Global Heterojunction PECVD Machines Market - Key Trends & Drivers Summarized

Why Are PECVD Systems Crucial in Scaling HJT Solar Cell Production?

Plasma-Enhanced Chemical Vapor Deposition (PECVD) machines play a foundational role in heterojunction (HJT) solar cell manufacturing by enabling the precise deposition of ultra-thin amorphous silicon (a-Si:H) layers on crystalline silicon wafers. These passivation layers are essential for minimizing surface defects, maximizing carrier lifetimes, and forming the critical heterojunction interface that defines HJT efficiency. PECVD systems are also used to deposit transparent conductive oxides (TCOs) that serve as electrode layers, allowing for effective current extraction without sacrificing transparency.The performance and reliability of HJT solar cells are directly tied to the quality and uniformity of PECVD-deposited films. As HJT scales toward mass adoption, demand for high-throughput, inline PECVD tools that offer temperature control, deposition precision, and low particle contamination is increasing rapidly. Advanced PECVD systems are being customized for ultra-thin films, low-damage processing, and reduced cycle times - all of which are essential for reducing per-watt production costs in competitive PV manufacturing environments.

How Are Equipment Manufacturers Innovating to Meet Next-Generation Deposition Requirements?

PECVD machine manufacturers are responding to the demands of the HJT segment with specialized equipment featuring modular chambers, multi-zone temperature controls, and high-uniformity plasma sources. Innovations include dual-chamber deposition systems that allow for continuous a-Si and TCO layer formation without exposing wafers to air, which improves throughput and material adhesion. These configurations reduce production bottlenecks and contamination risks, increasing yield in commercial-scale HJT production.Process integration capabilities, such as combining PECVD with sputtering or atomic layer deposition (ALD) systems, are also gaining traction. Software-driven process optimization using machine learning and real-time feedback loops is being deployed to control plasma uniformity and minimize defects. Additionally, manufacturers are developing PECVD tools capable of handling thinner wafers and advanced cell structures such as tandem or IBC-HJT (interdigitated back contact) formats. These systems are also becoming more energy efficient, addressing both economic and environmental sustainability targets.

Which Regions and Segments Are Driving Demand for HJT PECVD Tools?

Asia-Pacific, particularly China, is the epicenter of PECVD machine demand, driven by aggressive expansion of HJT manufacturing lines. Major solar cell manufacturers are investing heavily in dedicated HJT capacity, prompting equipment suppliers to scale up production and develop next-gen tools. South Korea and Japan, with their strong semiconductor and materials technology bases, are also advancing PECVD tool development for hybrid HJT applications and next-generation PV R&D.Demand is concentrated in the solar manufacturing sector, especially in high-efficiency module lines aimed at utility-scale, commercial, and premium rooftop markets. Research institutions and pilot-scale manufacturers in Europe and North America are also contributing to PECVD innovation as they explore perovskite-HJT tandem cells and building-integrated solar solutions. As the HJT supply chain matures, PECVD systems are becoming strategic assets in achieving yield optimization and cost reduction.

The Growth in the Heterojunction PECVD Machines Market Is Driven by Several Factors

The growth in the heterojunction PECVD machines market is driven by the rapid scaling of HJT solar cell production, increasing demand for high-efficiency PV modules, and the need for precise, low-temperature thin-film deposition. As solar manufacturers transition from PERC to next-gen architectures, PECVD systems have emerged as critical enablers of performance, reliability, and cost-efficiency.Technological innovations in inline, multi-chamber systems, combined with AI-driven process controls and energy optimization, are enhancing tool performance and factory productivity. Policy-driven decarbonization targets and the rise of green hydrogen and solar-integrated infrastructure are expanding investment in HJT technologies, further boosting PECVD demand. As the solar industry pursues higher efficiency, longer life cycles, and better bifacial performance, PECVD tools tailored to HJT applications are becoming indispensable to the next era of photovoltaic manufacturing.

Report Scope

The report analyzes the Heterojunction PECVD Machines market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (In-Line Type, Horizontal Type, Other Types); Application (Battery Manufacturer, Solar Cell Manufacturing, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the In-Line Machines segment, which is expected to reach US$869.7 Million by 2030 with a CAGR of a 5.5%. The Horizontal Machines segment is also set to grow at 8.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $272.4 Million in 2024, and China, forecasted to grow at an impressive 10.2% CAGR to reach $300.2 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Heterojunction PECVD Machines Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Heterojunction PECVD Machines Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Heterojunction PECVD Machines Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3Sun, Akcome Technology, Boviet Solar, Canadian Solar, Enel Green Power and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Heterojunction PECVD Machines market report include:

- AIXTRON SE

- Canon Anelva Corporation

- GS-Solar

- H2GEMINI

- Ideal Energy Sunflower

- INDEOtec SA

- Jinchen Machinery Co., Ltd.

- Maxwell Technologies

- Meyer Burger Technology AG

- NAURA Technology Group Co., Ltd.

- Oxford Instruments plc

- Plasma-Therm LLC

- RENA Technologies GmbH

- Roth & Rau AG

- SAMCO Inc.

- Shenzhen Hekeda Precision Equipment

- Shenzhen S.C New Energy Technology

- Singulus Technologies AG

- TEL Solar Ltd.

- VON ARDENNE GmbH

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AIXTRON SE

- Canon Anelva Corporation

- GS-Solar

- H2GEMINI

- Ideal Energy Sunflower

- INDEOtec SA

- Jinchen Machinery Co., Ltd.

- Maxwell Technologies

- Meyer Burger Technology AG

- NAURA Technology Group Co., Ltd.

- Oxford Instruments plc

- Plasma-Therm LLC

- RENA Technologies GmbH

- Roth & Rau AG

- SAMCO Inc.

- Shenzhen Hekeda Precision Equipment

- Shenzhen S.C New Energy Technology

- Singulus Technologies AG

- TEL Solar Ltd.

- VON ARDENNE GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 278 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

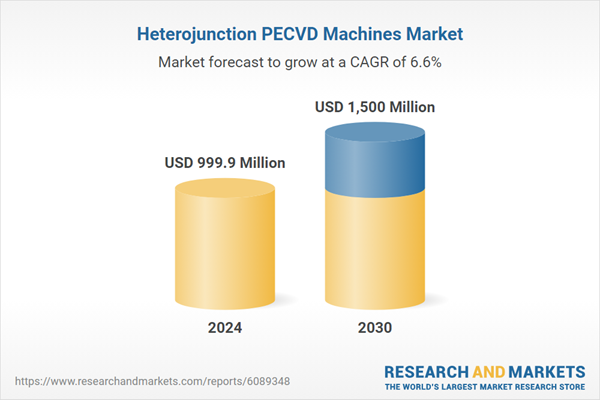

| Estimated Market Value ( USD | $ 999.9 Million |

| Forecasted Market Value ( USD | $ 1500 Million |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |