Global Architectural Paint Oxide Market - Key Trends & Drivers Summarized

Why Are Oxide Pigments Critical to the Aesthetic, Durability, and Environmental Performance of Architectural Paints?

Oxide pigments - primarily iron oxides - serve as essential ingredients in architectural paints, imparting long-lasting color, opacity, UV resistance, and weatherability. These inorganic pigments are favored in both interior and exterior coatings for their excellent lightfastness, chemical inertness, and resistance to fading or degradation under harsh environmental conditions. Their non-toxic nature and stability across a wide pH range also make them compatible with various binder systems, including waterborne and solvent-based paints used in residential, commercial, and industrial architecture.Iron oxides are available in a broad spectrum of earthy tones, including reds, yellows, browns, and blacks, which are foundational to contemporary architectural color palettes. Their ability to maintain consistent tinting strength and visual appeal over time supports the growing demand for coatings that combine design flexibility with technical performance. Architectural paints incorporating oxide pigments are commonly applied on concrete, masonry, stucco, drywall, and plaster surfaces - offering both decorative value and protective performance against environmental wear.

In addition to aesthetic contribution, oxide pigments play a role in enhancing functional attributes such as heat reflectivity, corrosion resistance, and fire retardance. For instance, specialty iron oxides are used in cool roof coatings to reduce heat absorption, while zinc or titanium oxides contribute to mildew resistance and exterior durability. As building materials increasingly require both visual distinction and functional coatings, oxide pigments are positioned as high-performance, multifunctional colorants across the architectural coatings industry.

How Are Production Advances, Regulatory Trends, and Material Engineering Enhancing Pigment Performance?

Manufacturers are continually refining the synthesis and processing of oxide pigments to achieve tighter particle size distribution, higher tinting strength, and lower impurities. Precipitation, calcination, and micronization processes are being optimized to produce pigments with enhanced dispersibility and compatibility across diverse paint systems. Surface-treated oxides with encapsulation or hydrophobic coatings are improving dispersion in aqueous formulations and reducing issues like flooding, floating, and pigment-binder separation.Color consistency and opacity are critical quality parameters in architectural paints, particularly for high-coverage, one-coat systems demanded in commercial and high-end residential applications. Oxide pigments engineered for superior hiding power allow paint manufacturers to reduce pigment loading while maintaining vibrant, durable coverage - delivering cost and application efficiency. Hybrid pigment systems combining iron oxide with organic colorants or extender pigments are also being used to expand the available color range while maintaining weatherability and chemical resistance.

Regulatory compliance and sustainability goals are shaping material innovation in architectural pigments. Lead chromate alternatives and low-VOC formulations are accelerating the shift toward environmentally benign oxides. Producers are aligning with REACH, RoHS, and LEED standards by eliminating heavy metal impurities and enhancing lifecycle transparency. Meanwhile, demand for recyclable, low-energy input pigments is driving interest in synthetic and natural oxide sources that offer performance without compromising environmental credentials.

Which Application Segments and Regional Markets Are Fueling Growth in Architectural Paint Oxide Demand?

The residential and commercial construction sectors are the principal end-users of architectural paint oxides, with demand tied closely to new construction, renovation, and infrastructure upgrades. In exterior applications - such as facades, fencing, and roof coatings - oxide pigments offer essential color durability and UV resistance in climates prone to heat, humidity, or pollution. In interior settings, they provide rich, muted hues popular in contemporary design, while maintaining superior coverage, washability, and low toxicity.Specialty architectural applications such as textured finishes, cementitious paints, and anti-carbonation coatings are also driving oxide pigment usage. These products rely on oxides for color retention under harsh outdoor exposure, as well as for compatibility with mineral substrates like concrete and stone. Additionally, oxide-based pigments are widely used in primer-sealer products and elastomeric wall coatings, where longevity and substrate adhesion are critical.

Regionally, Asia-Pacific dominates architectural oxide pigment demand due to rapid urbanization, large-scale housing developments, and robust infrastructure investments across China, India, and Southeast Asia. North America and Europe remain key markets for premium architectural coatings, driven by regulatory compliance, refurbishment trends, and energy-efficient building codes. The Middle East and Africa are emerging as growth areas, where rising construction activity and heat-resistant coatings are increasing the use of oxide-pigmented exterior paints in both commercial and residential settings.

How Are Market Dynamics, Color Trends, and Raw Material Sourcing Strategies Influencing Growth Trajectories?

The architectural coatings industry is increasingly influenced by consumer color trends, sustainability requirements, and price-sensitive procurement strategies. Oxide pigments, with their natural earth-tone appeal and stable supply base, are well positioned to meet both designer preferences and supply chain continuity goals. The growing popularity of biophilic and minimalist design themes is reinforcing demand for warm, muted tones that are best achieved through oxide-based pigment systems.Raw material sourcing strategies are focusing on the reliability and traceability of iron oxide feedstocks, with producers balancing between synthetic (precipitated or calcined) and naturally mined oxides. While synthetic oxides offer superior color control and purity, natural variants are valued in markets prioritizing low embodied energy and local resource utilization. Some manufacturers are investing in closed-loop production models to recycle pigment-laden wastewater and improve resource efficiency.

Competitive differentiation is emerging around pigment customization, dispersion technology, and compatibility with next-gen architectural coatings such as breathable paints, self-cleaning surfaces, and antimicrobial finishes. Paint companies are collaborating with pigment suppliers to develop formulations that align with evolving building codes, environmental certifications, and consumer expectations. As innovation and sustainability reshape architectural coatings, oxide pigments are adapting to deliver long-term performance with reduced ecological impact.

What Are the Factors Driving Growth in the Architectural Paint Oxide Market?

The architectural paint oxide market is growing steadily, driven by the sustained global demand for durable, aesthetically pleasing, and environmentally compliant coatings. Iron oxide and related inorganic pigments continue to be favored for their balance of cost-efficiency, color stability, and functional versatility across interior and exterior architectural applications. The ongoing expansion of construction activity - particularly in emerging economies - further reinforces baseline demand for high-performance pigment systems.Innovation in formulation technology, combined with increased awareness of regulatory compliance and sustainable building practices, is elevating the value proposition of oxide pigments in architectural coatings. Their integration into eco-friendly, VOC-compliant, and energy-efficient paint systems is opening new pathways for differentiation in a highly competitive market. Strategic sourcing, color customization, and lifecycle compatibility are key themes shaping market dynamics.

Looking ahead, the evolution of the architectural paint oxide market will depend on how effectively pigment suppliers align with performance expectations, design trends, and green construction standards. As buildings become more expressive, intelligent, and sustainable, could oxide pigments become the cornerstone of next-generation architectural color and coating technologies?

Report Scope

The report analyzes the Architectural Paint Oxide market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product (Polyurethane, Acrylic, Epoxy, Polyester, Alkyd); Application (Residential, Non-Residential, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Polyurethane segment, which is expected to reach US$41.9 Million by 2030 with a CAGR of a 9.4%. The Acrylic segment is also set to grow at 7.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $18.3 Million in 2024, and China, forecasted to grow at an impressive 12.4% CAGR to reach $22.8 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Architectural Paint Oxide Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Architectural Paint Oxide Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Architectural Paint Oxide Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

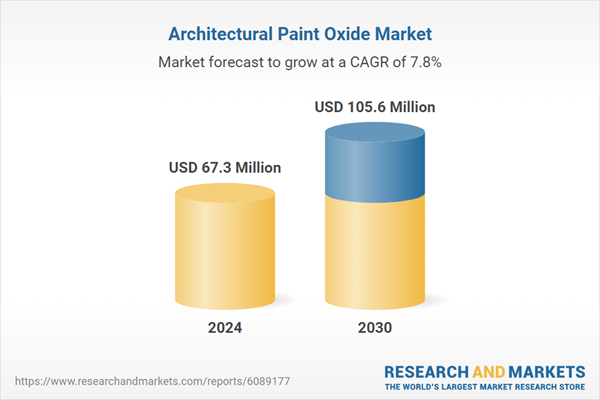

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aotai Electric Co., Ltd., Arcon Welding Equipment, CEA S.p.A., Colfax Corporation (ESAB), Deca S.p.A. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Architectural Paint Oxide market report include:

- 3 Trees Group

- AkzoNobel N.V.

- Asian Paints Limited

- Axalta Coating Systems Ltd.

- BASF SE

- Benjamin Moore & Co.

- Berger Paints India Ltd.

- Brillux GmbH & Co. KG

- Caparol Paints

- CIN, S.A.

- Cloverdale Paint Inc.

- DAW SE

- DuluxGroup Ltd.

- FENZI S.p.A

- Flügger Group A/S

- Gaco Western

- Hempel A/S

- Jotun Group

- Kansai Paint Co., Ltd.

- Masco Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3 Trees Group

- AkzoNobel N.V.

- Asian Paints Limited

- Axalta Coating Systems Ltd.

- BASF SE

- Benjamin Moore & Co.

- Berger Paints India Ltd.

- Brillux GmbH & Co. KG

- Caparol Paints

- CIN, S.A.

- Cloverdale Paint Inc.

- DAW SE

- DuluxGroup Ltd.

- FENZI S.p.A

- Flügger Group A/S

- Gaco Western

- Hempel A/S

- Jotun Group

- Kansai Paint Co., Ltd.

- Masco Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 285 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 67.3 Million |

| Forecasted Market Value ( USD | $ 105.6 Million |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | Global |