Global Magnetic Plastics Market - Key Trends & Drivers Summarized

What Makes Magnetic Plastics Such a Unique Class of Functional Materials?

Magnetic plastics, also known as polymer-bonded magnets or magnetic composites, are hybrid materials formed by embedding magnetic powders - such as ferrites, neodymium-iron-boron (NdFeB), or samarium-cobalt - into thermoplastic or thermosetting polymer matrices. These materials combine the flexibility, lightweight properties, and moldability of plastics with the magnetic functionality traditionally found in metal-based magnets. Unlike sintered magnets, magnetic plastics can be shaped into complex geometries via injection molding or extrusion, allowing manufacturers to integrate them easily into intricate components without secondary machining.They are widely used in applications where weight reduction, design freedom, and corrosion resistance are critical - such as in miniature motors, sensors, actuators, medical devices, consumer electronics, and even automotive assemblies. Magnetic plastics can be isotropic or anisotropic depending on whether the magnetic particles are aligned during processing. This tunability allows engineers to customize the magnetic orientation and performance to suit specific device requirements. As industries demand more compact and energy-efficient components, the relevance of magnetic plastics is growing rapidly.

How Are Innovations in Materials and Processing Technologies Advancing Product Capabilities?

The performance of magnetic plastics is being enhanced significantly through innovations in polymer chemistry, filler dispersion techniques, and additive manufacturing. Advanced thermoplastics like polyamide, PPS, and PEEK are increasingly used as matrices due to their high thermal stability and mechanical strength, enabling magnetic plastics to perform reliably in high-temperature and harsh operating environments. Equally important is the improvement in particle surface treatments and coupling agents, which promote better adhesion between magnetic fillers and polymers, thereby enhancing mechanical integrity and magnetic consistency.Emerging trends include the use of rare-earth-free and high-entropy magnetic materials to reduce reliance on critical raw materials while maintaining competitive performance levels. Additionally, 3D printing of magnetic polymers is becoming a viable technique for prototyping and producing complex parts with embedded functionality, such as sensors with integrated circuits. In high-frequency applications, low eddy current losses and shape customization make magnetic plastics an appealing substitute for laminated magnetic cores or metallic magnets. Continuous R&D efforts are also focusing on improving the alignment of anisotropic particles during molding to optimize magnetic flux density in end-use devices.

Which End-Use Industries Are Driving Demand for Magnetic Plastics and Why?

The adoption of magnetic plastics is rapidly increasing across several key industries, most notably automotive, electronics, healthcare, and industrial automation. In electric vehicles and hybrid drivetrains, these materials are used in compact motor designs and integrated magnetic sensors, contributing to reduced system weight and improved energy efficiency. Consumer electronics manufacturers use magnetic plastics in speakers, vibration motors, and wearable device components where miniaturization and electromagnetic interference reduction are critical.In the healthcare sector, magnetic plastics are used in diagnostics, therapeutic equipment, and drug delivery systems where biocompatibility, non-corrosiveness, and customization of shape are required. Industrial robots and factory automation systems incorporate magnetic plastic-based encoders, torque sensors, and motion control devices that benefit from the material's lightweight and customizable characteristics. Additionally, the renewable energy sector is adopting magnetic plastics in wind turbine sensors and energy harvesting systems, reflecting the growing demand for durable and high-performance materials in dynamic operating environments.

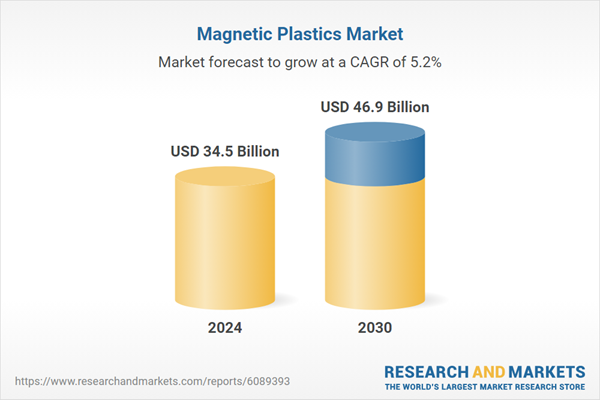

The Growth in the Magnetic Plastics Market Is Driven by Several Factors…

The growth in the magnetic plastics market is driven by several factors including the miniaturization of electronic devices, the shift toward electric mobility, and increasing demand for lightweight magnetic components across automotive and industrial systems. The rapid expansion of electric motors in EVs, e-bikes, and drones is pushing OEMs to adopt polymer-bonded magnets that can be customized for performance and integrated into space-constrained architectures. Additionally, advancements in polymer science and magnetic filler engineering are enabling broader thermal, mechanical, and magnetic tuning, opening new application frontiers in sensors, actuators, and medical diagnostics.The rise of automated manufacturing and smart factories is further increasing the need for compact, reliable sensors and encoders, where magnetic plastics offer precision and design freedom. Moreover, the proliferation of IoT devices and wearables is creating demand for lightweight, corrosion-resistant magnetic materials that can support continuous operation in diverse environments. Regulatory pressure to reduce the use of heavy metals and hazardous materials is also favoring the use of thermoplastic magnetic composites over traditional sintered magnets. As additive manufacturing of functional materials matures, magnetic plastics are likely to become a mainstream solution in both prototyping and series production across a variety of high-tech sectors.

Report Scope

The report analyzes the Magnetic Plastics market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Material (Ferrous Bonded, Neodymium Iron Boron Bonded); End-Use (Food, Electrical & Electronics, Medical, Automotive, Aerospace, Construction, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Ferrous Bonded Material segment, which is expected to reach US$29.2 Billion by 2030 with a CAGR of a 4.1%. The Neodymium Iron Boron Bonded Material segment is also set to grow at 7.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $9.4 Billion in 2024, and China, forecasted to grow at an impressive 8.1% CAGR to reach $9.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Magnetic Plastics Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Magnetic Plastics Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Magnetic Plastics Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Agile Setu Mobility Private Limited, Alstom, American Maglev Technology Inc., Bharat Heavy Electricals Ltd (BHEL), Central Japan Railway Company (JR Central) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Magnetic Plastics market report include:

- 3M Company

- Adams Magnetic Products Co.

- ALL Magnetics Inc.

- Arnold Magnetic Technologies

- BASF SE

- Bunting Magnetics Co.

- Eclipse Magnetics

- Hengdian Group DMEGC Magnetics Co. Ltd

- INGENIERÍA MAGNETICA APLICADA SLU

- Kolektor Magnet Technology GmbH

- Magma Magnetic Technologies

- Magnum Magnetics

- MS-Schramberg GmbH & Co. KG

- OM Group

- Sura Magnets AB

- Tengye Magnetic Materials Co., Ltd.

- ThyssenKrupp AG

- VACUUMSCHMELZE GmbH & Co. KG

- Voestalpine High Performance Metals GmbH

- Yantai Shougang Magnetic Materials Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Company

- Adams Magnetic Products Co.

- ALL Magnetics Inc.

- Arnold Magnetic Technologies

- BASF SE

- Bunting Magnetics Co.

- Eclipse Magnetics

- Hengdian Group DMEGC Magnetics Co. Ltd

- INGENIERÍA MAGNETICA APLICADA SLU

- Kolektor Magnet Technology GmbH

- Magma Magnetic Technologies

- Magnum Magnetics

- MS-Schramberg GmbH & Co. KG

- OM Group

- Sura Magnets AB

- Tengye Magnetic Materials Co., Ltd.

- ThyssenKrupp AG

- VACUUMSCHMELZE GmbH & Co. KG

- Voestalpine High Performance Metals GmbH

- Yantai Shougang Magnetic Materials Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 217 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 34.5 Billion |

| Forecasted Market Value ( USD | $ 46.9 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |