Global Amine Hardeners Market - Key Trends & Drivers Summarized

Why Are Amine Hardeners Central to Performance and Durability in Epoxy-Based Applications?

Amine hardeners are essential curing agents that react with epoxy resins to form crosslinked thermoset polymers, imparting mechanical strength, chemical resistance, and dimensional stability. These hardeners are integral to the curing process, enabling high-performance formulations used across coatings, adhesives, composites, flooring, electrical encapsulation, and construction systems.Their ability to tailor pot life, cure speed, and heat resistance makes amine hardeners critical for diverse end-use environments - from high-load industrial flooring and marine coatings to electronic insulators and wind turbine composites. As industries demand higher performance from epoxy systems, the selection and customization of amine hardeners have become pivotal to product reliability.

How Are Formulation Advances and Hybrid Chemistries Expanding Hardener Functionality?

Modern formulation strategies are blending different amine types - aliphatic, cycloaliphatic, aromatic, and polyetheramines - to fine-tune cure kinetics, adhesion, and substrate compatibility. Low-odor, low-viscosity variants are being developed to meet VOC regulations and improve handling in occupational settings. These innovations also enhance wetting on difficult substrates and reduce yellowing in UV-exposed environments.Hybrid chemistries combining amines with other curing agents such as anhydrides or polyamides are enabling multifunctional performance across thermal, mechanical, and weathering criteria. Additionally, advancements in latency control, ambient temperature cure, and surface tolerance are widening application windows in field conditions and cold-climate environments.

Which End-Use Industries and Regional Markets Are Driving Demand for Amine Hardener Systems?

High-growth sectors such as wind energy, automotive lightweighting, industrial electronics, and civil infrastructure are major demand centers for amine-cured epoxy systems. In construction, amine hardeners support seamless flooring, rebar coatings, and moisture-tolerant primers; in electronics, they enable potting compounds, PCB protection, and thermal interface materials.North America and Europe lead in innovation-driven usage, while Asia-Pacific commands volume growth through expanding manufacturing, energy, and transportation sectors. Emerging economies are investing in durable infrastructure and renewable energy assets - boosting the demand for amine-cured resins that withstand harsh operating conditions.

How Are Sustainability Goals, Regulatory Pressures, and End-User Customization Needs Influencing Market Evolution?

Regulatory shifts toward low-VOC and non-toxic chemistries are reshaping product development. Waterborne and bio-based amine hardeners are gaining traction, while REACH compliance and GHS labeling influence raw material choices. Manufacturers are exploring renewable feedstocks, safe handling improvements, and recyclable epoxy systems to align with circular economy goals.Customization is also intensifying - end-users require hardeners tuned for application methods (spray, brush, or cast), open time, and in-service demands. Modular product platforms, adjustable mix ratios, and digital formulation tools are supporting tailored performance. As smart manufacturing gains ground, real-time data integration is expected to guide hardener selection for process optimization and quality control.

What Are the Factors Driving Growth in the Amine Hardeners Market?

The amine hardeners market is experiencing robust momentum driven by rising adoption of epoxy systems in high-performance applications, environmental push for greener curing agents, and expanding industrialization across developing markets. Growth enablers include hybrid chemistries, regulatory-compliant low-VOC offerings, and improved compatibility with advanced epoxy formulations.Looking ahead, the market's trajectory will hinge on how well amine hardener technologies align with emerging performance needs, environmental mandates, and increasingly digitalized manufacturing ecosystems. As applications grow more demanding and design cycles more complex, could amine hardeners become the invisible enablers powering the next era of epoxy innovation?

Report Scope

The report analyzes the Amine Hardeners market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Aliphatic Amine, Cycloaliphatic Amine, Aromatic Amine, Modified Amine); End-Use (Metal Coatings, Civil Engineering, Composites & Adhesives, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Aliphatic Amine segment, which is expected to reach US$936.1 Million by 2030 with a CAGR of a 3.6%. The Cycloaliphatic Amine segment is also set to grow at 1.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $464.9 Million in 2024, and China, forecasted to grow at an impressive 5.2% CAGR to reach $389.1 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Amine Hardeners Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Amine Hardeners Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Amine Hardeners Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AIMS Power, Carspa New Energy, Eaton Corporation (Tripp Lite), Foshan Snat Energy Electrical Technology Co., Ltd., Guangzhou Congsin Electronic Technology Co., Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Amine Hardeners market report include:

- Aditya Birla Chemicals

- Air Products and Chemicals, Inc.

- AkzoNobel N.V.

- Alfa Aesar

- Amines & Plasticizers Ltd.

- Arkema S.A.

- Atul Ltd.

- Balaji Amines Ltd.

- BASF SE

- Celanese Corporation

- Clariant AG

- CVC Thermoset Specialties

- DIC Corporation

- Dow Chemical Company

- Eastman Chemical Company

- Evonik Industries AG

- Gabriel Performance Products

- Gantrade Corporation

- Hexion Inc.

- Huntsman Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aditya Birla Chemicals

- Air Products and Chemicals, Inc.

- AkzoNobel N.V.

- Alfa Aesar

- Amines & Plasticizers Ltd.

- Arkema S.A.

- Atul Ltd.

- Balaji Amines Ltd.

- BASF SE

- Celanese Corporation

- Clariant AG

- CVC Thermoset Specialties

- DIC Corporation

- Dow Chemical Company

- Eastman Chemical Company

- Evonik Industries AG

- Gabriel Performance Products

- Gantrade Corporation

- Hexion Inc.

- Huntsman Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 284 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

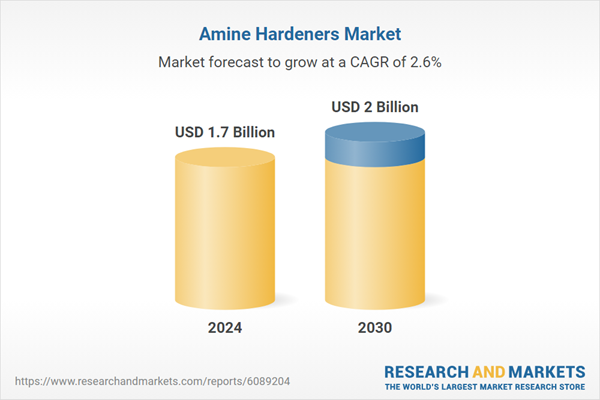

| Estimated Market Value ( USD | $ 1.7 Billion |

| Forecasted Market Value ( USD | $ 2 Billion |

| Compound Annual Growth Rate | 2.6% |

| Regions Covered | Global |