Global Hemp Fiber Market - Key Trends & Drivers Summarized

Why Is Hemp Fiber Regaining Global Relevance as a Sustainable Material?

Hemp fiber, derived from the stalk of the Cannabis sativa plant, is experiencing a global resurgence due to its environmental advantages and versatile application potential. Unlike many traditional fibers, hemp grows quickly, requires minimal pesticides, improves soil health, and captures significant carbon during its cultivation. These agronomic benefits, combined with rising interest in renewable and biodegradable materials, are repositioning hemp fiber as a sustainable alternative to synthetic fibers and resource-intensive crops like cotton.With increasing scrutiny on environmental impact in textiles, packaging, automotive, and construction industries, hemp fiber is emerging as a viable solution. Its high tensile strength, anti-microbial properties, UV resistance, and breathability make it ideal for producing clothing, ropes, insulation, geotextiles, and composite panels. As governments and companies strive to decarbonize supply chains and reduce plastic use, hemp fiber offers both performance and sustainability credentials across multiple sectors.

How Are Processing Technologies and Policy Support Driving Market Expansion?

Technological advancements in hemp decortication, retting, and fiber refining are improving the quality, yield, and consistency of industrial hemp fiber. Modern mechanical decorticators allow efficient separation of bast and hurd fibers, supporting large-scale processing. Enzyme-based treatments and advanced blending techniques are enabling softer, more uniform fibers suited for high-end textile and nonwoven applications. Innovation in bio-composites and fiber-plastic blends is expanding hemp's role in automotive parts, packaging films, and building materials.Policy changes are also catalyzing market development. Many countries have legalized industrial hemp cultivation and are promoting its use through agricultural subsidies, R&D support, and incentives for sustainable manufacturing. Consumer demand for eco-labeled and organically sourced products is pushing brands in fashion, personal care, and food packaging to integrate hemp-based inputs. These regulatory and consumer-driven shifts are turning hemp fiber from a niche material into a strategic raw input across industries.

Which Applications and Regions Are Leading the Hemp Fiber Revolution?

The textile sector remains a key application area, with hemp fabrics used in apparel, home furnishings, and technical textiles. Nonwoven hemp is gaining momentum in insulation, automotive panels, and biodegradable composites. Construction is another fast-growing segment, where hempcrete and hemp-based insulation materials offer thermal efficiency, fire resistance, and carbon neutrality. Paper and pulp industries are revisiting hemp as an alternative to wood pulp for low-footprint printing and packaging applications.Europe currently leads the global market due to progressive agricultural policies, a mature natural fiber ecosystem, and strong demand from sustainable brands. France, the Netherlands, and Germany are major producers and innovators in hemp processing. North America is expanding rapidly, supported by the U.S. Farm Bill legalization of hemp and investment from the automotive and fashion industries. Asia-Pacific is also a significant player, with China as the world's largest hemp fiber producer and exporter. Latin America and Africa are beginning to adopt hemp as part of climate-smart agriculture and rural development strategies.

The Growth in the Hemp Fiber Market Is Driven by Several Factors

The growth in the hemp fiber market is driven by increasing global demand for sustainable raw materials, favorable regulatory reforms, and broad industrial interest in decarbonizing supply chains. Environmental concerns around synthetic fibers, cotton's water intensity, and deforestation in paper and construction supply chains are accelerating the shift toward hemp-based alternatives. Advances in processing technology are improving fiber quality, making hemp more competitive in both performance and cost.Policy incentives for green materials, consumer awareness of eco-friendly products, and supply chain diversification goals are aligning to drive hemp fiber adoption across textiles, automotive, packaging, and construction. The material's low ecological footprint and wide application versatility make it uniquely positioned as both a traditional and next-generation fiber. As industries increasingly integrate circular and bio-based strategies, hemp fiber is emerging as a cornerstone material in the global sustainability transition.

Report Scope

The report analyzes the Hemp Fiber market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Source (Conventional, Organic, Other Sources); Product Type (Fibers, Shivs, Seeds, Stalks, Other Product Types); Application (Textiles, Pulp & Paper, Composite Materials, Insulation, Animal Bedding, Other Applications); End-Use (Automotive, Construction, Animal Care, Textiles, Furniture, Food & Beverages, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Conventional Hemp Fiber segment, which is expected to reach US$10.9 Billion by 2030 with a CAGR of a 16.6%. The Organic Hemp Fiber segment is also set to grow at 22% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2 Billion in 2024, and China, forecasted to grow at an impressive 25% CAGR to reach $4.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Hemp Fiber Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Hemp Fiber Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Hemp Fiber Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Al-Tawfiq Company, Amcor plc, BAG Corp, Bemis Company, Inc., Berry Global, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Hemp Fiber market report include:

- American Hemp LLC

- BaFa Holding BV

- Canah International

- Canvaloop Fibre Pvt. Ltd.

- Cavac Biomatériaux

- Colorado Hemp Works Inc.

- Cone Denim LLC

- Dun Agro Hemp Group

- Ecofibre Ltd.

- GenCanna Global USA Inc.

- Hemp Inc.

- Hemp Oil Canada Inc.

- HempFlax Group B.V.

- Hempline Inc.

- HemPoland Sp. z o.o.

- Hempro International GmbH & Co. KG

- Industrial Hemp Manufacturing LLC

- Konoplex LLC

- Parkland Industrial Hemp Growers Co-op. Ltd.

- South Hemp Tecno srl

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- American Hemp LLC

- BaFa Holding BV

- Canah International

- Canvaloop Fibre Pvt. Ltd.

- Cavac Biomatériaux

- Colorado Hemp Works Inc.

- Cone Denim LLC

- Dun Agro Hemp Group

- Ecofibre Ltd.

- GenCanna Global USA Inc.

- Hemp Inc.

- Hemp Oil Canada Inc.

- HempFlax Group B.V.

- Hempline Inc.

- HemPoland Sp. z o.o.

- Hempro International GmbH & Co. KG

- Industrial Hemp Manufacturing LLC

- Konoplex LLC

- Parkland Industrial Hemp Growers Co-op. Ltd.

- South Hemp Tecno srl

Table Information

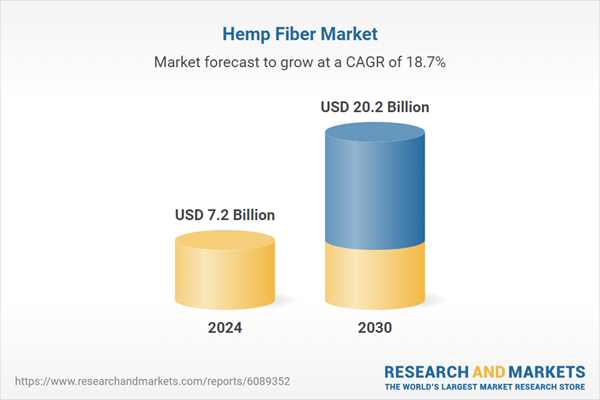

| Report Attribute | Details |

|---|---|

| No. of Pages | 391 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 7.2 Billion |

| Forecasted Market Value ( USD | $ 20.2 Billion |

| Compound Annual Growth Rate | 18.7% |

| Regions Covered | Global |