Global Anodized Titanium Market - Key Trends & Drivers Summarized

Why Is Anodized Titanium Gaining Strategic Importance Across Advanced Manufacturing and Design Applications?

Anodized titanium is increasingly being adopted across high-performance and design-centric sectors due to its unique combination of corrosion resistance, surface hardness, aesthetic appeal, and biocompatibility. The anodization process modifies the oxide layer on the titanium surface via electrochemical treatment, creating a durable, non-toxic coating that enhances functionality while also enabling a wide range of interference colors without the use of dyes or pigments. These attributes position anodized titanium as a material of choice in industries requiring lightweight strength, chemical stability, and visual differentiation.In aerospace and defense, anodized titanium is used for structural and non-structural components exposed to harsh environments, offering improved fatigue life, resistance to salt spray and oxidation, and reduced galling during assembly. In the medical field, its inert and biocompatible properties make it ideal for surgical implants, dental hardware, and orthopedic devices, where surface texturing through anodization improves osseointegration and implant performance. The material is also widely used in jewelry, watches, and consumer electronics where metallic coloration and hypoallergenic properties are valued.

Beyond durability, anodized titanium's appeal is also tied to its lightweight profile and strength-to-weight ratio, which supports use in automotive and sporting equipment requiring both high strength and reduced mass. As industries seek materials that combine performance with design flexibility, anodized titanium is emerging as a competitive alternative to painted, plated, or composite surfaces - especially in premium applications where surface quality, chemical inertness, and visual customization are key differentiators.

How Are Advancements in Anodizing Techniques Enhancing Titanium Surface Engineering?

Technological progress in anodizing processes is unlocking new possibilities for tailoring titanium surface characteristics. Controlled voltage anodizing enables the creation of vibrant, interference-based color finishes by precisely modulating oxide layer thickness. Unlike coatings or dyes, these colorations are integral to the metal surface and do not peel, fade, or degrade over time. Advances in pulse anodizing and computer-controlled process parameters are further enhancing consistency, repeatability, and uniformity across complex geometries and part sizes.Functional anodizing techniques are being engineered to create micro- and nano-scale surface structures that improve wettability, adhesion, and antimicrobial resistance. In biomedical applications, such surface modifications can promote faster healing, reduce bacterial colonization, and improve compatibility with soft and hard tissues. In aerospace and marine systems, micro-porous anodized surfaces enhance bonding with adhesives or composite overwraps, supporting hybrid material integration and weight reduction initiatives.

New approaches such as plasma electrolytic oxidation (PEO) and hybrid anodization processes are enabling thicker, more wear-resistant oxide layers suitable for high-load, high-friction applications. These advanced anodized finishes offer superior dielectric strength, chemical resistance, and surface hardness, expanding the scope of anodized titanium in electronics, energy storage, and structural applications. As surface engineering becomes integral to product innovation, anodized titanium continues to evolve from a protective finish into a multifunctional, engineered surface solution.

Which End-Use Sectors and Geographies Are Driving Demand for Anodized Titanium Applications?

The medical device industry remains a leading consumer of anodized titanium, particularly for orthopedic implants, dental fixtures, surgical tools, and spinal hardware. The need for hypoallergenic, biocompatible surfaces that withstand repeated sterilization and interact safely with human tissue is driving consistent demand. Custom-colored anodized titanium is also preferred for surgical instrumentation to enable visual coding and easier identification during procedures, supporting safety and workflow efficiency in clinical settings.Aerospace and defense sectors are accelerating adoption of anodized titanium in fasteners, panels, and internal cabin components where corrosion resistance, lightweighting, and durability are critical. These industries benefit from the material's ability to operate under extreme temperatures and corrosive environments without degradation. In consumer goods, anodized titanium is gaining popularity in premium eyewear, luxury watches, writing instruments, and mobile device frames - valued for its ability to deliver high-impact aesthetics without sacrificing structural integrity.

Geographically, North America and Europe lead in terms of high-value application development and materials R&D, supported by robust aerospace, medical device, and industrial manufacturing bases. However, Asia-Pacific is the fastest-growing market, with China, Japan, and South Korea showing strong demand across consumer electronics, automotive components, and sporting goods. The regional emphasis on precision manufacturing, design innovation, and functional aesthetics is creating fertile ground for anodized titanium adoption in both industrial and lifestyle sectors.

How Are Sustainability, Cost Efficiency, and Customization Needs Influencing Market Evolution?

Sustainability concerns are elevating the profile of anodized titanium as an environmentally preferable alternative to painted or electroplated surfaces. The anodizing process is free from volatile organic compounds (VOCs), heavy metals, and hazardous waste associated with traditional coating systems. With rising regulatory scrutiny and corporate ESG mandates, industries are shifting toward cleaner surface treatment processes that offer both performance and compliance benefits. Moreover, the long lifespan and recyclability of titanium reduce lifecycle emissions and enhance circularity.Cost efficiency is emerging as a dual challenge and opportunity. While titanium remains more expensive than conventional metals such as aluminum or steel, advances in machining, forming, and surface processing are narrowing the cost-performance gap. Anodizing itself adds minimal thickness and requires no post-treatment coatings, simplifying finishing workflows and reducing maintenance over the product life cycle. For high-value or precision applications where performance and durability outweigh initial material cost, anodized titanium delivers compelling ROI through lifecycle efficiency.

Customization is another powerful driver, particularly in sectors demanding product differentiation through color, texture, and branding. The ability to produce distinct and permanent surface colors without added weight or chemical additives gives anodized titanium a unique position in the market. In industries like luxury goods, wearables, and advanced instrumentation, this capacity for high-fidelity personalization supports both functional and aesthetic product strategies. As end-users increasingly seek tailored solutions, anodized titanium is aligning with the growing demand for material-driven design flexibility.

What Are the Factors Driving Growth in the Anodized Titanium Market?

The anodized titanium market is expanding steadily, supported by rising demand for corrosion-resistant, biocompatible, and aesthetically versatile materials across high-value sectors. The material's unique combination of functional durability and design appeal is driving adoption in aerospace, medical, consumer goods, and industrial design applications. Key growth drivers include the need for lightweight alternatives to coated metals, regulatory push for environmentally friendly surface treatments, and rising investments in precision manufacturing technologies.As industries place greater emphasis on product longevity, material traceability, and manufacturing sustainability, anodized titanium is emerging as a premium solution that meets both performance and regulatory criteria. Technological advancements in anodizing processes are enabling broader application scopes, from structural components and implants to luxury goods and customized tools. Integration with digital fabrication methods and surface engineering innovations is further enhancing the material's market readiness.

Looking ahead, the market's evolution will hinge on how effectively anodized titanium solutions align with global trends in lightweighting, functional aesthetics, and environmentally conscious design. As industries seek materials that perform across engineering and branding dimensions, could anodized titanium become the definitive intersection of strength, sustainability, and surface innovation?

Report Scope

The report analyzes the Anodized Titanium market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Titanium Dioxide, Titanium Tetroxide, Other Product Types); Application (Biomedical Treatment, Aviation, Automotive, Marine, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Titanium Dioxide segment, which is expected to reach US$10.2 Billion by 2030 with a CAGR of a 2.8%. The Titanium Tetroxide segment is also set to grow at 2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.7 Billion in 2024, and China, forecasted to grow at an impressive 4.8% CAGR to reach $3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Anodized Titanium Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Anodized Titanium Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Anodized Titanium Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AM Batteries Inc., Arkema S.A., BASF SE, Blue Ocean & Black Stone Technology Co., Ltd., Chengdu Indigo Power Sources Co., Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Anodized Titanium market report include:

- Admat Inc.

- Allegheny Technologies Inc. (ATI)

- Anoplate Corporation

- Baoji Titanium Industry Co., Ltd.

- Best Technology Inc.

- Boni Tech Co., Ltd.

- CXMET (ChuangXin Metal Materials Co., Ltd.)

- Danco Anodizing

- Firmakes Titanium Co., Ltd.

- Grandis Titanium

- Hebei Boni Tech Co., Ltd.

- HLC Metal Parts Ltd.

- IPEC Global, Inc.

- Micron Srl

- Norsk Titanium AS

- OKDOR Manufacturing

- OSAKA Titanium Technologies Co., Ltd.

- Performance Titanium Group

- Reliable Source, Inc.

- Rohde AG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Admat Inc.

- Allegheny Technologies Inc. (ATI)

- Anoplate Corporation

- Baoji Titanium Industry Co., Ltd.

- Best Technology Inc.

- Boni Tech Co., Ltd.

- CXMET (ChuangXin Metal Materials Co., Ltd.)

- Danco Anodizing

- Firmakes Titanium Co., Ltd.

- Grandis Titanium

- Hebei Boni Tech Co., Ltd.

- HLC Metal Parts Ltd.

- IPEC Global, Inc.

- Micron Srl

- Norsk Titanium AS

- OKDOR Manufacturing

- OSAKA Titanium Technologies Co., Ltd.

- Performance Titanium Group

- Reliable Source, Inc.

- Rohde AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 279 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

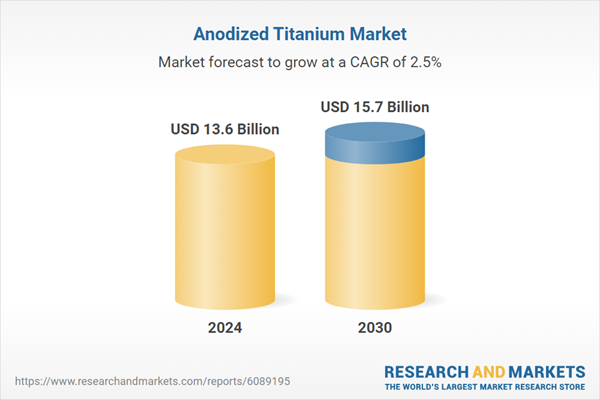

| Estimated Market Value ( USD | $ 13.6 Billion |

| Forecasted Market Value ( USD | $ 15.7 Billion |

| Compound Annual Growth Rate | 2.5% |

| Regions Covered | Global |