Global High-Temperature Industrial Burners Market - Key Trends & Drivers Summarized

Why Are High-Temperature Industrial Burners Critical to Energy-Intensive Manufacturing?

High-temperature industrial burners are integral to the operation of furnaces, kilns, and reactors across sectors such as metals, cement, glass, chemicals, and ceramics. These burners enable precise thermal processing at temperatures exceeding 1,200°C, critical for phase transformations, sintering, melting, and catalytic reactions. They are designed to ensure efficient fuel combustion, uniform heat distribution, and reduced thermal losses, thereby enhancing product quality and energy efficiency in continuous and batch processes.As global energy-intensive industries modernize, high-temperature burners are being engineered to support more aggressive thermal profiles while minimizing NO? and CO emissions. In metallurgy, regenerative and oxy-fuel burners are being deployed to achieve higher furnace efficiencies and faster heating cycles. In the cement and glass industries, advanced burner systems help optimize fuel usage and clinker formation. The ongoing decarbonization push is intensifying demand for burners compatible with cleaner fuels such as hydrogen, biofuels, and synthetic gases, creating new design and control challenges for burner OEMs.

How Are Burner Technologies Evolving to Meet Emissions and Efficiency Standards?

Technological innovations in burner design are focused on combustion optimization, fuel flexibility, and emissions reduction. Low-NO? burners, flameless combustion systems, and staged combustion technologies are being increasingly deployed to meet tightening environmental regulations. These systems reduce flame temperature and ensure controlled oxygen-fuel mixing to suppress the formation of thermal NO?. Computational Fluid Dynamics (CFD) modeling is playing a key role in optimizing flame geometry, heat flux distribution, and gas flow dynamics for consistent and clean combustion.Automation and digitalization are also reshaping industrial burner systems. Smart sensors, PLC-based control loops, and IoT-enabled diagnostics are allowing real-time monitoring of temperature, oxygen concentration, fuel usage, and burner health. These systems enable predictive maintenance, fault detection, and performance optimization - critical in high-temperature environments where process stability is non-negotiable. Hybrid burners capable of switching between gas, liquid, and renewable fuels are being developed to enhance operational resilience and reduce carbon intensity. Such advancements are making high-temperature burners smarter, cleaner, and more adaptive to evolving industrial demands.

Where Is Demand Surging Across Industrial Sectors and Geographic Regions?

The metals and metallurgy sector remains the dominant consumer of high-temperature burners, with applications in steel reheat furnaces, foundries, and aluminum melting. Demand is rising in tandem with capacity expansion and energy efficiency upgrades in developing countries. In cement manufacturing, burners are used in kilns for clinker production, where fuel flexibility and emissions reduction are key. Glass melting and annealing also rely heavily on high-efficiency burner systems to maintain precise thermal conditions and reduce energy costs.Geographically, Asia Pacific leads in installed capacity due to rapid industrialization, especially in China and India. However, demand is also rising in Europe and North America as older facilities undergo modernization to meet decarbonization targets and integrate alternative fuels. Specialty industries such as waste-to-energy plants, ceramics, and advanced chemical reactors are adopting next-gen burner systems to support customized combustion profiles. Additionally, the emergence of hydrogen-ready and dual-fuel burners is opening new opportunities in energy transition projects across regions focused on industrial sustainability.

The Growth in the High-Temperature Industrial Burners Market Is Driven by Several Factors…

It is driven by the global push for cleaner, more energy-efficient industrial processes and the need to replace legacy combustion systems with high-performance alternatives. One major factor is the enforcement of emissions standards, particularly around NO? and CO, which is prompting industries to adopt low-emission burner technologies. The shift toward alternative and renewable fuels - including hydrogen, syngas, and biomass - is also reshaping burner design and expanding demand for fuel-flexible combustion systems.Simultaneously, the modernization of aging industrial infrastructure and the growing focus on process automation are leading to increased deployment of intelligent burner systems with integrated monitoring and control. The expanding global production of metals, cement, and chemicals is sustaining demand for high-capacity thermal systems in both greenfield and brownfield installations. Lastly, the role of high-temperature burners in supporting industrial decarbonization - especially through energy efficiency improvements and integration with hydrogen supply chains - is positioning them as critical enablers of low-carbon manufacturing.

Report Scope

The report analyzes the High-Temperature Industrial Burners market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Fuel Type (Gas Burner, Oil Burner, Dual Fuel Burner); Application (Boilers, Steam & Gas Turbine, Heat Recovery Steam Generation, Furnaces / Forges, Other Applications); End-Use (Metallurgy, Power Generation, Oil & Gas, Cement & Refractories, Chemical & Petro Chemical, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Gas Burner segment, which is expected to reach US$1 Billion by 2030 with a CAGR of a 2.1%. The Oil Burner segment is also set to grow at 3.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $451.7 Million in 2024, and China, forecasted to grow at an impressive 5.2% CAGR to reach $378 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global High-Temperature Industrial Burners Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global High-Temperature Industrial Burners Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global High-Temperature Industrial Burners Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ADEKA Corporation, Air Liquide S.A., Air Products and Chemicals Inc., Applied Materials, Inc., Arkema Group and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 37 companies featured in this High-Temperature Industrial Burners market report include:

- Alfa Laval AB

- Andritz AG

- Astec Industries, Inc.

- Babcock Wanson

- Baltur S.p.A

- Bloom Engineering

- ClearSign Technologies Corporation

- Forbes Marshall Private Limited

- Honeywell International Inc.

- John Zink Hamworthy Combustion

- Oilon Group Oy

- Olympia Kogyo Co., Ltd.

- Oxilon Private Limited

- SAACKE GmbH

- Selas Heat Technology Company

- Tenova S.p.A

- Volcano Co., Ltd.

- Webster Combustion Technology, LLC

- Weishaupt Group

- Zeeco, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alfa Laval AB

- Andritz AG

- Astec Industries, Inc.

- Babcock Wanson

- Baltur S.p.A

- Bloom Engineering

- ClearSign Technologies Corporation

- Forbes Marshall Private Limited

- Honeywell International Inc.

- John Zink Hamworthy Combustion

- Oilon Group Oy

- Olympia Kogyo Co., Ltd.

- Oxilon Private Limited

- SAACKE GmbH

- Selas Heat Technology Company

- Tenova S.p.A

- Volcano Co., Ltd.

- Webster Combustion Technology, LLC

- Weishaupt Group

- Zeeco, Inc.

Table Information

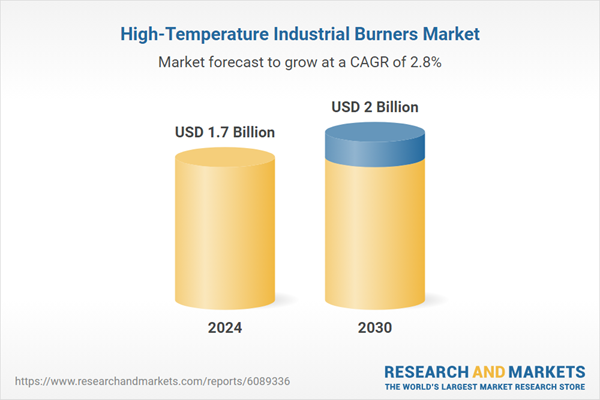

| Report Attribute | Details |

|---|---|

| No. of Pages | 385 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.7 Billion |

| Forecasted Market Value ( USD | $ 2 Billion |

| Compound Annual Growth Rate | 2.8% |

| Regions Covered | Global |