Global 4K Monitors Market - Key Trends & Drivers Summarized

Why Are 4K Monitors Becoming a Standard Across Professional, Consumer, and Industrial Display Applications?

4K monitors, offering Ultra High Definition (UHD) resolution of 3840 x 2160 pixels, are reshaping user expectations for clarity, color accuracy, and immersive visual experience. As demand for precision visuals grows across sectors - from creative content production and software development to financial trading and medical imaging - 4K displays are emerging as the preferred format for professional environments requiring high pixel density and expansive screen real estate.The transition to hybrid work models, expansion of digital workflows, and rising consumer engagement in high-definition entertainment and gaming are accelerating the mainstream adoption of 4K monitors. Enterprises are equipping employees with advanced visual tools to enhance productivity, while consumers are upgrading home setups for multimedia, design, and competitive gaming experiences that demand sharp visuals and smooth performance.

How Are Technological Advancements Enhancing the Value Proposition of 4K Monitors?

Improved panel technologies - such as IPS, OLED, and mini-LED - are delivering enhanced contrast, color depth, and viewing angles, which are critical for tasks requiring visual fidelity. High refresh rates (120Hz and above), low response times, and adaptive sync features are also making 4K monitors viable for esports and animation-intensive applications. USB-C connectivity, HDR support, and integrated calibration tools are further expanding utility across professional and creative workflows.Advancements in graphics processing and data transmission standards - such as HDMI 2.1 and DisplayPort 2.0 - are enabling seamless support for 4K at high frame rates with minimal latency. Monitor vendors are integrating ergonomic features, multi-monitor compatibility, and embedded productivity tools to cater to enterprise, content creation, and programming needs. These innovations are reinforcing 4K monitors as multifunctional assets across increasingly convergent digital environments.

Which Use Cases and Regional Markets Are Driving 4K Monitor Adoption?

Professional content creators, CAD designers, software developers, and financial analysts are driving enterprise demand for 4K monitors, especially where clarity, multitasking, and color accuracy are mission-critical. In the consumer segment, video editors, streamers, and high-end gamers are increasingly opting for UHD setups that enhance realism and visual precision. Healthcare and surveillance are additional verticals utilizing 4K resolution for diagnostic accuracy and real-time situational awareness.North America and Europe remain key demand centers, underpinned by high digital infrastructure maturity and elevated enterprise IT spending. Asia-Pacific is witnessing rapid growth, driven by increasing PC penetration, expanding gaming ecosystems, and industrial digitization in countries like China, Japan, and South Korea. Growth is also emerging in Latin America and the Middle East, where urban tech adoption and entertainment consumption are on the rise.

How Are Pricing Trends, Supply Chains, and Sustainability Mandates Influencing Market Expansion?

Declining panel prices, improved manufacturing efficiencies, and growing competition among OEMs are making 4K monitors more accessible across segments. However, supply chain constraints related to semiconductor components and logistics continue to pose volatility in pricing and availability. Vendors are responding with diversified sourcing strategies and regional assembly to de-risk production and meet local demand efficiently.Sustainability is becoming a differentiator, with manufacturers integrating energy-efficient backlights, recyclable materials, and certifications like ENERGY STAR and EPEAT. As enterprises align monitor procurement with environmental policies, eco-design and lifecycle management are gaining prominence. These considerations are shaping product development, marketing strategies, and procurement decisions across the display ecosystem.

What Are the Factors Driving Growth in the 4K Monitors Market?

The 4K monitors market is expanding as visual precision becomes central to both professional performance and consumer experience. Key drivers include the growing need for multitasking efficiency, advanced content creation tools, immersive entertainment, and real-time visualization. Technological convergence, declining costs, and enhanced display innovations are propelling uptake across verticals and geographies.Looking forward, the market's direction will be shaped by how well display technologies align with emerging usage paradigms, sustainability priorities, and cross-platform digital workflows. As high-resolution visual infrastructure becomes the norm, could 4K monitors define the next evolution in how humans engage with digital content across work, creation, and play?

Report Scope

The report analyzes the 4K Monitors market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Application (Electronics, Education, Aerospace & Defense, Advertisement & Entertainment, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the ElectronicsApplication segment, which is expected to reach US$153.5 Billion by 2030 with a CAGR of a 21.5%. The Education Application segment is also set to grow at 23.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $37.7 Billion in 2024, and China, forecasted to grow at an impressive 28.6% CAGR to reach $105.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global 4K Monitors Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global 4K Monitors Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global 4K Monitors Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ACSE GmbH, Agersens Pty Ltd, AngryMole Technologies, Anixter International Inc., Apator SA and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this 4K Monitors market report include:

- Acer Inc.

- AJA Video Systems

- Alienware (Dell subsidiary)

- AOC International

- Apple Inc.

- ASUS (ASUSTeK Computer Inc.)

- AU Optronics Corp.

- BenQ Corporation

- BOE Technology Group Co., Ltd.

- Canon Inc.

- Dell Technologies Inc.

- Eizo Corporation

- Gigabyte Technology Co., Ltd.

- HP Inc.

- Innolux Corporation

- JVC Kenwood Corporation

- Lenovo Group Limited

- LG Electronics Inc.

- MSI (Micro-Star International Co., Ltd.)

- NEC Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Acer Inc.

- AJA Video Systems

- Alienware (Dell subsidiary)

- AOC International

- Apple Inc.

- ASUS (ASUSTeK Computer Inc.)

- AU Optronics Corp.

- BenQ Corporation

- BOE Technology Group Co., Ltd.

- Canon Inc.

- Dell Technologies Inc.

- Eizo Corporation

- Gigabyte Technology Co., Ltd.

- HP Inc.

- Innolux Corporation

- JVC Kenwood Corporation

- Lenovo Group Limited

- LG Electronics Inc.

- MSI (Micro-Star International Co., Ltd.)

- NEC Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 179 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

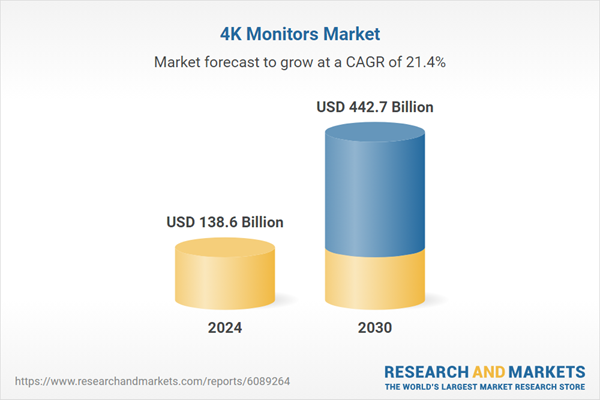

| Estimated Market Value ( USD | $ 138.6 Billion |

| Forecasted Market Value ( USD | $ 442.7 Billion |

| Compound Annual Growth Rate | 21.4% |

| Regions Covered | Global |