Global Artificial Intelligence Sensors Market - Key Trends & Drivers Summarized

Why Are AI Sensors Revolutionizing Data Acquisition, Environmental Awareness, and Autonomous Decision-Making?

Artificial Intelligence (AI) sensors represent a new class of smart components that integrate embedded AI capabilities directly into the sensor architecture. Unlike traditional sensors that merely collect data for downstream processing, AI sensors analyze and interpret signals at the point of acquisition enabling immediate, context-aware responses. These sensors are transforming how machines perceive and interact with their environments across applications in automotive, healthcare, manufacturing, consumer electronics, and robotics.By fusing sensor hardware with on-device machine learning models, AI sensors perform real-time inference for pattern recognition, anomaly detection, classification, and predictive monitoring. This localized intelligence reduces latency, limits data transmission needs, and enhances operational autonomy particularly critical in edge environments with constrained bandwidth or response-time requirements. For example, AI-powered image sensors can identify objects or gestures in surveillance systems, while acoustic sensors equipped with NLP models can trigger voice-command responses in smart devices without cloud dependence.

In industrial and automotive domains, AI sensors contribute to higher system reliability and safety by identifying faults, detecting wear patterns, and anticipating failures through continuous, adaptive monitoring. In smart infrastructure and energy systems, AI-enhanced environmental sensors provide precise air quality, vibration, or temperature analytics supporting automation, energy optimization, and predictive maintenance. As the number of connected devices grows, AI sensors are emerging as foundational elements of scalable, real-time intelligent systems that bridge perception and action.

How Are Edge AI, Multimodal Fusion, and Neuromorphic Engineering Enhancing Sensor Intelligence?

Edge AI is a key enabler for AI sensors, allowing machine learning models to be executed directly on microcontrollers, FPGAs, or neuromorphic chips embedded within the sensor unit. This capability eliminates the need to offload raw data to external processors or cloud platforms for interpretation, significantly reducing power consumption and enhancing data privacy. AI sensors optimized for edge deployment support use cases such as gesture recognition in wearables, facial authentication in mobile devices, and obstacle detection in autonomous vehicles.Multimodal sensor fusion combining data from multiple sensor types such as vision, radar, LiDAR, audio, and thermal augments the contextual awareness and accuracy of AI systems. AI algorithms interpret these diverse data streams simultaneously to form a coherent situational picture, which is particularly useful in dynamic, unstructured environments. For instance, in advanced driver-assistance systems (ADAS), AI fuses camera and radar inputs to enhance object detection reliability under varying weather or lighting conditions.

Neuromorphic sensor development is also gaining momentum. Inspired by biological systems, these sensors mimic neural architectures and process spiking signals in an event-driven fashion, drastically reducing energy usage and enabling real-time learning. Visual and tactile neuromorphic sensors are being explored in applications like prosthetics, robotics, and security systems where traditional sensors struggle with latency and adaptability. These advances are setting the stage for next-generation sensing systems that are not only responsive but also capable of evolving through on-device learning.

Which Application Verticals and Global Markets Are Accelerating Demand for AI-Integrated Sensors?

Automotive is a dominant vertical, where AI sensors are crucial to autonomous driving, driver monitoring systems, and intelligent infotainment. Cameras, LiDAR, radar, and ultrasonic sensors with embedded AI process visual and spatial data to support object tracking, lane departure alerts, pedestrian detection, and adaptive cruise control. The demand for sensor redundancy and real-time decision-making in safety-critical environments is driving OEM and Tier-1 supplier investments in AI-enabled sensor technologies.In healthcare, AI biosensors are being deployed for real-time monitoring of physiological parameters such as ECG, glucose, and blood oxygen levels. These sensors analyze biometric signals on-device, reducing reliance on cloud processing and enabling continuous health tracking in wearables and remote patient monitoring systems. AI is also being integrated into imaging sensors for enhanced diagnostics and early anomaly detection, particularly in low-resource or mobile healthcare settings.

Consumer electronics and smart home markets are adopting AI sensors to deliver seamless user experiences through gesture, presence, and environmental sensing. Smart speakers, cameras, thermostats, and appliances are integrating on-device AI to interpret audio, motion, or ambient inputs for personalized control. Regionally, North America and Asia-Pacific are leading adoption due to high consumer demand, advanced semiconductor ecosystems, and active government support for smart infrastructure. Europe is emphasizing data privacy and sustainable IoT design, while emerging markets are leveraging AI sensors for public safety, transportation, and healthcare delivery at scale.

How Are Interoperability, Power Efficiency, and Regulatory Standards Shaping Market Deployment?

Interoperability is a critical challenge as AI sensors are deployed across diverse hardware ecosystems and communication protocols. Standardization efforts are underway to align sensor interfaces, data formats, and integration protocols facilitating plug-and-play compatibility with AI frameworks, edge platforms, and cloud systems. Vendors are increasingly offering AI sensor SDKs and middleware to simplify deployment and enable application-specific customization without extensive reprogramming.Power efficiency remains a defining factor in AI sensor adoption, especially in mobile, wearable, and remote applications. Developers are focusing on ultra-low-power design, duty cycling, and event-triggered processing to extend battery life without sacrificing performance. AI models are being quantized, pruned, and compressed to fit within the limited compute and memory resources of embedded microcontrollers enabling advanced sensing capabilities in size- and power-constrained environments.

Regulatory frameworks governing AI and sensor technologies are becoming more prominent, particularly in sectors involving health data, facial recognition, and public surveillance. Compliance with GDPR, HIPAA, and emerging AI legislation is guiding the design of privacy-preserving AI sensor solutions. Features such as on-device encryption, data anonymization, and user consent interfaces are being integrated to ensure responsible deployment. As ethical and safety considerations intensify, AI sensor vendors must align performance innovation with trust-building measures to sustain market momentum.

What Are the Factors Driving Growth in the AI Sensors Market?

The AI sensors market is experiencing rapid growth, driven by the convergence of edge computing, miniaturization, and demand for real-time, context-aware intelligence across sectors. These sensors are bridging the gap between raw data capture and intelligent action enabling smarter machines, environments, and user experiences without the latency and overhead of centralized processing.Growth is supported by trends in autonomous systems, IoT proliferation, personalized healthcare, and ambient computing. AI sensors deliver differentiated value by combining compact form factors, rapid inference capabilities, and local decision-making into a single unit unlocking innovation in industries ranging from automotive and healthcare to consumer electronics and industrial automation.

Looking ahead, the trajectory of the AI sensors market will depend on how effectively manufacturers address integration complexity, energy constraints, and data governance requirements. As sensing becomes increasingly intelligent and ubiquitous, could AI-powered sensors form the core infrastructure of the next generation of autonomous, adaptive, and human-aware technologies?

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Pressure Sensors segment, which is expected to reach US$4.6 Billion by 2030 with a CAGR of a 26.8%. The Position Sensors segment is also set to grow at 23.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.2 Billion in 2024, and China, forecasted to grow at an impressive 25.0% CAGR to reach $2.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Artificial Intelligence Sensors Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Artificial Intelligence Sensors Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Artificial Intelligence Sensors Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Ltd., Analog Devices, Inc., Apple Inc., Baidu, Inc., and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Artificial Intelligence Sensors market report include:

- ABB Ltd.

- Analog Devices, Inc.

- Apple Inc.

- Baidu, Inc.

- Bosch Sensortec GmbH

- Cognex Corporation

- General Electric Company

- Honeywell International Inc.

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Infineon Technologies AG

- Intel Corporation

- Micron Technology, Inc.

- Microsoft Corporation

- NXP Semiconductors N.V.

- Omron Corporation

- Panasonic Corporation

- Pepperl+Fuchs SE

- Qualcomm Technologies, Inc.

- Robert Bosch GmbH

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Ltd.

- Analog Devices, Inc.

- Apple Inc.

- Baidu, Inc.

- Bosch Sensortec GmbH

- Cognex Corporation

- General Electric Company

- Honeywell International Inc.

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Infineon Technologies AG

- Intel Corporation

- Micron Technology, Inc.

- Microsoft Corporation

- NXP Semiconductors N.V.

- Omron Corporation

- Panasonic Corporation

- Pepperl+Fuchs SE

- Qualcomm Technologies, Inc.

- Robert Bosch GmbH

Table Information

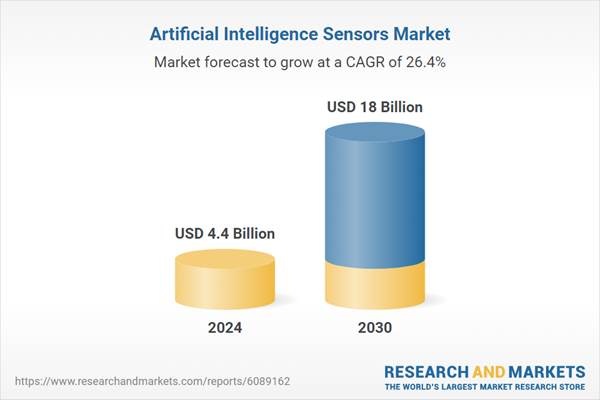

| Report Attribute | Details |

|---|---|

| No. of Pages | 216 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.4 Billion |

| Forecasted Market Value ( USD | $ 18 Billion |

| Compound Annual Growth Rate | 26.4% |

| Regions Covered | Global |