Global PCBs in Computers and Peripherals Market - Key Trends & Drivers Summarized

How Are Increasing Processing Demands and Miniaturization Trends Reshaping PCB Requirements in Computing Devices?

Printed circuit boards (PCBs) are the central nervous system of modern computers and peripheral devices, providing electrical connectivity and mechanical support for integrated circuits, processors, and interface modules. As desktop PCs, laptops, servers, and peripherals such as printers, external drives, and gaming accessories grow more compact and powerful, there is increasing demand for high-density PCB architectures that offer superior thermal dissipation, signal integrity, and space optimization. With modern computing devices relying on multi-core processors, GPUs, and high-speed memory, the complexity of PCB design is reaching new heights.The adoption of microvia technology, surface-mount components, and multilayer stack-ups with advanced interconnects is enabling manufacturers to meet form factor constraints without compromising performance. High-layer-count rigid PCBs dominate in high-end motherboards, while rigid-flex PCBs are gaining popularity in thin-and-light devices like ultrabooks, tablets, and detachable keyboards. This convergence of miniaturization and multifunctionality is driving the need for precise design rules, advanced laminates, and superior fabrication processes.

Why Are Thermal Management, EMI Shielding, and Signal Integrity Becoming Central to PCB Design in Computing?

The need for enhanced thermal performance is a critical driver in PCB design for computing equipment. As processing power increases, so does heat generation, especially in compact systems where air flow is limited. Designers are integrating thermal vias, copper pours, and heat sinks directly into PCBs to improve thermal conductivity and prevent hotspots. In data-intensive applications such as gaming, CAD, or AI modeling, thermal management features are no longer optional - they are mission-critical.Simultaneously, maintaining signal integrity in high-speed data transmission is vital for peripheral devices such as USB-C hubs, graphic cards, external GPUs, and SSD enclosures. Electromagnetic interference (EMI) shielding through copper planes, differential pair routing, and controlled impedance PCB traces ensures clean signal propagation across dense interconnect paths. This is especially important in modern interfaces such as PCIe Gen4/Gen5, Thunderbolt, HDMI 2.1, and DDR5 memory buses, all of which require precision-engineered board layouts.

How Are AI PCs, Edge Computing, and Peripherals Innovation Expanding PCB Application Scenarios?

The emergence of AI-integrated computing systems, edge servers, and compact multi-function peripherals is fueling demand for versatile PCB configurations. AI-enabled PCs, neural processing units (NPUs), and ARM-based computing platforms require custom boards that combine logic, power management, and machine learning accelerators in confined form factors. This is driving demand for advanced PCBs capable of integrating heterogeneous computing modules while supporting high-speed data transfers and low-latency performance.In peripherals, PCB innovation supports compact designs, wireless functionality, and sensor integration in devices like biometric scanners, wireless keyboards, VR accessories, and digital pens. The growing use of PCBs with embedded antennas, Bluetooth/Wi-Fi chips, and flexible interconnects enables seamless communication and ergonomic design. These enhancements reflect consumer demand for peripheral devices that are not only responsive and durable but also smart and connected.

What's Fueling the Growth of PCBs in Computers and Peripherals Market Globally?

The growth in the PCBs in computers and peripherals market is driven by several factors including surging demand for high-performance computing systems, widespread digital transformation across enterprises, and consumer appetite for compact, multifunctional devices. A key growth driver is the proliferation of AI-driven applications, gaming, hybrid work models, and cloud computing - all of which depend on increasingly powerful yet space-efficient PCBs.Additionally, the ongoing expansion of remote learning, content creation, and e-commerce is sustaining demand for notebooks, tablets, and productivity peripherals. OEMs and ODMs are ramping up investment in next-generation board technologies that support faster, cooler, and more energy-efficient devices. As computing continues to evolve toward intelligence, portability, and interconnectivity, PCB technologies will remain critical to enabling smarter, faster, and more reliable computer systems worldwide.

Report Scope

The report analyzes the PCBs in Computers and Peripherals market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Connectivity (Wireless, Wired); End-Use (Residential, Commercial).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Wireless Connectivity segment, which is expected to reach US$17.3 Billion by 2030 with a CAGR of a 3.4%. The Wired Connectivity segment is also set to grow at 5.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $5.7 Billion in 2024, and China, forecasted to grow at an impressive 7.4% CAGR to reach $5.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global PCBs in Computers and Peripherals Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global PCBs in Computers and Peripherals Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global PCBs in Computers and Peripherals Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Advanced Circuits, AT&S, BMK Group, Cirexx International, Compeq Manufacturing Co., Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this PCBs in Computers and Peripherals market report include:

- Advanced Circuits

- AT&S

- BMK Group

- Cirexx International

- Compeq Manufacturing Co., Ltd.

- Elec & Eltek International Co., Ltd.

- Ellington Electronics Technology Group

- EMSG Inc.

- Excello Circuits

- HiTech Circuits Co., Ltd.

- JHYPCB

- Lanner Electronics Inc.

- Murrietta Circuits

- Onanon Inc.

- Park Aerospace Corp

- PCBCart

- Sanmina Corporation

- Sierra Circuits

- TTM Technologies, Inc.

- Unimicron Technology Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Advanced Circuits

- AT&S

- BMK Group

- Cirexx International

- Compeq Manufacturing Co., Ltd.

- Elec & Eltek International Co., Ltd.

- Ellington Electronics Technology Group

- EMSG Inc.

- Excello Circuits

- HiTech Circuits Co., Ltd.

- JHYPCB

- Lanner Electronics Inc.

- Murrietta Circuits

- Onanon Inc.

- Park Aerospace Corp

- PCBCart

- Sanmina Corporation

- Sierra Circuits

- TTM Technologies, Inc.

- Unimicron Technology Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 274 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

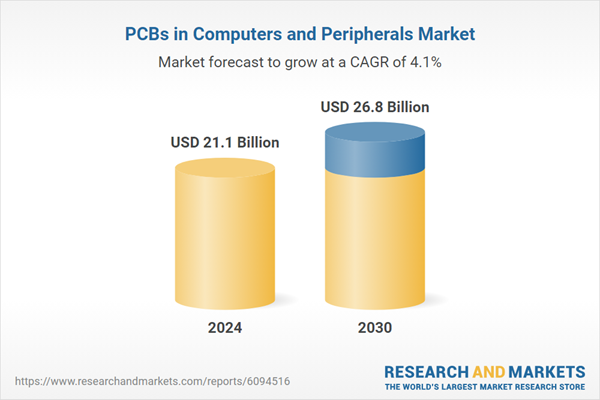

| Estimated Market Value ( USD | $ 21.1 Billion |

| Forecasted Market Value ( USD | $ 26.8 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |