Global Hot Rolled Coils Market - Key Trends & Drivers Summarized

Why Are Hot Rolled Coils Critical to Global Manufacturing and Infrastructure?

Hot rolled coils (HRCs) are foundational materials in heavy industries due to their excellent workability, weldability, and cost-effectiveness. Produced by heating slabs of steel above recrystallization temperature and then rolling them into thin sheets or coils, HRCs serve as the starting point for downstream steel products including pipes, automotive parts, structural beams, machinery, and appliances. Their versatility across flat and formed products makes them essential for sectors such as construction, transportation, shipbuilding, energy, and heavy equipment manufacturing.The robust demand for infrastructure development, energy projects, and automotive production is reinforcing the strategic importance of HRCs in national economies. Emerging economies are rapidly increasing HRC consumption to support urbanization, public transit systems, bridges, and industrial expansion. Meanwhile, the auto and appliance industries in developed regions continue to rely on hot rolled steel for strength-critical components and base materials for cold rolling or coating processes. This broad industrial reliance ensures that HRC demand remains closely tied to global economic health and industrial output.

How Are Process Improvements and Alloy Innovations Shaping Market Competitiveness?

Technological advancements in rolling mills, reheating furnaces, and quality control systems are significantly enhancing hot rolled coil production. Modern HRC lines now integrate real-time thickness monitoring, precise temperature control, and accelerated cooling to achieve consistent mechanical properties and dimensional accuracy. These improvements are enabling production of high-strength, low-alloy (HSLA) HRCs with improved formability and corrosion resistance for automotive and structural applications.In alloy development, steelmakers are optimizing chemistries to meet evolving standards in wear resistance, tensile strength, and fatigue durability. Customized grades - such as dual-phase steels and weather-resistant steels - are enabling high-performance components with reduced weight and longer service life. Furthermore, integration with digital control systems and Industry 4.0 tools is allowing producers to fine-tune coil characteristics for specific customer applications. These process innovations are helping manufacturers differentiate on quality, reduce energy intensity, and remain cost-competitive in global markets.

Where Is HRC Demand Surging Across Industries and Regional Economies?

The construction sector remains the single largest end-user of hot rolled coils, with applications in beams, plates, frameworks, and reinforcements. Residential, commercial, and civil engineering projects all depend on HRC for its load-bearing capacity and adaptability to diverse shapes. Automotive manufacturers use HRC in frames, undercarriages, and reinforcements, where it is later formed, galvanized, or cold-rolled. The energy sector, particularly oil and gas, utilizes HRC in pipeline fabrication and structural components for rigs and refineries.Regionally, Asia Pacific dominates global consumption, led by China and India, where urban infrastructure, transport networks, and manufacturing capacity continue to expand. North America and Europe maintain steady demand, driven by industrial modernization, retrofitting of aging infrastructure, and increased use of electric vehicles. Meanwhile, Latin America and Africa are witnessing growing imports of HRC to support public infrastructure, mining, and local manufacturing initiatives. Trade dynamics, anti-dumping policies, and regional free trade agreements continue to influence the global flow of HRC volumes across these geographies.

The Growth in the Hot Rolled Coils Market Is Driven by Several Factors…

It is driven by expanding construction and infrastructure projects, steady growth in automotive production, and increasing demand for durable, cost-efficient steel products in emerging economies. Industrial recovery in the post-pandemic period, combined with public spending on transport, energy, and housing, is significantly boosting steel consumption, with HRC at the center of this demand. In parallel, innovation in high-strength and corrosion-resistant grades is opening new end-use opportunities and reducing the need for post-processing.Technological upgrades in steel manufacturing - especially in electric arc furnaces (EAFs) and continuous rolling lines - are improving output efficiency, material performance, and sustainability metrics. Trade liberalization in some regions, coupled with rising steel demand in green infrastructure and renewable energy, is further stimulating global HRC trade flows. Lastly, OEMs' shift toward lightweight and multifunctional steel components is reinforcing hot rolled coil usage across sectors where material adaptability, structural strength, and processing versatility are indispensable.

Report Scope

The report analyzes the Hot Rolled Coils market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Thickness (3 mm, 3 - 10 mm, Above 3 mm); End-Use (Construction, Automotive, Machinery, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the 3 mm Thickness Coils segment, which is expected to reach US$224.6 Million by 2030 with a CAGR of a 4.7%. The 3 - 10 mm Thickness Coils segment is also set to grow at 2.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $78.5 Million in 2024, and China, forecasted to grow at an impressive 7.4% CAGR to reach $74.2 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Hot Rolled Coils Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Hot Rolled Coils Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Hot Rolled Coils Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Bairds Malt Ltd., BarthHaas, BrewDemon, Brewferm, Briess Malt & Ingredients Co. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Hot Rolled Coils market report include:

- Angang Steel Company Limited

- ArcelorMittal

- BlueScope Steel Limited

- China Baowu Steel Group Corp.

- Electrosteel Steels Ltd.

- GNEE Steel

- Hyundai Steel Company

- JFE Steel Corporation

- Jindal Stainless Limited

- JSW Steel Ltd.

- Krakatau Steel

- Majestic Steel USA

- Nippon Steel Corporation

- Outokumpu Oyj

- POSCO

- Sahaviriya Steel Industries

- Shanghai Metal Corporation

- Tata Steel Limited

- United States Steel Corporation

- Worthington Industries Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Angang Steel Company Limited

- ArcelorMittal

- BlueScope Steel Limited

- China Baowu Steel Group Corp.

- Electrosteel Steels Ltd.

- GNEE Steel

- Hyundai Steel Company

- JFE Steel Corporation

- Jindal Stainless Limited

- JSW Steel Ltd.

- Krakatau Steel

- Majestic Steel USA

- Nippon Steel Corporation

- Outokumpu Oyj

- POSCO

- Sahaviriya Steel Industries

- Shanghai Metal Corporation

- Tata Steel Limited

- United States Steel Corporation

- Worthington Industries Inc.

Table Information

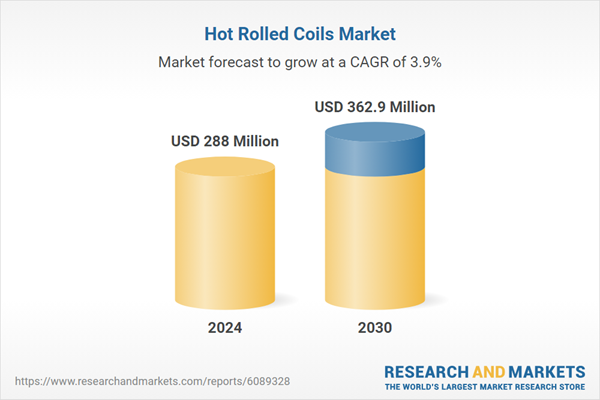

| Report Attribute | Details |

|---|---|

| No. of Pages | 272 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 288 Million |

| Forecasted Market Value ( USD | $ 362.9 Million |

| Compound Annual Growth Rate | 3.9% |

| Regions Covered | Global |