Global Arabinogalactan Market - Key Trends & Drivers Summarized

Why Is Arabinogalactan Gaining Recognition Across Health, Food, and Industrial Applications?

Arabinogalactan, a highly branched polysaccharide composed of arabinose and galactose sugars, is increasingly valued for its functional properties in nutritional, pharmaceutical, and industrial formulations. Naturally derived from the wood of the Larix (larch) tree and other botanical sources, arabinogalactan offers a combination of solubility, prebiotic activity, and emulsification potential that supports diverse end-use applications. Its status as a non-starch, water-soluble dietary fiber makes it especially attractive for gut health and immune system modulation.In the health and wellness sector, arabinogalactan is incorporated into functional foods, beverages, and dietary supplements due to its ability to support gastrointestinal health, enhance mineral absorption, and stimulate beneficial gut flora such as Lactobacillus and Bifidobacterium. It also demonstrates immunomodulatory effects, with clinical studies suggesting it can increase natural killer cell activity and reduce the incidence of upper respiratory infections. These attributes align with growing consumer demand for evidence-backed, plant-based ingredients that support preventative health and immunity.

Beyond nutrition, arabinogalactan is being used in pharmaceutical applications as a binder, stabilizer, and drug delivery agent due to its biocompatibility and low toxicity. It is also gaining interest in cosmetics and personal care for its moisturizing and film-forming properties. As consumer awareness of clean label, plant-derived, and gut-supportive ingredients expands, arabinogalactan is emerging as a versatile bioactive compound bridging traditional wellness practices with modern functional product development.

How Are Extraction Technologies and Formulation Innovations Enhancing Product Utility and Market Reach?

Advances in extraction and purification technologies are improving the consistency, scalability, and functional quality of commercial-grade arabinogalactan. Mechanical, aqueous, and enzymatic extraction techniques are being optimized to preserve bioactivity while minimizing environmental impact and production cost. Standardized processing protocols are enabling manufacturers to deliver high-purity, low-ash arabinogalactan powders with consistent molecular weight profiles suitable for regulated nutraceutical and pharmaceutical markets.Microencapsulation and controlled-release formulations are being explored to extend the utility of arabinogalactan in probiotic delivery, synbiotic blends, and immune health supplements. These techniques enhance stability and targeted release in the gastrointestinal tract, improving efficacy and consumer compliance. In food processing, arabinogalactan is being formulated as a fiber fortifier, emulsifier, and mouthfeel enhancer in dairy alternatives, powdered beverages, and baked goods. Its neutral taste and excellent solubility support seamless integration into diverse product formats.

In industrial applications, the compound's natural emulsifying and water-retention properties are being utilized in paper manufacturing, oil drilling fluids, and adhesives. Biopolymer research is investigating arabinogalactan as a sustainable alternative to synthetic thickeners and film-forming agents. As sustainability, biodegradability, and plant-origin sourcing gain traction, arabinogalactan is well-positioned as a renewable ingredient with cross-sectoral application potential.

Which End-Use Industries and Regional Markets Are Driving Demand for Arabinogalactan Products?

Nutraceuticals and functional foods remain the largest application areas for arabinogalactan, particularly in immune health, digestive wellness, and prebiotic nutrition segments. The ingredient is gaining traction among formulators of synbiotics, where it complements probiotic strains to promote gut microbiome balance. Consumer-facing brands are also leveraging arabinogalactan's clean label appeal in fiber-enriched snacks, immune-support drinks, and wellness gummies. Pediatric and geriatric nutrition markets, which demand gentle, efficacious fiber sources, are showing heightened interest in arabinogalactan-based solutions.The pharmaceutical and veterinary sectors are exploring arabinogalactan for its role in drug solubilization, mucosal delivery, and as a carrier in vaccine formulations. Its immune-modulatory profile is also being assessed in conjunction with antiviral therapies and immune-compromised patient care. In animal health, arabinogalactan is used as a feed additive to enhance gut health and feed efficiency in poultry, swine, and companion animals - offering a natural alternative to antibiotic growth promoters.

Geographically, North America leads in arabinogalactan production and consumption, largely due to its established larch wood harvesting industry and well-developed nutraceutical market. Europe follows, driven by stringent regulatory frameworks and strong demand for evidence-based, natural health ingredients. Asia-Pacific is witnessing increasing adoption, fueled by rising health awareness, dietary supplement penetration, and functional food innovation in China, Japan, South Korea, and Australia. As plant-based and functional nutrition trends globalize, arabinogalactan is gaining strategic relevance across regions and sectors.

How Are Regulatory Approvals, Clinical Validation, and Sustainability Trends Influencing Market Dynamics?

Regulatory recognition of arabinogalactan as Generally Recognized As Safe (GRAS) by the U.S. FDA and its inclusion in the European Food Safety Authority's (EFSA) list of approved dietary fibers have provided a solid foundation for its global market adoption. Compliance with key food and pharma-grade certifications - such as USP, FCC, and ISO - further enhances its credibility among manufacturers seeking regulatory clarity and formulation confidence. As clinical research on gut health and immunity continues to grow, arabinogalactan's evidence base is becoming a critical differentiator in product positioning.Health claims substantiated by peer-reviewed studies are enabling manufacturers to market arabinogalactan-based products with a focus on immune support, microbiome modulation, and fiber fortification - attributes that align with consumer preferences for wellness, prevention, and digestive health. In regulated markets, such claims also support clearer product labeling, improved shelf appeal, and consumer trust. Additionally, the expanding field of personalized nutrition is opening up new avenues for arabinogalactan inclusion in data-driven health and microbiome-targeted formulations.

Sustainability trends are reinforcing the appeal of arabinogalactan as a low-impact, naturally derived ingredient. It is typically sourced from larch wood, a renewable forestry by-product, allowing manufacturers to leverage circular economy narratives and minimize raw material waste. With environmental transparency becoming a core component of ingredient sourcing and brand equity, arabinogalactan offers a compelling proposition for companies seeking both functionality and ecological responsibility.

What Are the Factors Driving Growth in the Arabinogalactan Market?

The arabinogalactan market is gaining momentum, propelled by rising consumer interest in prebiotic fibers, immune-supportive ingredients, and plant-based wellness solutions. Demand is further supported by clinical evidence, regulatory acceptance, and cross-functional utility in nutraceutical, pharmaceutical, food, and industrial domains. Its adaptability across dosage formats and end-use applications enhances its relevance in a competitive, health-conscious global market.Growth is also being driven by increasing investments in microbiome science, personalized nutrition, and functional ingredient innovation. Arabinogalactan's compatibility with clean label standards, coupled with its renewable sourcing and minimal sensory impact, positions it well in both premium and mainstream product lines. Meanwhile, expanding global access to natural and specialty ingredients is opening new markets in Asia, Latin America, and the Middle East.

Looking forward, the trajectory of the arabinogalactan market will depend on how effectively producers scale supply, validate health benefits through robust science, and differentiate applications across segments. As consumer health priorities continue to evolve, could arabinogalactan become a foundational ingredient in the next generation of integrative health and functional nutrition solutions?

Report Scope

The report analyzes the Arabinogalactan market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Western Larch Source, Mongolian Larch Source); Application (Food & Dietary Supplement, Pharmaceutical, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Western Larch Source segment, which is expected to reach US$115 Million by 2030 with a CAGR of a 3.1%. The Mongolian Larch Source segment is also set to grow at 1.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $42.6 Million in 2024, and China, forecasted to grow at an impressive 4.9% CAGR to reach $34.9 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Arabinogalactan Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Arabinogalactan Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Arabinogalactan Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3Glasses, ARShow, AYiWa, GuDong, HIKVISION and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this Arabinogalactan market report include:

- Aceto Corporation

- Actylis

- Ametis JSC

- Archer Daniels Midland Company

- Ataman Kimya A.S.

- BASF SE

- Biosynth Ltd.

- Cargill Incorporated

- DaVinci Laboratories of Vermont

- Dextra Laboratories Ltd.

- DuPont de Nemours Inc.

- Elicityl S.A.

- Enomark

- FoodScience of Vermont

- Glentham Life Sciences Ltd.

- Green Stone Swiss Co., Ltd.

- H&Z Industry Co., Ltd.

- Hangzhou Meite Chemical Co., Ltd.

- Jeeva Organic

- Jilin Forest Industry Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aceto Corporation

- Actylis

- Ametis JSC

- Archer Daniels Midland Company

- Ataman Kimya A.S.

- BASF SE

- Biosynth Ltd.

- Cargill Incorporated

- DaVinci Laboratories of Vermont

- Dextra Laboratories Ltd.

- DuPont de Nemours Inc.

- Elicityl S.A.

- Enomark

- FoodScience of Vermont

- Glentham Life Sciences Ltd.

- Green Stone Swiss Co., Ltd.

- H&Z Industry Co., Ltd.

- Hangzhou Meite Chemical Co., Ltd.

- Jeeva Organic

- Jilin Forest Industry Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 281 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

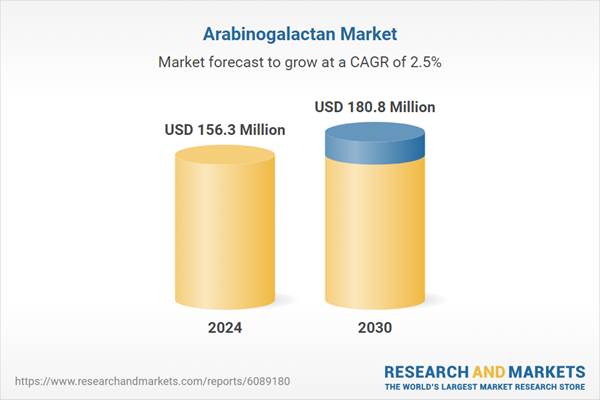

| Estimated Market Value ( USD | $ 156.3 Million |

| Forecasted Market Value ( USD | $ 180.8 Million |

| Compound Annual Growth Rate | 2.5% |

| Regions Covered | Global |