execution Systems (MES), electronic batch records, and AI-enabled anomaly detection tools are being integrated to track fill volumes, environmental metrics, and container integrity in real time. These digital tools streamline documentation, reduce human error, and enable faster deviation resolution - essential for ensuring Good Manufacturing Practice (GMP) compliance and audit readiness. Coupled with digital twins and predictive maintenance, these systems are advancing the reliability and traceability of fill finish workflows.

Which End Markets and Regional Ecosystems Are Expanding Demand for Aseptic Fill Finish Solutions?

Biopharmaceutical companies focused on monoclonal antibodies, vaccines, mRNA-based therapies, and advanced biologics are the largest end-users of aseptic fill finish services. These firms require specialized infrastructure to fill sensitive formulations without compromising sterility or stability. Contract Development and Manufacturing Organizations (CDMOs) are also expanding aseptic capabilities to support a growing number of virtual biotech clients and fast-track products under accelerated regulatory pathways.Injectable generics, oncology drugs, and biosimilars are further driving demand for cost-efficient, high-speed fill finish operations. Pharmaceutical companies are investing in both in-house capacity and outsourced partnerships to meet global distribution needs, especially for high-value therapies in oncology, autoimmune disease, and rare disorders. With the global trend toward self-administered therapies, prefilled syringes and cartridge-based formats are creating new demand for precision filling and flexible line configurations.

Regionally, North America and Europe dominate due to the concentration of biopharma R&D, regulatory leadership, and presence of advanced CDMO infrastructure. Asia-Pacific - particularly China, South Korea, and India - is seeing rapid investment in aseptic fill finish capacity to support domestic biopharma manufacturing and attract global contract manufacturing contracts. Emerging regions in Latin America and the Middle East are also investing in localized aseptic fill finish facilities to secure supply chains for essential medicines and reduce import dependence.

How Are Compliance, Supply Chain Resilience, and Format Flexibility Shaping Strategic Deployment?

Regulatory compliance remains a cornerstone of aseptic fill finish operations. Guidelines from the FDA, EMA, and PIC/S increasingly emphasize risk-based validation, particulate control, and environmental monitoring. Process analytical technologies (PAT), in-line fill weight verification, and high-resolution particle inspection systems are being integrated to meet evolving standards and reduce the risk of batch rejection.Supply chain resilience has become a strategic imperative post-pandemic. Companies are investing in redundant fill finish lines, dual-source suppliers, and regionalized CDMO partnerships to reduce lead times and mitigate single-point-of-failure risks. Fill finish capacity is now a competitive differentiator in ensuring reliable drug product availability, especially in high-stakes therapeutic categories such as vaccines, oncology injectables, and emergency-use biologics.

Format flexibility is critical to market responsiveness. As patient-centric drug delivery becomes more prominent, manufacturers are expected to accommodate diverse container types - including vials, prefilled syringes, cartridges, and auto-injectors - on modular or multi-format lines. Scalable, reconfigurable filling platforms are enabling faster product switches, smaller batch sizes, and late-stage customization - capabilities that are increasingly valued in a market defined by biologic complexity and precision medicine.

What Are the Factors Driving Growth in the Aseptic Fill Finish Market?

The aseptic fill finish market is experiencing sustained growth, driven by the proliferation of biologics, surge in injectable therapies, and heightened regulatory focus on sterility assurance. As injectable formulations become more complex and individualized, aseptic fill finish emerges as a mission-critical process in ensuring drug safety, shelf stability, and global distribution readiness.Key drivers include automation of cleanroom operations, expansion of CDMO service portfolios, increased adoption of isolator technologies, and digitization of compliance workflows. The push toward decentralized manufacturing and personalized therapies further reinforces the need for flexible, high-performance aseptic systems.

Looking ahead, the future of the market will depend on how effectively manufacturers balance regulatory compliance, modular scale-up, and global accessibility. As biologic innovation advances, could aseptic fill finish become the defining infrastructure supporting next-generation injectable therapies?

Report Scope

The report analyzes the Aseptic Fill Finish market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Packaging Containers (Vials, Syringes, Ampoules, Cartridges); Type (Preclinical / Clinical, Commercial, Other Types).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Vials Packaging segment, which is expected to reach US$4 Billion by 2030 with a CAGR of a 8.3%. The Syringes Packaging segment is also set to grow at 5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.5 Billion in 2024, and China, forecasted to grow at an impressive 11.1% CAGR to reach $1.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Aseptic Fill Finish Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Aseptic Fill Finish Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Aseptic Fill Finish Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M, AntWorks Pte Ltd., Artimus Robotics, Asahi Glass Co., Ltd., Bayer MaterialScience and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Aseptic Fill Finish market report include:

- AbbVie Contract Manufacturing

- Aenova Group

- AGC Biologics

- Ajinomoto Bio-Pharma Services

- Alcami Corporation

- Argonaut Manufacturing Services

- Asymchem

- Avara Pharmaceutical Services

- Baxter BioPharma Solutions

- BioConnection

- BioPharma Solutions

- BioReliance

- Boehringer Ingelheim BioXcellence

- Catalent Biologics

- Charles River Laboratories

- CordenPharma

- Delpharm

- Fareva

- Fresenius Kabi

- Grand River Aseptic Manufacturing

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AbbVie Contract Manufacturing

- Aenova Group

- AGC Biologics

- Ajinomoto Bio-Pharma Services

- Alcami Corporation

- Argonaut Manufacturing Services

- Asymchem

- Avara Pharmaceutical Services

- Baxter BioPharma Solutions

- BioConnection

- BioPharma Solutions

- BioReliance

- Boehringer Ingelheim BioXcellence

- Catalent Biologics

- Charles River Laboratories

- CordenPharma

- Delpharm

- Fareva

- Fresenius Kabi

- Grand River Aseptic Manufacturing

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 288 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

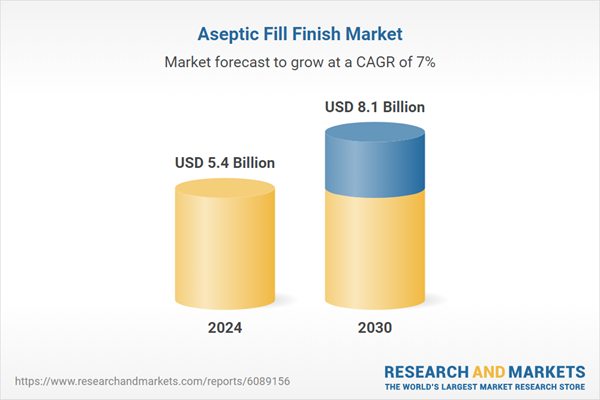

| Estimated Market Value ( USD | $ 5.4 Billion |

| Forecasted Market Value ( USD | $ 8.1 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |