Global Heavy Duty Bags and Sacks Market - Key Trends & Drivers Summarized

Why Are Heavy Duty Bags and Sacks in High Demand Across Industrial Supply Chains?

Heavy duty bags and sacks are vital components of global logistics and industrial packaging, designed to handle large volumes, high weights, and rugged transit conditions. Typically made from materials like woven polypropylene, polyethylene, jute, or multi-wall paper, these bags are engineered for durability, tear resistance, and environmental protection. Their primary appeal lies in their ability to safely transport and store bulk goods such as agricultural produce, chemicals, cement, construction materials, and industrial powders.Industries dependent on bulk packaging - such as agriculture, mining, chemicals, and construction - rely heavily on these sacks to reduce spillage, prevent contamination, and optimize storage. Additionally, increasing international trade and globalized supply chains have amplified the need for secure, efficient packaging solutions that can withstand long-distance shipping, loading stress, and variable weather. Heavy duty sacks provide a practical, scalable packaging format that supports both manual and automated handling systems in warehousing and logistics hubs.

How Are Materials, Features, and Sustainability Requirements Transforming Bag Design?

Technological innovation in material science is leading to stronger, lighter, and more recyclable bag structures. Woven polypropylene (PP) continues to dominate due to its strength-to-weight ratio, but newer variants with UV stabilization, moisture resistance, and anti-static properties are broadening use cases. Multi-layered constructions and laminated films are increasingly used to protect sensitive contents like fertilizers, flour, or animal feed from air, moisture, and infestation.In response to sustainability demands, manufacturers are focusing on biodegradable linings, post-consumer recycled (PCR) plastic integration, and reusability features. Design enhancements such as baffles for shape retention, gussets for volumetric efficiency, and discharge spouts for controlled unloading are also gaining popularity. Automation-compatible formats such as form-fill-seal (FFS) bags and valve sacks are enabling high-speed filling and closing processes in industrial packaging lines. These trends are pushing heavy duty sacks toward higher value and increased customization for end-user requirements.

Which Markets and End-Uses Are Driving Global Demand for Heavy Duty Packaging?

The agriculture sector is the largest end-user, utilizing heavy duty sacks for storing and transporting grains, seeds, fertilizers, and animal feed. The construction and building materials segment also generates substantial demand, particularly for packaging cement, sand, lime, and concrete additives. The chemical and minerals industries depend on these bags for safely containing hazardous or reactive powders and granules. The retail sector, especially in developing regions, is increasingly using bulk packaging formats for commodity goods distribution.Asia-Pacific leads the global market due to its large agricultural base, expanding construction sector, and rising industrial output. China, India, and Southeast Asian countries dominate both production and consumption. North America and Europe show steady demand, with greater emphasis on environmentally friendly and automation-compatible formats. The Middle East, Africa, and Latin America are emerging growth markets, supported by infrastructure development, food security programs, and local manufacturing expansion.

The Growth in the Heavy Duty Bags and Sacks Market Is Driven by Several Factors

The growth in the heavy duty bags and sacks market is driven by expanding global trade, infrastructure development, and rising demand for durable, efficient packaging across bulk-handling industries. Agricultural output growth, construction booms in emerging markets, and increased mineral extraction are fueling product uptake. Technological innovations in polymer engineering and sustainable materials are creating advanced sacks with higher performance and lower environmental impact.Automation in warehousing and packaging lines is pushing demand for machine-compatible formats, while regulations on food and chemical safety are encouraging adoption of higher-specification barrier bags. Additionally, government policies favoring reusable and recyclable packaging are supporting a shift toward eco-conscious bag solutions. As end-users prioritize cost efficiency, product integrity, and environmental compliance, heavy duty sacks continue to evolve as a cornerstone of industrial packaging systems.

Report Scope

The report analyzes the Heavy Duty Bag and Sacks market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Open Mouth, Pasted Valve, Gusset Bags, Rubber Sacks, Woven Sacks, Trash Sacks); Capacity (Less Than 20 Kg, 20 - 40 Kg, Above 40 Kg); Material (Paper, Plastic, Jute); End-Use (Food, Agriculture, Chemical & Fertilizer, Building & Construction, Automotive, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Open Mouth segment, which is expected to reach US$4.4 Billion by 2030 with a CAGR of a 3%. The Pasted Valve segment is also set to grow at 4.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.7 Billion in 2024, and China, forecasted to grow at an impressive 6.6% CAGR to reach $3.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Heavy Duty Bag and Sacks Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Heavy Duty Bag and Sacks Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Heavy Duty Bag and Sacks Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Ltd., Autonics Corporation, Caloritech (Chromalox), Fuji Electric Co., Ltd., Honeywell International Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Heavy Duty Bag and Sacks market report include:

- Al-Tawfiq Company

- Amcor plc

- BAG Corp

- Bemis Company, Inc.

- Berry Global, Inc.

- Cromwell Polyethylene Ltd.

- Global-Pak Inc.

- Hood Packaging Corporation

- Inteplast Group

- LC Packaging International BV

- MegaSack Corporation

- Mondi Group

- Muscat Polymers Pvt. Ltd.

- Nihon Matai Co., Ltd.

- Novolex

- ProAmpac LLC

- Seevent Plastics Ltd.

- Segezha Group LLC

- Sonoco Products Company

- Wooderson Packaging Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Al-Tawfiq Company

- Amcor plc

- BAG Corp

- Bemis Company, Inc.

- Berry Global, Inc.

- Cromwell Polyethylene Ltd.

- Global-Pak Inc.

- Hood Packaging Corporation

- Inteplast Group

- LC Packaging International BV

- MegaSack Corporation

- Mondi Group

- Muscat Polymers Pvt. Ltd.

- Nihon Matai Co., Ltd.

- Novolex

- ProAmpac LLC

- Seevent Plastics Ltd.

- Segezha Group LLC

- Sonoco Products Company

- Wooderson Packaging Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 483 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

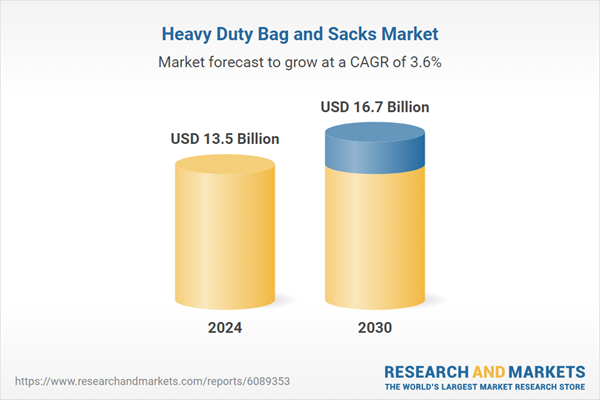

| Estimated Market Value ( USD | $ 13.5 Billion |

| Forecasted Market Value ( USD | $ 16.7 Billion |

| Compound Annual Growth Rate | 3.6% |

| Regions Covered | Global |