Global Alkali Soaps Market - Key Trends & Drivers Summarized

Why Are Alkali Soaps a Staple in Personal Hygiene, Industrial Cleaning, and Value-Driven Consumer Segments?

Alkali soaps - typically produced by the saponification of fats and oils with strong alkalis such as sodium hydroxide (for hard soaps) or potassium hydroxide (for soft/liquid soaps) - are widely used for their surfactant properties, biodegradability, and cost-effectiveness. These soaps form the backbone of traditional cleansing solutions in personal care, household cleaning, and industrial degreasing, where their ability to emulsify oils and suspend dirt remains unmatched in basic hygiene and sanitation.Despite the proliferation of synthetic detergents and sulfate-based cleansers, alkali soaps continue to hold significant market relevance due to their minimal chemical complexity, low environmental impact, and widespread consumer trust - particularly in developing markets where affordability and availability remain key purchase drivers. Their compatibility with natural oils, herbal extracts, and essential additives further supports their presence in value-tier and traditional product lines.

How Are Formulation Enhancements and Market Positioning Evolving to Align With Changing Consumer Expectations?

Recent product innovations focus on improving the sensory profile and moisturizing capabilities of alkali soaps, traditionally criticized for their higher pH and potential skin dryness. Manufacturers are incorporating emollients, glycerin, and pH-neutralizing agents to create more skin-friendly bars, while maintaining the soaps' fundamental cleansing power. The inclusion of botanical additives, antibacterial agents, and skin-specific formulations is broadening their appeal in both personal care and clinical hygiene markets.In response to growing demand for clean-label and eco-conscious products, many brands are rebranding alkali soaps as sustainable alternatives to synthetic surfactants, emphasizing their plastic-free formats, palm-free bases, and minimal processing. This shift is positioning alkali soap not just as a legacy product but as a viable option for consumers prioritizing natural, low-impact formulations.

Which End-Use Segments and Regional Markets Are Driving Growth in Alkali Soap Consumption?

Household and personal care segments dominate alkali soap usage, particularly in bar and laundry soap formats across Asia, Africa, and Latin America. In these regions, hard soaps remain essential daily-use products, valued for their multipurpose utility and cost-effectiveness. The institutional and industrial cleaning sectors also continue to rely on alkali-based soaps and soap powders for degreasing, equipment sanitation, and bulk hygiene applications.India, Indonesia, Nigeria, and Brazil are among the key volume-driven markets, where traditional and local brands coexist with multinational players. In contrast, developed markets such as North America and Western Europe are seeing a niche resurgence of artisanal and organic alkali soap brands, targeting environmentally aware and ingredient-conscious consumers. Growth in the hospitality and healthcare sectors is also driving demand for high-purity, antimicrobial alkali soaps tailored to bulk use.

How Are Sustainability Mandates, Supply Chain Trends, and Local Production Ecosystems Shaping Market Dynamics?

Alkali soaps benefit from relatively simple production processes and readily available feedstocks - vegetable oils, animal fats, and alkalis - making them highly adaptable to localized manufacturing models. This supports regional economies, reduces supply chain dependency, and aligns with sustainability goals such as reduced carbon footprint and circular packaging.With regulatory pressures increasing around surfactant toxicity, biodegradability, and plastic packaging, alkali soap manufacturers are gaining a comparative advantage in compliance and marketing narratives. Certifications such as COSMOS Organic and USDA BioPreferred are now being applied to soap products, helping distinguish plant-based alkali soaps in premium and export-focused categories.

What Are the Factors Driving Growth in the Alkali Soaps Market?

The alkali soaps market is advancing on the strength of continued demand in essential hygiene, improved product formulations, and rising alignment with natural, biodegradable, and low-cost cleaning solutions. Key growth drivers include robust consumption in high-population emerging markets, rising awareness of soap's germicidal efficacy, and a renewed focus on sustainable packaging and production practices. With both traditional use and premium repositioning in play, alkali soaps are adapting to a highly stratified and evolving global hygiene landscape.Looking ahead, the market's growth will depend on how effectively manufacturers can blend legacy value with innovation in formulation, branding, and environmental positioning. As consumer preferences shift toward safer, cleaner, and simpler products, could alkali soaps reclaim prominence as the essential yet evolved foundation of global hygiene and surface care solutions?

Report Scope

The report analyzes the Alkali Soaps market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Bar Soap, Liquid Soap, Paper Soap, Medicated Soap, Laundry Soap, Other Product Types); Application (Household, Commercial, Industrial, Other Applications); End-Use (Men, Women, Children, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Bar Soap segment, which is expected to reach US$5.7 Billion by 2030 with a CAGR of a 4%. The Liquid Soap segment is also set to grow at 6.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $5.3 Billion in 2024, and China, forecasted to grow at an impressive 7.7% CAGR to reach $5.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Alkali Soaps Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Alkali Soaps Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Alkali Soaps Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

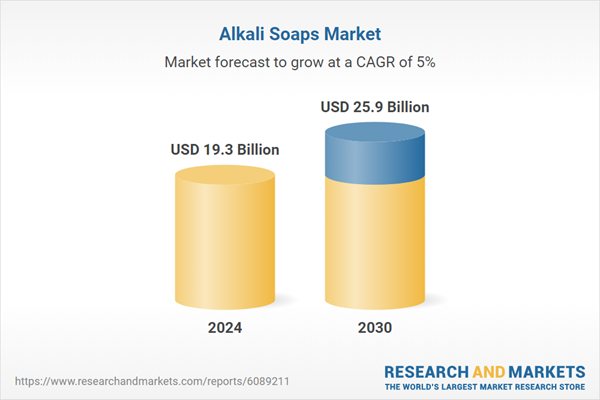

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alma Lasers, Anastasis Infibilitis Technology, Beijing IVYlaser Technology, Beijing Keylaser Sci-Tech, Beijing Mega Beauty Technology and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Alkali Soaps market report include:

- Apothecary Soap Company

- Arkema

- BASF SE

- Biotec Italia

- Botanie Soap

- Bradford Soap Works

- Bulk Apothecary

- Camlay Industries

- Church & Dwight Co., Inc.

- Colgate-Palmolive Company

- Commonwealth Soap & Toiletries

- Cutera

- DEKA Laser

- Elemenic

- Esensya Organika

- FMC Corporation

- Godrej Consumer Products Limited

- Henkel AG & Co. KGaA

- Johnson & Johnson

- Kao Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Apothecary Soap Company

- Arkema

- BASF SE

- Biotec Italia

- Botanie Soap

- Bradford Soap Works

- Bulk Apothecary

- Camlay Industries

- Church & Dwight Co., Inc.

- Colgate-Palmolive Company

- Commonwealth Soap & Toiletries

- Cutera

- DEKA Laser

- Elemenic

- Esensya Organika

- FMC Corporation

- Godrej Consumer Products Limited

- Henkel AG & Co. KGaA

- Johnson & Johnson

- Kao Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 389 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 19.3 Billion |

| Forecasted Market Value ( USD | $ 25.9 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |