Global Animation and VFX Market - Key Trends & Drivers Summarized

Why Are Animation and VFX Integral to Modern Content Creation and Storytelling?

Animation and visual effects (VFX) have become foundational tools in contemporary content development, enabling creators to deliver immersive, visually compelling narratives across film, television, gaming, advertising, and digital media. These technologies extend creative possibilities beyond physical limitations, allowing the visualization of abstract, fantastical, or complex scenes with photorealistic fidelity and emotional resonance. From blockbuster films and animated features to AR-enhanced ads and immersive web content, animation and VFX are redefining audience engagement through visual innovation.The ability of animation and VFX to enhance storytelling while maintaining cost efficiency is driving widespread adoption. Studios can simulate environments, characters, and effects that would be prohibitively expensive - or physically impossible - to achieve through live-action alone. VFX techniques such as digital compositing, motion capture, CGI (computer-generated imagery), and procedural animation allow for seamless integration of virtual and real-world elements. This not only elevates production value but also reduces reliance on physical sets, stunts, and on-location shooting, creating greater flexibility in production planning.

The rise of on-demand content consumption via OTT platforms, mobile media, and streaming services is further accelerating the demand for high-quality, visually differentiated content. Animation and VFX are no longer limited to big-budget Hollywood productions; they are now embedded across short-form content, educational videos, branded marketing assets, and virtual influencers. As content ecosystems grow more diversified and globalized, the role of animation and VFX as core enablers of digital storytelling continues to expand across industries and platforms.

How Are Technological Innovations and Production Workflows Shaping Creative Output?

Technology is fundamentally transforming the animation and VFX pipeline, enabling faster rendering, real-time previews, and collaborative production models across geographically dispersed teams. The adoption of GPU-accelerated rendering engines, real-time ray tracing, and cloud-based virtual workstations has streamlined workflows, reduced production bottlenecks, and democratized access to high-end tools. Software platforms such as Unreal Engine, Unity, Autodesk Maya, Houdini, and Blender are now standard in hybrid production environments that integrate live-action with digital assets.AI and machine learning are beginning to play transformative roles in automating repetitive tasks such as rotoscoping, facial animation, lip-syncing, and environment generation. These tools allow artists to shift focus from mechanical execution to creative decision-making, thereby enhancing both efficiency and quality. Real-time rendering and virtual production are further blurring the lines between post-production and live-action, allowing directors to make visual decisions during filming through digital sets and LED volume stages.

Pipeline interoperability and asset reusability have also emerged as strategic priorities. Studios are leveraging modular asset libraries, standardizing on open formats like USD (Universal Scene Description), and using cloud-based asset management systems to accelerate previsualization, iteration, and version control. These advances support simultaneous collaboration among animators, VFX artists, lighting specialists, and compositors - shortening development cycles and enabling agile responses to creative changes. As the demand for high-throughput content increases, streamlined, tech-driven pipelines are becoming essential to scalability and competitiveness.

Which Content Verticals and Regional Markets Are Driving Demand for Animation and VFX Services?

Film and television remain the largest end-use segments, with studios investing heavily in VFX to create cinematic universes, enhance period dramas, and bring supernatural narratives to life. Animation, both 2D and 3D, continues to be central to children's content, feature films, and adult-themed animated series. Streaming platforms are increasingly commissioning animated originals and VFX-rich productions to differentiate their content libraries and meet rising demand for diverse, culturally resonant storytelling.Gaming is another major growth driver, where real-time animation, motion capture, and immersive VFX are critical to gameplay realism and narrative depth. AAA game development, mobile gaming, and e-sports broadcasting all rely on cinematic sequences and interactive storytelling powered by animation and VFX. Advertising, too, is rapidly adopting these technologies to deliver immersive brand experiences across digital, social, and augmented reality platforms - particularly as consumer attention spans shrink and visual differentiation becomes a key competitive advantage.

Regionally, North America and Western Europe remain dominant in terms of production scale, technological infrastructure, and studio presence. However, Asia-Pacific is the fastest-growing market, driven by thriving media ecosystems in India, South Korea, Japan, and China. Government incentives, a large creative talent pool, and lower production costs are attracting outsourcing and co-production deals. Meanwhile, Latin America and parts of the Middle East are emerging as niche markets with increasing demand for localized animated content and regionally flavored VFX-heavy productions.

How Are Remote Collaboration, Global Talent Access, and IP Strategies Influencing Market Evolution?

The post-pandemic normalization of remote workflows has reshaped how animation and VFX studios operate, opening up access to global talent and decentralizing production infrastructure. Cloud-based rendering, virtual desktops, and collaborative project management tools have enabled studios to scale production while maintaining business continuity across time zones. This flexibility supports cost-effective outsourcing, talent diversity, and rapid scalability - particularly important for projects requiring multilingual or cross-cultural creative input.As international co-productions and service deals increase, studios are placing greater emphasis on IP (intellectual property) development and retention. Owning original animated content or signature VFX pipelines allows studios to maximize monetization through licensing, merchandising, and syndication. With streaming platforms actively acquiring and co-developing global IPs, independent and mid-sized studios are finding new paths to scale their visibility and revenue streams. Meanwhile, the rise of virtual characters and AI-generated avatars is opening new frontiers in IP monetization across social media, fashion, and metaverse platforms.

Compliance with international content standards, data security protocols, and labor regulations is also shaping vendor selection, particularly in global outsourcing arrangements. Studios must invest in secure data transfer systems, remote workflow auditability, and cross-border collaboration tools to meet the expectations of major content producers. As creative boundaries expand, the ability to execute globally while ensuring consistency, legal clarity, and operational agility is becoming a key differentiator in the competitive animation and VFX marketplace.

What Are the Factors Driving Growth in the Animation and VFX Market?

The animation and VFX market is growing steadily, fueled by the convergence of rising digital content consumption, expanding streaming investments, and the growing use of immersive storytelling tools across media formats. These technologies are no longer confined to entertainment but are now embedded across education, healthcare, corporate communication, and brand marketing. Key growth drivers include demand for high-quality visuals, the need for scalable content production, and the application of real-time rendering in emerging areas such as AR, VR, and virtual production.Technology convergence and globalization are creating a dynamic landscape in which content creators seek speed, scalability, and quality from animation and VFX partners. Cloud infrastructure, AI-enabled automation, and cross-platform interoperability are accelerating development cycles and enabling smaller studios to compete at global standards. Simultaneously, the shift toward decentralized, IP-driven business models is enabling greater creative freedom, faster turnaround, and more personalized content at scale.

Looking forward, the market's trajectory will depend on how well animation and VFX providers align with evolving audience preferences, platform requirements, and technology ecosystems. As storytelling becomes more interactive, immersive, and visually driven, could these creative technologies emerge as the central engine of the next digital content revolution?

Report Scope

The report analyzes the Animation and VFX market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Animation Platform (Television & OTT Films, Advertisement, Gaming, Other Animation Platforms).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Television & OTT Films Platform segment, which is expected to reach US$153.6 Billion by 2030 with a CAGR of a 13.8%. The Advertisement Platform segment is also set to grow at 13.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $46.5 Billion in 2024, and China, forecasted to grow at an impressive 17.2% CAGR to reach $74.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Animation and VFX Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Animation and VFX Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Animation and VFX Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ancon Building Products, Arkema S.A., BASF SE, Bostik, CHRYSO S.A.S. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Animation and VFX market report include:

- Animal Logic

- Base FX

- Blue Sky Studios

- Blur Studio

- BUF Compagnie

- Cinesite

- CoSA VFX

- Crafty Apes

- Digital Domain

- Digital Idea

- DNEG

- Framestore

- Image Engine

- Industrial Light & Magic (ILM)

- Jellyfish Pictures

- Luma Pictures

- Method Studios

- Mikros Animation

- Moving Picture Company (MPC)

- Pixar Animation Studios

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Animal Logic

- Base FX

- Blue Sky Studios

- Blur Studio

- BUF Compagnie

- Cinesite

- CoSA VFX

- Crafty Apes

- Digital Domain

- Digital Idea

- DNEG

- Framestore

- Image Engine

- Industrial Light & Magic (ILM)

- Jellyfish Pictures

- Luma Pictures

- Method Studios

- Mikros Animation

- Moving Picture Company (MPC)

- Pixar Animation Studios

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 178 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

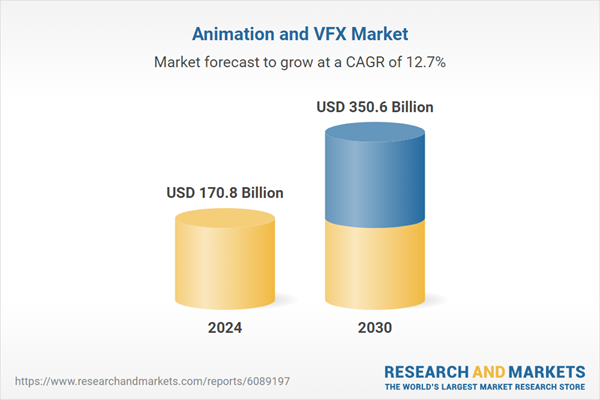

| Estimated Market Value ( USD | $ 170.8 Billion |

| Forecasted Market Value ( USD | $ 350.6 Billion |

| Compound Annual Growth Rate | 12.7% |

| Regions Covered | Global |