Global Artificial Intelligence Store Manager Tools Market - Key Trends & Drivers Summarized

Why Are AI-Powered Store Manager Tools Transforming Retail Operations, Inventory Control, and Customer Engagement?

Artificial Intelligence (AI) store manager tools are reshaping how brick-and-mortar retail environments are managed by automating key operational decisions, streamlining workflows, and enhancing customer service delivery. These tools integrate machine learning, computer vision, and predictive analytics into store management systems enabling real-time intelligence across inventory tracking, staffing, merchandising, pricing, and customer experience. As physical retailers compete with the speed and personalization of e-commerce, AI tools are empowering store managers to operate with greater efficiency, agility, and.Inventory visibility is among the most critical areas of transformation. AI-powered systems analyze historical sales, seasonality, foot traffic, and supply chain data to generate automated replenishment alerts, reduce stockouts, and minimize excess inventory. Shelf-scanning robots or computer vision-enabled cameras detect misplaced, low, or out-of-stock items, while AI-based demand forecasting adjusts stock levels dynamically in response to local conditions. These real-time insights allow store managers to maintain high on-shelf availability and operational continuity without manual checks.

AI tools also enhance employee productivity and customer experience. Intelligent scheduling platforms allocate staff based on predicted footfall, peak periods, and task urgency. In-store recommendation engines analyze shopper behavior and loyalty data to guide personalized interactions and cross-selling strategies. Voice-activated dashboards, digital twins of store layouts, and mobile-based alerts are giving store managers unprecedented control over daily operations enabling proactive, instead of reactive, management in high-velocity retail environments.

How Are Computer Vision, Conversational AI, and Predictive Analytics Elevating Functional Capabilities in Store Management?

Computer vision technologies embedded in AI store manager tools are enabling automated planogram compliance, foot traffic analysis, queue detection, and loss prevention. These systems identify misplaced products, optimize display layouts, and monitor shopper flows helping managers enhance merchandising effectiveness and reduce shrinkage. In addition to inventory alignment, vision AI is being used to assess in-store customer sentiment, track dwell times in specific departments, and improve the allocation of promotional displays based on actual consumer behavior.Conversational AI platforms are augmenting human decision-making with voice-enabled assistants that provide instant access to store performance metrics, task lists, and incident reports. Store managers can use natural language commands to retrieve analytics, update schedules, or report operational issues, reducing administrative burden and improving responsiveness. These virtual assistants are also being deployed to train new employees, manage digital SOPs (standard operating procedures), and relay real-time instructions during busy periods or unexpected disruptions.

Predictive analytics tools help managers anticipate operational needs such as restocking, shift scheduling, and promotional planning based on historical patterns and emerging trends. AI algorithms generate forecasts for demand spikes, labor shortages, and localized promotions, supporting decisions that optimize margins and resource deployment. Some platforms integrate POS, CRM, and supply chain systems to create a unified view of store health, enabling dynamic reallocation of assets and faster recovery from supply delays or sales fluctuations. These tools are helping retailers create more responsive.

Which Retail Segments and Regional Markets Are Accelerating Adoption of AI Store Manager Tools?

Grocery, big-box, and fashion retail chains are leading adopters of AI store manager tools due to their complex inventory structures, high transaction volumes, and need for real-time operational control. Supermarkets use AI to manage perishables, optimize shelf space, and predict demand for fast-moving consumer goods (FMCG). Apparel retailers deploy AI to streamline SKU management, reduce returns, and enhance visual merchandising. Convenience stores and QSRs (quick-service restaurants) are adopting lightweight, cloud-based AI tools to drive consistency and efficiency across franchised locations.Luxury and experiential retail segments are also leveraging AI tools for concierge-style service personalization and real-time VIP engagement. In-store AI solutions integrated with clienteling apps allow managers to deliver premium.

Regionally, North America and Europe lead in AI adoption for store operations, driven by mature retail ecosystems, labor cost pressures, and innovation-focused retail strategies. Asia-Pacific particularly China, Japan, South Korea, and India is witnessing rapid uptake, supported by mobile-first retail models, smart store innovations, and strong investment in retail automation technologies. In Latin America and the Middle East, AI adoption is emerging through pilot programs, regional retail chains, and government-supported digital transformation initiatives focused on small and mid-sized enterprises (SMEs).

How Are Integration, User Experience, and ROI Metrics Shaping Strategic Deployment of AI Store Management Platforms?

Seamless integration with existing retail management systems (RMS), enterprise resource planning (ERP), and customer relationship management (CRM) platforms is essential for the successful deployment of AI store manager tools. Vendors are increasingly offering modular solutions with open APIs, cloud-based interfaces, and plug-and-play compatibility to ensure interoperability. Integration with IoT devices such as smart shelves, cameras, and kiosks further enhances AI's visibility into physical store conditions and operational variables.User experience is a critical success factor, especially for frontline store managers who may not have deep technical backgrounds. Intuitive interfaces, mobile accessibility, customizable dashboards, and role-based access controls ensure that insights are actionable and easy to interpret. Training modules, guided recommendations, and explainable AI functions are being embedded to support adoption and reduce learning curves. These features are helping align AI insights with daily decision-making at the store level.

Return on investment (ROI) metrics are increasingly tied to AI-driven improvements in operational efficiency, inventory accuracy, labor productivity, and customer satisfaction. Retailers are evaluating AI platforms based on their ability to reduce shrinkage, boost sell-through rates, shorten response times, and lower the cost-to-serve. As AI store manager tools shift from pilots to enterprise-scale deployments, proof of value through quantifiable KPIs and business case alignment is becoming critical to long-term adoption strategies and vendor selection.

What Are the Factors Driving Growth in the AI Store Manager Tools Market?

The AI store manager tools market is expanding rapidly as retailers seek to modernize in-store operations, counter labor shortages, and deliver hyper-responsive customer experiences. AI enables smarter, leaner store management through real-time data interpretation, automation of routine tasks, and intelligent decision support helping physical retail remain competitive in a digitally dominant commerce landscape.Key growth drivers include increased deployment of smart retail infrastructure, rising complexity of omnichannel operations, and demand for.

Looking ahead, the trajectory of this market will depend on how effectively AI tools integrate with legacy systems, support human-centric workflows, and demonstrate tangible ROI across diverse store formats. As retail operations become increasingly intelligent and self-correcting, could AI-driven store management redefine the role of in-store leadership in the next era of retail?

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Software segment, which is expected to reach US$244.9 Million by 2030 with a CAGR of a 27.9%. The Service segment is also set to grow at 20.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $23.8 Million in 2024, and China, forecasted to grow at an impressive 23.8% CAGR to reach $52.9 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Artificial Intelligence Store Manager Tools Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Artificial Intelligence Store Manager Tools Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Artificial Intelligence Store Manager Tools Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AI Store Manager, Amazon Web Services, Inc., Apple Inc., Brightpearl, and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Artificial Intelligence Store Manager Tools market report include:

- AI Store Manager

- Amazon Web Services, Inc.

- Apple Inc.

- Brightpearl

- Caper AI

- Focal Systems

- GK Software SE

- Google LLC

- IBM Corporation

- Impact Analytics

- Infineon Technologies AG

- Intel Corporation

- Kimonix

- LEAFIO AI

- Microsoft Corporation

- NXP Semiconductors N.V.

- Omron Corporation

- Oracle Corporation

- Panasonic Corporation

- Pepperl+Fuchs SE

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AI Store Manager

- Amazon Web Services, Inc.

- Apple Inc.

- Brightpearl

- Caper AI

- Focal Systems

- GK Software SE

- Google LLC

- IBM Corporation

- Impact Analytics

- Infineon Technologies AG

- Intel Corporation

- Kimonix

- LEAFIO AI

- Microsoft Corporation

- NXP Semiconductors N.V.

- Omron Corporation

- Oracle Corporation

- Panasonic Corporation

- Pepperl+Fuchs SE

Table Information

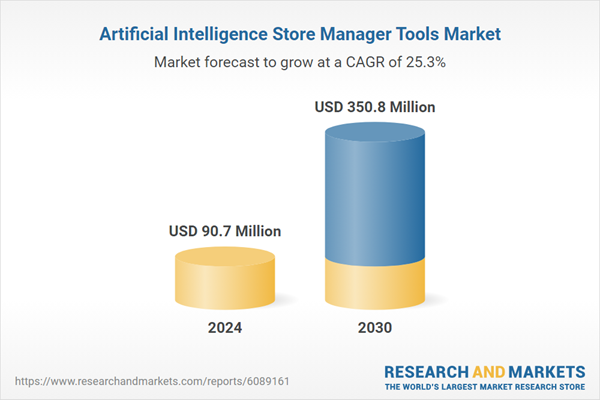

| Report Attribute | Details |

|---|---|

| No. of Pages | 143 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 90.7 Million |

| Forecasted Market Value ( USD | $ 350.8 Million |

| Compound Annual Growth Rate | 25.3% |

| Regions Covered | Global |