Global High-Density Interconnect PCBs Market - Key Trends & Drivers Summarized

Why Are High-Density Interconnect PCBs Redefining Electronic Miniaturization?

High-Density Interconnect (HDI) PCBs are transforming the landscape of electronics manufacturing by enabling miniaturized, high-performance devices in increasingly compact footprints. With more components per square inch, HDI boards are critical to sectors such as smartphones, wearable devices, automotive electronics, medical implants, and advanced military communication systems. Their ability to support higher wiring densities, finer lines and spaces, smaller vias, and multiple layers makes them ideal for enabling lightweight, power-efficient electronics without compromising processing power or signal integrity.The demand for HDI PCBs is closely tied to the broader trend of device convergence - where multifunctional electronics are becoming smaller, thinner, and more integrated. The push for higher data rates, signal reliability, and faster processing speeds in compact formats is fueling the need for board architectures that can handle complex routing and tighter interconnects. This is particularly evident in next-gen smartphones and 5G infrastructure, where HDI boards support higher-layer counts and multi-functionality in a limited footprint, enabling better thermal management and electrical performance.

How Are Design Techniques and Material Advances Enabling Higher Layer Counts and Reliability?

Technological innovation in PCB fabrication is a core enabler of HDI evolution. Techniques such as sequential lamination, via-in-pad design, laser drilling, and microvia stacking are being widely adopted to achieve increased layer density without compromising mechanical stability. The use of stacked and staggered vias enables more robust vertical interconnections, improving routing efficiency and signal transmission across layers. These approaches are vital in high-speed and high-frequency applications where signal integrity is paramount.Material advancements also play a critical role. High-performance laminates with low dielectric constants and high glass transition temperatures are increasingly being used to reduce signal loss and withstand thermal cycling in harsh conditions. Moreover, the adoption of halogen-free, lead-free, and RoHS-compliant materials is addressing environmental concerns while meeting global regulatory standards. Integration of embedded passive components and system-in-package (SiP) configurations into HDI boards is another trend reducing form factors and increasing device functionality. These innovations allow HDI PCBs to deliver higher interconnect reliability, reduced parasitics, and enhanced EMI shielding.

Where Is Demand Accelerating Most in End-Use Sectors?

Consumer electronics dominate HDI PCB adoption, particularly in mobile phones, smartwatches, AR/VR gear, and tablets, where performance and miniaturization go hand in hand. In automotive applications, HDI boards are increasingly used in ADAS, infotainment systems, battery management units, and electric powertrains. As vehicles become more electrified and autonomous, HDI PCBs enable high-speed data processing and communication between subsystems without increasing spatial footprint or weight.In the medical sector, HDI PCBs are critical for compact diagnostic imaging equipment, surgical tools, and implantable devices such as pacemakers and neurostimulators. Military and aerospace applications rely on HDI boards for advanced radar systems, satellite communications, and avionics due to their superior signal integrity, thermal resistance, and space efficiency. Data centers and networking infrastructure also represent a growing segment, where HDI boards support high-frequency, low-latency data transmission in servers, routers, and AI accelerators. These diversified applications are establishing HDI PCBs as foundational components across future-facing industries.

The Growth in the High-Density Interconnect PCBs Market Is Driven by Several Factors…

It is driven by the relentless pursuit of performance, efficiency, and miniaturization across electronic product design. Key among these drivers is the widespread adoption of 5G, which requires densely routed PCBs to support massive data flows and complex antenna architectures in compact base stations and handheld devices. The growth of wearable technology, IoT devices, and edge computing platforms is also necessitating ultra-thin, multi-layer boards with high interconnect density and reduced electromagnetic interference.The automotive sector's shift toward electrification and autonomous driving is another significant growth driver, creating demand for HDI boards that meet stringent durability, reliability, and signal performance standards under extreme conditions. Additionally, technological advancements in laser drilling, via filling, and multilayer lamination processes are reducing manufacturing costs and enhancing design flexibility, making HDI PCBs more accessible to mid-tier device manufacturers. Regulatory mandates pushing for greener, lead-free, and halogen-free components are further encouraging OEMs to adopt HDI solutions that support sustainability without compromising functionality.

Report Scope

The report analyzes the High-Density Interconnect PCBs market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Technology [4-6 Layer, 8-10 Layer, Above 10 Layer); End-Use (Smartphones & Tablets, Computers, Telecom / Datacom, Consumer Electronics, Automotive, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Smartphones & Tablets End-Use segment, which is expected to reach US$16.2 Billion by 2030 with a CAGR of a 4.5%. The Computers End-Use segment is also set to grow at 2.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $4.1 Billion in 2024, and China, forecasted to grow at an impressive 7.8% CAGR to reach $4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global High-Density Interconnect PCBs Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global High-Density Interconnect PCBs Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global High-Density Interconnect PCBs Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Ltd., Amphenol Corporation, Aptiv PLC, Caton Connector Corporation, Eaton Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this High-Density Interconnect PCBs market report include:

- Advanced Circuits

- AT&S (Austria Technologie & Systemtechnik AG)

- Compeq Manufacturing Co., Ltd.

- Dynamic Electronics Co., Ltd.

- Ellington Electronics Technology Group

- Fujitsu Interconnect Technologies Ltd.

- Ibiden Co., Ltd.

- Meiko Electronics Co., Ltd.

- Millennium Circuits Limited

- NCAB Group

- RayMing Technology

- Shennan Circuits Co., Ltd.

- Sierra Circuits, Inc.

- Sumitomo Electric Industries, Ltd.

- Tripod Technology Corporation

- TTM Technologies, Inc.

- Unimicron Technology Corporation

- Unitech Printed Circuit Board Corp.

- Wus Printed Circuit Co., Ltd.

- Zhen Ding Technology Holding Limited

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Advanced Circuits

- AT&S (Austria Technologie & Systemtechnik AG)

- Compeq Manufacturing Co., Ltd.

- Dynamic Electronics Co., Ltd.

- Ellington Electronics Technology Group

- Fujitsu Interconnect Technologies Ltd.

- Ibiden Co., Ltd.

- Meiko Electronics Co., Ltd.

- Millennium Circuits Limited

- NCAB Group

- RayMing Technology

- Shennan Circuits Co., Ltd.

- Sierra Circuits, Inc.

- Sumitomo Electric Industries, Ltd.

- Tripod Technology Corporation

- TTM Technologies, Inc.

- Unimicron Technology Corporation

- Unitech Printed Circuit Board Corp.

- Wus Printed Circuit Co., Ltd.

- Zhen Ding Technology Holding Limited

Table Information

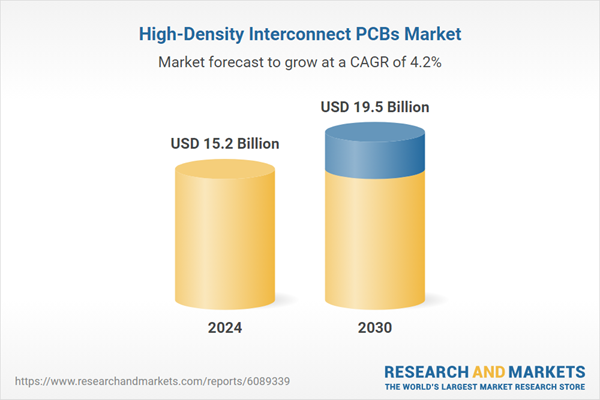

| Report Attribute | Details |

|---|---|

| No. of Pages | 193 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 15.2 Billion |

| Forecasted Market Value ( USD | $ 19.5 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |