Global Hook and Loop Products Market - Key Trends & Drivers Summarized

Why Are Hook and Loop Fasteners Remaining Indispensable in Modern Manufacturing?

Hook and loop fasteners, often generically referred to as Velcro, continue to be indispensable components across multiple industries due to their reusability, ease of application, and reliable fastening capabilities. Comprising two fabric strips - one with tiny hooks and another with soft loops - these products enable secure yet removable attachment in both consumer and industrial applications. From footwear and apparel to aerospace, automotive, healthcare, and electronics, the functionality and simplicity of hook and loop systems make them ideal for quick closure, bundling, and ergonomic design integration.In an era of increasing focus on user convenience, modularity, and customization, hook and loop products are gaining renewed importance in product development. Their application extends well beyond textiles, including roles in cable management, orthopedic devices, medical braces, and even cleanroom environments. Their ability to withstand vibration, pressure, and repeated cycles without degradation enhances product longevity and operational reliability - making them critical in use cases that demand secure fastening with minimal tooling or mechanical complexity.

How Are Product Innovations and Material Enhancements Shaping the Competitive Landscape?

Ongoing innovations in material science and manufacturing processes are elevating hook and loop performance across demanding environments. High-performance variants made of nylon, polyester, stainless steel, or fire-retardant fibers are being developed for military, aviation, and industrial safety applications. Advanced coatings and adhesives are being used to enhance bonding strength on metal, glass, plastic, and fabric surfaces, enabling wider applicability in rugged or unconventional use cases.Design advancements include low-profile, high-cycle versions that reduce bulk and improve aesthetics in consumer electronics and wearable devices. Die-cut, pre-molded, and self-engaging hook and loop systems are also gaining traction for automated assembly lines. Additionally, products designed to meet RoHS, REACH, and ISO standards are being developed for use in environmentally and medically sensitive industries. Antimicrobial coatings and hypoallergenic variants are expanding usage in healthcare, especially for pediatric and wound-care applications. These technological improvements are allowing hook and loop fasteners to compete effectively with mechanical and chemical fastening systems.

Where Are Hook and Loop Products Gaining Prominence Across End-Use Sectors?

In the automotive sector, hook and loop fasteners are widely used for wire harnessing, headliner mounting, seat assembly, and interior paneling. Their light weight and ease of installation make them ideal for improving manufacturing efficiency and reducing vehicle weight. In aerospace, they play critical roles in securing equipment, cable routing, and fabric paneling within tight tolerances. The healthcare sector continues to be a high-growth area, with usage in orthotic supports, surgical drapes, and adjustable medical garments.In consumer electronics, the rise of wearables and modular accessories is expanding the need for micro-hook and low-profile fasteners. The apparel and sportswear industries are adopting high-performance and water-resistant variants in footwear, outerwear, and athletic gear. In industrial packaging and logistics, hook and loop straps are used for bundling and securing loads in reusable systems, reducing reliance on disposable materials like tape or zip ties. Educational products, military gear, pet accessories, and furniture assembly all represent fast-growing end-use areas contributing to the segment's expansion.

The Growth in the Hook and Loop Products Market Is Driven by Several Factors…

It is driven by the material versatility, reusability, and ergonomic advantages of hook and loop systems, making them highly adaptable across a broad range of industries. The increasing demand for lightweight, non-permanent, and tool-free fastening systems in automotive and aerospace manufacturing is fueling adoption. Growth in the healthcare sector - particularly in orthopedics, rehabilitation, and homecare - has created sustained demand for hypoallergenic, high-strength fasteners that meet clinical hygiene and comfort standards.Simultaneously, the rise of DIY culture, modular furniture, and eco-conscious packaging is stimulating retail demand for customizable fastening solutions. Innovations in adhesive formulations, thermal resistance, and fabric integration are enabling use in extreme environments, expanding industrial application potential. Sustainability trends are also favoring hook and loop solutions due to their reusability and low waste profile. Together, these drivers are ensuring the continued relevance and growth of hook and loop products in both established and emerging markets.

Report Scope

The report analyzes the Hook and Loop Products market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Nylon Hook & Loop, Polyester Hook & Loop, Other Types); Application (Footwear & Apparel, Transportation, Industrial Manufacturing, Automotive, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Nylon Hook & Loop segment, which is expected to reach US$1.6 Billion by 2030 with a CAGR of a 3%. The Polyester Hook & Loop segment is also set to grow at 3.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $574.9 Million in 2024, and China, forecasted to grow at an impressive 6% CAGR to reach $503.3 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Hook and Loop Products Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Hook and Loop Products Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Hook and Loop Products Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abbott Laboratories, Ascensia Diabetes Care, B. Braun Melsungen AG, Bayer Healthcare, Cofoe Medical Technology Co. Ltd and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this Hook and Loop Products market report include:

- 3M

- APLIX

- Clarendon Specialty Fasteners

- DirecTex

- Dunlap Industries Inc.

- Essentra plc

- Gottlieb Binder GmbH & Co. KG

- HALCO

- Heyi

- Jianli Sticky Ribbon Co., Ltd.

- Krahnen & Gobbers GmbH

- Kuraray Co., Ltd.

- LOVETEX INDUSTRIAL CORP.

- Nam Liong Global Corporation

- Paiho North America Corporation

- Shingyi

- Siddharth Filaments Pvt. Ltd.

- Speedtech International

- tesa SE

- Velcro Companies

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M

- APLIX

- Clarendon Specialty Fasteners

- DirecTex

- Dunlap Industries Inc.

- Essentra plc

- Gottlieb Binder GmbH & Co. KG

- HALCO

- Heyi

- Jianli Sticky Ribbon Co., Ltd.

- Krahnen & Gobbers GmbH

- Kuraray Co., Ltd.

- LOVETEX INDUSTRIAL CORP.

- Nam Liong Global Corporation

- Paiho North America Corporation

- Shingyi

- Siddharth Filaments Pvt. Ltd.

- Speedtech International

- tesa SE

- Velcro Companies

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 290 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

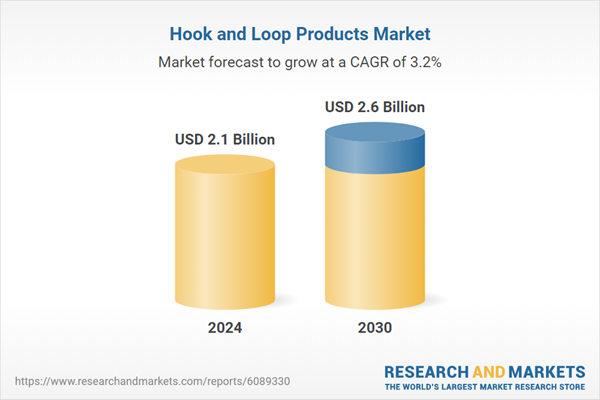

| Estimated Market Value ( USD | $ 2.1 Billion |

| Forecasted Market Value ( USD | $ 2.6 Billion |

| Compound Annual Growth Rate | 3.2% |

| Regions Covered | Global |