Global Application Performance Monitoring Market - Key Trends & Drivers Summarized

Why Is Application Performance Monitoring Essential to Digital Experience, Business Continuity, and Operational Intelligence?

Application Performance Monitoring (APM) has evolved into a critical enabler of enterprise digital strategy, ensuring that software applications operate reliably, responsively, and in alignment with user expectations. As organizations across industries undergo digital transformation, their reliance on complex, distributed applications - spanning cloud-native architectures, APIs, microservices, and mobile front ends - has intensified. APM provides real-time visibility into application behavior, transaction performance, and user experience, enabling proactive identification and resolution of performance bottlenecks.In today's always-on digital economy, application slowdowns, outages, or degradations directly impact customer satisfaction, employee productivity, and revenue generation. APM helps mitigate these risks by monitoring key performance indicators (KPIs) such as response times, error rates, server throughput, and resource utilization. These insights allow IT teams to triage issues quickly, reduce mean time to resolution (MTTR), and uphold service-level agreements (SLAs) across mission-critical workloads. For customer-facing platforms - such as e-commerce portals, banking apps, or online booking systems - APM directly supports business continuity and brand reputation.

The growing adoption of agile development, DevOps practices, and CI/CD pipelines further reinforces the need for continuous performance feedback throughout the software lifecycle. APM not only supports production environments but also plays a key role in pre-deployment testing, release validation, and post-release optimization. As software becomes the core interface between businesses and customers, APM is increasingly viewed as a strategic layer of operational intelligence that bridges development, IT operations, and business outcomes.

How Are AI-Driven Analytics, Observability Integration, and Cloud-Native Architectures Redefining APM Capabilities?

Modern APM platforms are leveraging artificial intelligence and machine learning (AI/ML) to automate anomaly detection, root cause analysis, and incident prioritization. These capabilities help organizations manage performance at scale across dynamic application landscapes where manual monitoring is no longer viable. AI/ML models can correlate metrics, logs, and traces in real time to detect deviations from normal behavior, forecast performance degradation, and recommend remedial actions - enabling more resilient and self-healing application environments.The shift from traditional APM to full-stack observability is also transforming how performance data is collected, analyzed, and acted upon. Observability platforms unify telemetry from infrastructure, application code, user sessions, and business transactions into a cohesive analytical view. This convergence allows teams to understand how infrastructure events, code-level changes, and user interactions impact end-to-end application performance. OpenTelemetry and other standardization efforts are further enabling vendor-agnostic instrumentation and interoperability across diverse technology stacks.

Cloud-native architectures - built on containers, Kubernetes, and serverless functions - present new challenges and opportunities for APM. These environments generate massive volumes of ephemeral, interdependent telemetry data, requiring APM tools to provide granular, real-time visibility without performance overhead. Lightweight agents, distributed tracing, and service maps are now essential features for monitoring containerized applications in multicloud or hybrid cloud settings. As enterprises modernize their application delivery models, APM must evolve to support dynamic environments without sacrificing depth or precision of insights.

Which Enterprise Segments and Regional Markets Are Driving Adoption of Application Performance Monitoring Solutions?

Large enterprises across banking, financial services, e-commerce, telecommunications, and healthcare are among the leading adopters of APM, owing to their complex IT infrastructures and critical reliance on application availability. These sectors often require stringent compliance, 24/7 uptime, and consistent digital engagement, making performance visibility a core operational requirement. With growing customer expectations around real-time interactions and personalized experiences, enterprises are investing in APM to ensure seamless front-end and back-end integration.Mid-market and digitally native businesses are also increasing APM adoption, particularly as they scale operations on public cloud platforms and expand their microservices footprints. As DevOps maturity grows among mid-sized enterprises, APM is being integrated into continuous delivery workflows to optimize release velocity and application quality. In addition, SaaS providers and technology companies are embedding APM into their own platforms to deliver performance assurance as part of their service offerings.

Regionally, North America leads the market due to early technology adoption, cloud maturity, and a high concentration of enterprise software vendors and hyperscale cloud providers. Europe follows closely, with strong uptake in regulated industries and a growing focus on observability and open-source telemetry integration. Asia-Pacific is witnessing the fastest growth, driven by rapid digitalization across India, China, Southeast Asia, and Australia. In Latin America, the Middle East, and parts of Africa, rising investments in IT modernization, online commerce, and customer experience transformation are catalyzing new demand for APM capabilities across both public and private sectors.

How Are Licensing Models, Platform Consolidation, and DevSecOps Trends Reshaping the Competitive Landscape?

The APM market is undergoing consolidation as enterprises seek unified platforms that integrate APM with infrastructure monitoring, log analytics, and security observability. Vendors are repositioning themselves as full-stack observability providers, combining real user monitoring (RUM), synthetic monitoring, distributed tracing, and business analytics under one roof. This convergence is being driven by customer demand for fewer monitoring silos, lower total cost of ownership, and deeper cross-functional collaboration across IT, security, and business teams.Flexible licensing models - including usage-based pricing, freemium tiers, and SaaS-based delivery - are making APM accessible to a broader range of organizations. These models allow for elastic scaling with cloud workloads and reduce upfront investment, particularly attractive for startups and enterprises undergoing digital transformation. Platform extensibility and ecosystem partnerships are also emerging as differentiators, enabling APM tools to integrate with DevOps toolchains, cloud-native orchestration frameworks, and incident management systems.

The rise of DevSecOps is reinforcing the role of APM in secure software delivery. Performance telemetry is increasingly being used to detect anomalies that may indicate security vulnerabilities, misconfigurations, or compliance violations. Integrating APM data into security information and event management (SIEM) platforms or cloud security posture management (CSPM) tools is expanding the scope of monitoring from performance to proactive risk detection. As digital environments become more interdependent and attack surfaces expand, APM is being recognized as a dual-purpose asset for both operational resilience and cyber readiness.

What Are the Factors Driving Growth in the Application Performance Monitoring Market?

The application performance monitoring market is expanding steadily, driven by the global acceleration of digital transformation, growing complexity of software architectures, and rising expectations for seamless user experience. Key growth enablers include cloud adoption, microservices deployment, remote work infrastructure, and the need for continuous delivery in competitive digital markets. APM's ability to connect technical metrics with business outcomes makes it essential for organizations seeking operational agility and customer-centricity.Next-generation APM platforms are evolving into intelligent observability suites, offering predictive insights, automation, and contextual analytics. As enterprises prioritize resiliency, speed, and performance in software delivery, APM is being woven into the fabric of IT operations, DevOps workflows, and executive decision-making. Demand is further bolstered by the increasing role of AI, real-time telemetry, and regulatory pressures around service reliability and transparency.

Looking ahead, the market's trajectory will hinge on how effectively APM solutions can unify observability, reduce operational silos, and support both legacy and cloud-native environments. As applications become the lifeblood of digital enterprises, could APM emerge as the central nervous system connecting infrastructure, innovation, and end-user experience?

Report Scope

The report analyzes the Application Performance Monitoring market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Solution (Software, Services, Training & Education); Access Type (Web APM, Mobile APM); Deployment (Cloud, On-Premise); End-Use (IT & Telecommunications, BFSI, Retail & E-Commerce, Healthcare, Manufacturing, Government, Media & Entertainment, Academics, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Software Component segment, which is expected to reach US$10.9 Billion by 2030 with a CAGR of a 16.9%. The Services Component segment is also set to grow at 13.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.2 Billion in 2024, and China, forecasted to grow at an impressive 20.6% CAGR to reach $4.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Application Performance Monitoring Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Application Performance Monitoring Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Application Performance Monitoring Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abbott Laboratories, Anteris Technologies Ltd., Artivion Inc., AutoTissue GmbH, Boston Scientific Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Application Performance Monitoring market report include:

- Akamai Technologies Inc.

- Amazon Web Services, Inc.

- AppDynamics LLC (Cisco Systems Inc.)

- BMC Software, Inc.

- Broadcom Inc.

- Datadog, Inc.

- Dynatrace, Inc.

- Google LLC

- Hewlett Packard Enterprise

- IBM Corporation

- LogicMonitor, Inc.

- Micro Focus International PLC

- Microsoft Corporation

- NetScout Systems, Inc.

- New Relic, Inc.

- Oracle Corporation

- Platform.sh SAS

- Riverbed Technology LLC

- ServiceNow, Inc.

- SignalFx (Splunk Inc.)

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Akamai Technologies Inc.

- Amazon Web Services, Inc.

- AppDynamics LLC (Cisco Systems Inc.)

- BMC Software, Inc.

- Broadcom Inc.

- Datadog, Inc.

- Dynatrace, Inc.

- Google LLC

- Hewlett Packard Enterprise

- IBM Corporation

- LogicMonitor, Inc.

- Micro Focus International PLC

- Microsoft Corporation

- NetScout Systems, Inc.

- New Relic, Inc.

- Oracle Corporation

- Platform.sh SAS

- Riverbed Technology LLC

- ServiceNow, Inc.

- SignalFx (Splunk Inc.)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 483 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

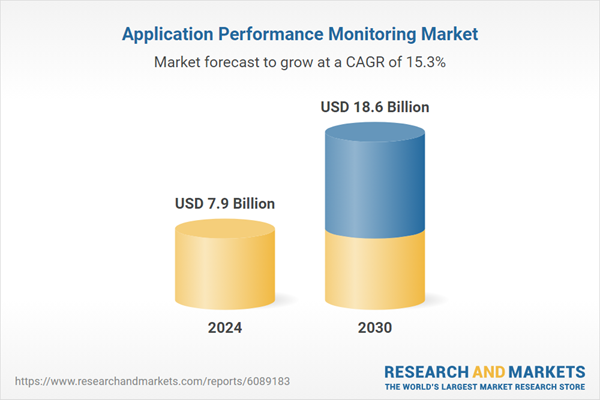

| Estimated Market Value ( USD | $ 7.9 Billion |

| Forecasted Market Value ( USD | $ 18.6 Billion |

| Compound Annual Growth Rate | 15.3% |

| Regions Covered | Global |