Global Managed Learning Services Market - Key Trends & Drivers Summarized

Why Are Organizations Turning to Managed Learning Services for Talent Development?

Managed learning services (MLS) refer to the outsourcing of learning and development (L&D) functions to specialized service providers who handle the end-to-end design, delivery, management, and measurement of training programs. As companies face rapid digital transformation, skills gaps, and evolving compliance requirements, many are opting for MLS partners to streamline training operations, reduce overhead, and align learning initiatives with business goals. From curriculum design and content creation to vendor management and learning technology support, MLS providers offer a comprehensive solution tailored to enterprise needs.Unlike traditional corporate training, MLS brings scalability, consistency, and strategic oversight to L&D. By outsourcing program management and leveraging external expertise, organizations can focus on workforce capability building and performance outcomes. The approach is gaining traction across industries including healthcare, BFSI, manufacturing, retail, and IT, where continuous learning is crucial for regulatory compliance, customer satisfaction, and operational agility.

How Are Digital Learning Platforms and Data Analytics Transforming MLS Delivery?

Technology is playing a pivotal role in enhancing the value and effectiveness of managed learning services. Cloud-based learning management systems (LMS), virtual classrooms, mobile learning apps, and AI-driven content curation tools are enabling seamless and personalized learner experiences. MLS providers are integrating these tools to deliver adaptive, on-demand, and gamified training programs that boost learner engagement and retention. Microlearning modules, AR/VR-based simulations, and multilingual content offerings are supporting global and decentralized workforces.Advanced learning analytics platforms are now embedded into MLS offerings, allowing organizations to track learner progress, measure program effectiveness, and align training initiatives with key performance indicators (KPIs). Predictive analytics is being used to identify skills gaps and recommend targeted learning paths. MLS vendors are also offering strategic consulting services to align learning roadmaps with future workforce planning and organizational transformation. This integration of content, delivery, analytics, and strategy is making MLS a core component of modern talent development ecosystems.

Which Types of Organizations Are Driving MLS Adoption and Why?

Large enterprises and global corporations are leading adopters of managed learning services, driven by their need to deliver standardized training across multiple geographies and business units. Industries with high compliance burdens - such as pharmaceuticals, financial services, and energy - rely on MLS to manage certification workflows, audit trails, and policy updates. Tech companies, facing fast-changing skills requirements in cloud, cybersecurity, and AI, use MLS to provide agile, role-based learning at scale.Mid-sized businesses and public-sector organizations are increasingly exploring MLS to access cutting-edge learning expertise without building large internal teams. Educational institutions and professional associations are also partnering with MLS providers to expand virtual learning programs and hybrid certification pathways. Additionally, as workforce reskilling becomes a priority in response to automation and AI adoption, governments are initiating public-private MLS partnerships to support national upskilling agendas.

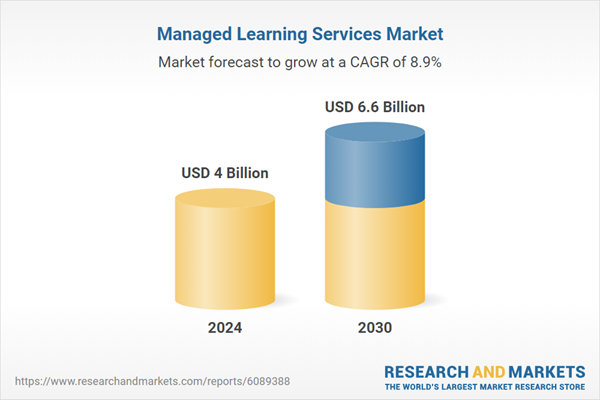

The Growth in the Managed Learning Services Market Is Driven by Several Factors…

The growth in the managed learning services market is driven by several factors including the rapid pace of digital disruption, increasing focus on workforce upskilling, and the need for scalable, technology-enabled training delivery. A central driver is the growing complexity of learning ecosystems, which require integration across LMS platforms, content providers, assessment tools, and compliance systems - capabilities MLS vendors are uniquely positioned to manage efficiently.The hybrid work model and global talent sourcing trends are fueling demand for decentralized, multilingual, and mobile-friendly learning formats, further boosting MLS relevance. Organizations seeking to measure training ROI and align learning outcomes with business goals are turning to MLS providers for analytics-driven program design and execution. Moreover, cost optimization pressures and the scarcity of in-house learning expertise are prompting firms to outsource non-core training functions. As lifelong learning becomes embedded in organizational culture, MLS is expected to remain a growth engine in the future of work and talent strategy.

Report Scope

The report analyzes the Managed Learning Services market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Sourcing External Training, L&D Administration, Supplier Management, Other Types); Organization Size (Large Enterprises, SMEs); Delivery Mode (Instructor-Led Training, Distance Learning, Blended Training); Vertical (IT & Telecommunications, Education, Consumer Goods & Retail, Healthcare, BFSI, Other Verticals).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Sourcing External Training segment, which is expected to reach US$3.5 Billion by 2030 with a CAGR of a 10.5%. The L&D Administration segment is also set to grow at 6.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.1 Billion in 2024, and China, forecasted to grow at an impressive 14.1% CAGR to reach $1.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Managed Learning Services Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Managed Learning Services Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Managed Learning Services Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Analogic Corporation, aycan Medical Systems, Candelis Inc., Carestream Health, Densitas Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Managed Learning Services market report include:

- Accenture

- AllenComm

- Aptara

- CGS (Computer Generated Solutions)

- Clarity Consultants

- Dale Carnegie Training

- ELB Learning

- GP Strategies Corporation

- Hemsley Fraser

- Infopro Learning

- Kaplan, Inc.

- Learning Tree International

- NIIT Limited

- Paradiso Solutions

- Skillsoft

- The Training Associates (TTA)

- TrainingFolks

- Upside Learning

- VPS Learning

- Wilson Learning Worldwide Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Accenture

- AllenComm

- Aptara

- CGS (Computer Generated Solutions)

- Clarity Consultants

- Dale Carnegie Training

- ELB Learning

- GP Strategies Corporation

- Hemsley Fraser

- Infopro Learning

- Kaplan, Inc.

- Learning Tree International

- NIIT Limited

- Paradiso Solutions

- Skillsoft

- The Training Associates (TTA)

- TrainingFolks

- Upside Learning

- VPS Learning

- Wilson Learning Worldwide Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 472 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4 Billion |

| Forecasted Market Value ( USD | $ 6.6 Billion |

| Compound Annual Growth Rate | 8.9% |

| Regions Covered | Global |