Global Antihistamine Market - Key Trends & Drivers Summarized

Why Are Antihistamines Critical to Managing Allergic, Inflammatory, and Hypersensitivity Conditions?

Antihistamines play a foundational role in the management of allergic disorders, functioning by antagonizing histamine receptors to reduce or prevent symptoms associated with allergic rhinitis, urticaria, conjunctivitis, anaphylaxis, and other hypersensitivity reactions. By blocking histamine activity at H1 or H2 receptors, these drugs provide relief from itching, swelling, nasal congestion, and hives - offering rapid symptomatic control in both acute and chronic allergic conditions. Their utility spans across self-limiting seasonal allergies to more persistent, medically managed dermatologic and respiratory disorders.First-generation antihistamines, though effective, are associated with sedation and central nervous system effects due to their ability to cross the blood-brain barrier. In contrast, second- and third-generation antihistamines such as loratadine, fexofenadine, and levocetirizine offer greater receptor selectivity and longer duration of action with minimal sedation. These newer agents have become the preferred choice for long-term therapy, enabling patients to maintain quality of life without cognitive impairment or drowsiness, particularly in daily-use scenarios such as allergic rhinitis or atopic dermatitis.

Beyond allergy management, antihistamines are being explored for broader therapeutic roles, including adjunctive treatment in anaphylaxis, motion sickness, insomnia, and nausea associated with chemotherapy. Some H1 antihistamines also show off-label potential in modulating cytokine activity in autoimmune and inflammatory disorders. Meanwhile, H2 receptor antagonists, though declining in prominence due to proton pump inhibitor (PPI) uptake, remain relevant in treating conditions like GERD, peptic ulcer disease, and histamine-mediated gastrointestinal hypersensitivity. This wide application scope continues to reinforce the clinical and commercial relevance of antihistamines across multiple care pathways.

How Are Formulation Advances and Delivery Innovations Enhancing Antihistamine Accessibility and Compliance?

Recent advances in drug formulation have improved the pharmacokinetics, tolerability, and convenience of antihistamine therapies. Long-acting, once-daily oral formulations are now widely available, reducing pill burden and enhancing adherence in chronic allergy sufferers. Orally disintegrating tablets, chewable forms, and liquid suspensions support pediatric and geriatric patient compliance, while combination products (e.g., antihistamines with decongestants) offer broader symptom control in upper respiratory allergy management.Intranasal antihistamines such as azelastine are gaining ground for patients requiring rapid, localized symptom relief with minimal systemic exposure. These are particularly effective for nasal congestion and rhinorrhea in allergic rhinitis, especially when used in combination with intranasal corticosteroids. Topical antihistamines are also used for dermatologic applications, including pruritus, insect bites, and atopic dermatitis, offering fast symptom control at the site of inflammation without systemic side effects.

Additionally, injectable and intravenous antihistamines continue to be used in acute care settings, including emergency treatment of anaphylaxis and allergic drug reactions. Advances in extended-release and dual-mechanism formulations (such as dual H1/H2 blockers or antihistamine-mast cell stabilizer hybrids) are being pursued to expand the therapeutic window and reduce recurrence of symptoms. As patient-centric care models expand, delivery systems that support ease of use, rapid onset, and minimal side effects are becoming critical to antihistamine market sustainability and growth.

Which Indications and Global Regions Are Driving Antihistamine Demand Growth?

Allergic rhinitis remains the leading indication for antihistamine use, followed by chronic urticaria, atopic dermatitis, and conjunctivitis. The rising global prevalence of allergic diseases - driven by environmental pollution, urbanization, and changing lifestyle patterns - is contributing to growing demand for antihistamine therapy across both prescription and over-the-counter (OTC) segments. Respiratory allergies, in particular, are surging due to increased pollen exposure, indoor allergens, and climate variability, especially in urban populations.Pediatric allergy treatment is a rapidly growing segment, where antihistamines are preferred for their favorable safety profile, rapid action, and non-steroidal nature. Seasonal and perennial allergies in children, coupled with parental demand for non-sedating, child-friendly formulations, are influencing product development and marketing strategies. In parallel, elderly populations with polypharmacy risks are shifting preference toward second-generation, low-interaction antihistamines for safe long-term use in chronic allergic and skin conditions.

Geographically, North America and Europe dominate antihistamine consumption due to well-established healthcare systems, widespread allergy diagnostics, and strong OTC retail networks. However, Asia-Pacific is experiencing the fastest growth, supported by rising allergy incidence, improved access to healthcare, and increasing public awareness in China, India, and Southeast Asia. The expansion of organized retail, growing pharmaceutical penetration, and higher diagnosis rates in developing regions are further reinforcing the global demand trajectory for antihistamines in both clinical and consumer settings.

How Are Regulatory Reclassifications, Market Competition, and OTC Expansion Reshaping Market Dynamics?

A significant portion of antihistamines has transitioned from prescription-only to OTC status in mature markets, reflecting their strong safety profile and widespread use. Regulatory reclassification has expanded consumer access, bolstered retail sales, and enabled self-medication for mild to moderate allergy symptoms. While this trend enhances market volume, it also intensifies price competition and necessitates strong branding, formulation differentiation, and direct-to-consumer marketing strategies to maintain share in a commoditized OTC landscape.At the same time, generic erosion is a persistent challenge, particularly for legacy first- and second-generation molecules. Branded manufacturers are responding with product line extensions, pediatric-specific formulations, combination packs, and patient loyalty programs to retain market positioning. Some companies are also investing in digital health platforms and telehealth integration to pair OTC antihistamine sales with personalized symptom management and allergist referrals.

Meanwhile, regulatory scrutiny around antihistamine safety in vulnerable populations - including infants, pregnant women, and patients with cardiovascular comorbidities - is prompting updated labeling, revised dosing guidelines, and renewed focus on pharmacovigilance. As health authorities tighten safety and efficacy requirements, manufacturers must invest in robust clinical evidence, post-market surveillance, and global compliance frameworks to sustain competitiveness in both regulated and semi-regulated markets.

What Are the Factors Driving Growth in the Antihistamine Market?

The antihistamine market is expanding consistently, driven by the global rise in allergic disease burden, increasing preference for symptom-focused treatment, and the shift toward consumer-managed care. Key growth enablers include expanded OTC availability, favorable safety profiles, and ongoing innovation in delivery formats catering to patient-specific needs. The broad therapeutic reach of antihistamines across respiratory, dermatologic, gastrointestinal, and acute care settings ensures continued market relevance.Formulation advancements, regional market penetration, and alignment with self-care trends are supporting category growth across both branded and generic segments. As demand for non-sedating, fast-acting, and long-duration antihistamines rises, manufacturers are focusing on differentiated, lifecycle-optimized portfolios to stay competitive in increasingly saturated retail channels. At the same time, digital health tools and AI-assisted allergy tracking are creating new opportunities to link antihistamines with proactive disease management.

Looking forward, the market's evolution will be shaped by how well manufacturers address the balance between consumer accessibility, clinical efficacy, and regulatory safety. As environmental factors intensify and patient expectations evolve, could antihistamines maintain their role as the cornerstone of modern allergy and hypersensitivity symptom control?

Report Scope

The report analyzes the Antihistamine market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (H-1 Blockers, H-2 Blockers); Administration Route (Oral, Parenteral, Topical)); Indication (Allergies, Urticaria, Dermatitis, Other Indications); Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Drug Stores, Online Pharmacies, Other Distribution Channels).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the H-1 Blockers segment, which is expected to reach US$227.4 Million by 2030 with a CAGR of a 5.5%. The H-2 Blockers segment is also set to grow at 3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $74.7 Million in 2024, and China, forecasted to grow at an impressive 8.4% CAGR to reach $74.7 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Antihistamine Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Antihistamine Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Antihistamine Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AbbVie Inc., AbCellera Biologics Inc., Amgen Inc., Argenx SE, AstraZeneca plc and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Antihistamine market report include:

- Ajanta Pharma Limited

- Almirall S.A.

- AstraZeneca plc

- Bayer AG

- Boehringer Ingelheim GmbH

- Bristol-Myers Squibb Company

- CVS Health Corporation

- Dr. Reddy's Laboratories Ltd.

- F. Hoffmann-La Roche Ltd

- GlaxoSmithKline plc

- Glenmark Pharmaceuticals Ltd.

- Hetero Drugs Ltd.

- Innate Pharma S.A.

- Johnson & Johnson

- Jubilant Pharma Limited

- Menarini Group

- Merck & Co., Inc.

- Mylan N.V.

- Novartis AG

- Olpha JSC

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ajanta Pharma Limited

- Almirall S.A.

- AstraZeneca plc

- Bayer AG

- Boehringer Ingelheim GmbH

- Bristol-Myers Squibb Company

- CVS Health Corporation

- Dr. Reddy's Laboratories Ltd.

- F. Hoffmann-La Roche Ltd

- GlaxoSmithKline plc

- Glenmark Pharmaceuticals Ltd.

- Hetero Drugs Ltd.

- Innate Pharma S.A.

- Johnson & Johnson

- Jubilant Pharma Limited

- Menarini Group

- Merck & Co., Inc.

- Mylan N.V.

- Novartis AG

- Olpha JSC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 479 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

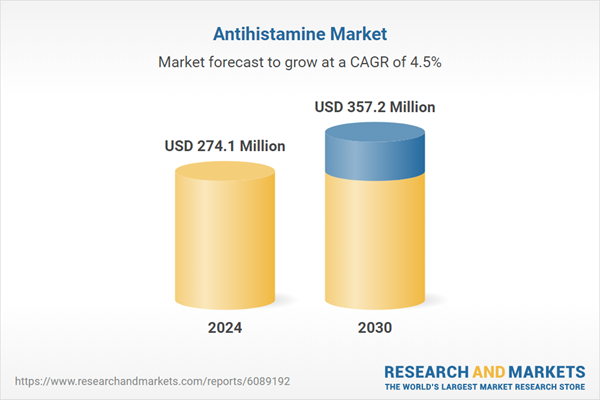

| Estimated Market Value ( USD | $ 274.1 Million |

| Forecasted Market Value ( USD | $ 357.2 Million |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |