Global Arc Ferrite Magnets Market - Key Trends & Drivers Summarized

Why Are Arc Ferrite Magnets Indispensable in Electromechanical Applications Requiring Cost-Effective Magnetic Performance?

Arc ferrite magnets, also known as segment ferrite magnets, are crucial components in the construction of permanent magnet motors, particularly in small to mid-sized electric motors used in appliances, automotive systems, and industrial machinery. Manufactured primarily from iron oxide and strontium carbonate, these magnets offer a compelling balance of performance, cost-efficiency, and corrosion resistance. Their characteristic arc shape is engineered to fit the curved inner surface of rotor assemblies, ensuring uniform magnetic flux and improved torque output in rotating systems.In brushed DC motors, universal motors, and AC induction motors, arc ferrite magnets serve as stator or rotor components that deliver stable magnetic fields under varying load conditions. Their thermal stability, mechanical robustness, and demagnetization resistance make them particularly well-suited for demanding operating environments such as power tools, household appliances, electric fans, and automotive starter motors. Despite the advent of higher-performance rare earth magnets, ferrite variants remain preferred in cost-sensitive, high-volume applications where moderate magnetic strength suffices.

The global push toward motor efficiency, emissions reduction, and electrification of mechanical systems is reinforcing the demand for arc ferrite magnets. In electric scooters, HVAC blower motors, windshield wipers, and fan drives, these magnets enable efficient, lightweight motor designs without reliance on scarce or expensive materials. As OEMs seek to balance functional requirements with material availability and cost control, arc ferrite magnets continue to deliver scalable value across a diverse range of motor-driven platforms.

How Are Manufacturing Advances and Material Engineering Improving Magnet Performance and Design Flexibility?

Advancements in ceramic processing and powder metallurgy have enhanced the magnetic properties and dimensional consistency of arc ferrite magnets. Modern manufacturing techniques - including isostatic pressing and die pressing with sintering - enable precise control over grain orientation, magnetization direction, and mechanical tolerances. These improvements allow for stronger, more uniform magnetic output, contributing to more efficient and compact motor designs.Surface treatment and coating technologies are also evolving to improve the wear resistance and bonding performance of arc ferrite magnets in adhesive-mounted or encapsulated assemblies. Epoxy coatings, polymer films, and chemical passivation are commonly applied to enhance moisture resistance and mechanical integration in electric motor housings. Additionally, multisegment arc designs - where several smaller ferrite segments form a complete ring - allow for cost-effective tooling and greater design flexibility, especially in motors with custom pole configurations.

R&D efforts are exploring hybrid magnetic assemblies that pair ferrite magnets with auxiliary soft magnetic materials or engineered flux guides to enhance field strength without incurring the full cost of rare-earth magnets. These composite approaches are enabling performance optimization for mid-range motor applications such as washing machines, vacuum cleaners, and industrial pumps. As material science continues to evolve, arc ferrite magnets are benefiting from incremental gains that improve their competitiveness in both legacy and emerging use cases.

Which End-Use Industries and Regional Markets Are Driving Demand for Arc Ferrite Magnet Solutions?

Consumer appliances constitute a significant share of arc ferrite magnet demand, with widespread usage in fan motors, washing machine drives, vacuum cleaner rotors, and HVAC blowers. The automotive industry is another key end-user, leveraging these magnets in electric window motors, seat adjusters, fuel pumps, and ABS systems. As automotive electrification progresses, ferrite magnets are being deployed in auxiliary electric motors across internal combustion engine (ICE) vehicles and increasingly in low-cost EV components.Industrial machinery and power tools represent a steady demand base, where ferrite-based motors are used in drills, grinders, compressors, and pumps. Their low cost, thermal endurance, and electrical insulation make them well-suited for continuous-duty cycles in rugged conditions. Additionally, ferrite magnets are finding use in electric bicycles, water pumps, and small wind turbines - applications that prioritize efficiency and affordability over magnetic density. In emerging applications such as agricultural automation and low-speed industrial robotics, arc ferrite magnets provide a dependable, budget-conscious motorization solution.

Regionally, Asia-Pacific dominates production and consumption, led by China, which has a highly integrated ferrite magnet supply chain serving the automotive, appliance, and industrial sectors. Japan and South Korea also maintain strong demand due to their high-end manufacturing bases. North America and Europe continue to use ferrite magnets in appliance and automotive applications, although some substitution with neodymium magnets is observed in performance-critical segments. Meanwhile, Latin America, Southeast Asia, and Africa are expanding adoption through growing consumer goods production and decentralized electrification initiatives.

How Are Raw Material Economics, Sustainability Pressures, and Market Competition Influencing Strategic Direction?

One of the primary advantages of arc ferrite magnets lies in their abundant raw material base, which insulates them from the price volatility and geopolitical risk associated with rare earth elements. With primary inputs such as iron oxide and strontium carbonate readily available at global scale, ferrite magnet production remains stable and cost-predictable - an increasingly important factor amid global supply chain disruptions and raw material nationalism.Sustainability and circular economy goals are influencing magnet procurement, particularly in Europe and North America. Ferrite magnets, being ceramic-based and recyclable without significant hazardous waste, are gaining favor as environmentally preferable alternatives to certain rare earth-containing counterparts. Additionally, the energy-efficient nature of ferrite magnet production supports lower lifecycle carbon footprints - reinforcing alignment with green manufacturing and ESG initiatives.

Market competition is intensifying between ferrite magnet producers in China, India, and Southeast Asia, prompting innovation in value-added services such as magnet customization, performance certification, and integrated rotor-stator design support. At the same time, partnerships between motor OEMs and magnet suppliers are expanding, aiming to co-develop optimized assemblies that reduce material use while meeting tightening efficiency standards. These dynamics are pushing arc ferrite magnets into more engineered and differentiated roles across global value chains.

What Are the Factors Driving Growth in the Arc Ferrite Magnets Market?

The arc ferrite magnets market is expanding steadily, supported by high-volume demand from appliance, automotive, and industrial motor segments. Their affordability, chemical stability, and reliable magnetic performance under varying temperatures continue to make them the material of choice for many mainstream electromechanical applications. As global manufacturers seek alternatives to rare earth magnets amid supply and cost pressures, ferrite-based solutions remain strategically important.Growth is further reinforced by ongoing advances in ceramic processing, magnet segmentation, and composite magnet system design. The transition to electrified mobility, energy-efficient appliances, and small-scale renewable systems presents fresh opportunities for arc ferrite magnets across emerging and mature markets. Their role in ensuring product affordability, design flexibility, and long-term reliability supports their continued relevance in a shifting magnetics landscape.

Looking ahead, the market's future will depend on how effectively ferrite magnet technologies adapt to evolving performance requirements, material sustainability goals, and regional supply strategies. As electrification becomes more democratized across industries and geographies, could arc ferrite magnets reassert themselves as the essential enabler of cost-effective, scalable electric motion?

Report Scope

The report analyzes the Arc Ferrite Magnets market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Sintered Ferrite Magnet, Bonded Ferrite Magnet); Application (Electro-Acoustic Product, Toy, Automotive, Home Appliance, Computer, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

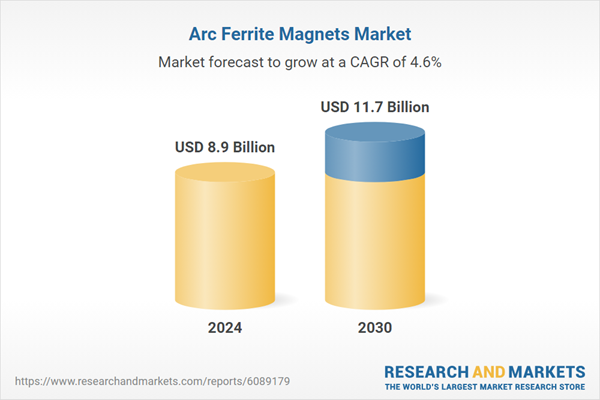

- Market Growth: Understand the significant growth trajectory of the Sintered Ferrite Magnet segment, which is expected to reach US$6.6 Billion by 2030 with a CAGR of a 3.5%. The Bonded Ferrite Magnet segment is also set to grow at 6.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.4 Billion in 2024, and China, forecasted to grow at an impressive 7.2% CAGR to reach $2.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Arc Ferrite Magnets Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Arc Ferrite Magnets Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Arc Ferrite Magnets Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aceto Corporation, Actylis, Ametis JSC, Archer Daniels Midland Company, Ataman Kimya A.S. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Arc Ferrite Magnets market report include:

- Adams Magnetic Products Co.

- Advanced Technology & Materials Co.

- Anhui Earth-Panda Advance Magnetic Material Co., Ltd.

- Arnold Magnetic Technologies

- BGRIMM Magnetic Materials & Technology Co., Ltd.

- DMEGC Magnetics

- Electron Energy Corporation

- Guangdong JPMF Magnetic Material Co., Ltd.

- Hangzhou Permanent Magnet Group

- Hitachi Metals, Ltd.

- Honesun Industrial Co., Ltd.

- Honsen Magnetics

- Hunan Aerospace Magnet & Magneto

- Jiangxi Yiyuan Magnetic Materials Co., Ltd.

- Linkup Magnet Co., Ltd.

- Magnequench International Inc.

- MPCO Magnetics

- Ningbo Jinshuo Magnet Technology Co., Ltd.

- Ningbo Ketian Magnet Co., Ltd.

- Ningbo Vastsky Magnet Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Adams Magnetic Products Co.

- Advanced Technology & Materials Co.

- Anhui Earth-Panda Advance Magnetic Material Co., Ltd.

- Arnold Magnetic Technologies

- BGRIMM Magnetic Materials & Technology Co., Ltd.

- DMEGC Magnetics

- Electron Energy Corporation

- Guangdong JPMF Magnetic Material Co., Ltd.

- Hangzhou Permanent Magnet Group

- Hitachi Metals, Ltd.

- Honesun Industrial Co., Ltd.

- Honsen Magnetics

- Hunan Aerospace Magnet & Magneto

- Jiangxi Yiyuan Magnetic Materials Co., Ltd.

- Linkup Magnet Co., Ltd.

- Magnequench International Inc.

- MPCO Magnetics

- Ningbo Jinshuo Magnet Technology Co., Ltd.

- Ningbo Ketian Magnet Co., Ltd.

- Ningbo Vastsky Magnet Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 279 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 8.9 Billion |

| Forecasted Market Value ( USD | $ 11.7 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | Global |