Global LED Tube Lights Market - Key Trends & Drivers Summarized

Why Are LED Tube Lights Leading the Transition to Sustainable Illumination?

LED tube lights are at the forefront of global lighting transformation, offering an energy-efficient, long-lasting alternative to traditional fluorescent tubes. They are widely adopted in commercial buildings, schools, hospitals, factories, parking lots, and increasingly in residential settings due to their superior lumens-per-watt output, instant-on functionality, and minimal heat generation. Their significantly lower energy consumption - up to 50% less than conventional fluorescent lighting - translates into reduced operational costs and carbon footprint, making them central to sustainable building design and green retrofitting initiatives.Governments, facility managers, and consumers alike are replacing legacy lighting systems with LED tubes to comply with energy-efficiency mandates, improve indoor visual comfort, and reduce maintenance frequency. LED tubes also offer advantages such as flicker-free illumination, higher color rendering indexes (CRI), and the absence of hazardous materials like mercury, which is found in fluorescent tubes. These attributes make them highly suitable for environments where visual clarity and safety are paramount, such as hospitals, educational institutions, and manufacturing floors.

How Are Product Innovations Driving Performance, Integration, and Market Reach?

Technological advancements have drastically improved LED tube performance, longevity, and compatibility. Today's LED tubes come in various types - Type A (ballast-compatible), Type B (ballast-bypass), Type C (external driver), and hybrid models - offering flexibility for both retrofit and new installations. Integrated smart features, such as motion sensors, daylight harvesting, dimming capabilities, and wireless connectivity, are increasingly being built into LED tube designs, enabling smart lighting networks in offices, warehouses, and retail environments.Thermal management and optical engineering have also advanced significantly, allowing for higher lumen output without increasing fixture size or energy use. High-efficacy LED chips, improved phosphor coatings, and polycarbonate-aluminum housings are enhancing durability and light distribution. Additionally, circular economy principles are being incorporated into design, with modular and recyclable components gaining favor in public procurement and environmentally focused projects. These innovations are not only enhancing product performance but also reducing total cost of ownership for large-scale users.

What Trends Are Influencing Adoption Across Commercial and Industrial Sectors?

The global shift toward energy-efficient building systems is a major trend influencing LED tube light adoption. Commercial office buildings, retail chains, schools, and healthcare facilities are upgrading to LED lighting to meet energy codes, improve occupant comfort, and lower electricity bills. Industrial sectors - such as logistics centers, production floors, and cold storage facilities - are transitioning to LED tubes for their robust performance in varying temperatures and their low maintenance needs. Moreover, the rapid growth of smart cities is driving investment in connected lighting systems, where LED tubes with embedded control technologies are a core infrastructure element.Retailers and manufacturers are also responding to increasing consumer demand for environmentally responsible products. LED tubes with certifications such as Energy Star, DLC, and RoHS compliance are becoming standard offerings in both B2B and B2C channels. The education and public sector - guided by energy-efficiency mandates and budget optimization goals - continue to be strong adopters, often leveraging government subsidies to implement large-scale retrofits. These trends are expected to accelerate as LED tubes become more affordable and integrated with IoT-based building management systems.

What Is Fueling the Global Growth of the LED Tube Lights Market?

The growth in the LED tube lights market is driven by several factors rooted in energy conservation, regulatory compliance, and lighting system modernization. Foremost is the global drive to reduce electricity consumption and greenhouse gas emissions, which has placed LED lighting at the center of energy transition policies in both developed and emerging economies. Retrofitting programs supported by government incentives and utility rebates are expanding market penetration in public infrastructure, educational institutions, and housing complexes.Rapid urbanization and the digitization of building systems are also promoting the shift to intelligent lighting, with LED tubes offering a flexible platform for smart upgrades. Advancements in component efficiency, design versatility, and price competitiveness are enabling wider adoption even in cost-sensitive regions. Furthermore, the phasing out of fluorescent lighting in regions like the EU and North America - due to environmental regulations and disposal concerns - is creating a replacement demand that LED tubes are ideally positioned to fulfill. These factors, combined with heightened awareness of lifecycle costs and sustainability goals, are underpinning the global acceleration of LED tube light adoption.

Report Scope

The report analyzes the LED Tube Lights market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Tube Type (T5, T8, T12, Other Tube Types); Application (Residential, Commercial).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the T5 Tube segment, which is expected to reach US$3.7 Billion by 2030 with a CAGR of a 11.4%. The T8 Tube segment is also set to grow at 7.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.2 Billion in 2024, and China, forecasted to grow at an impressive 13.3% CAGR to reach $1.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global LED Tube Lights Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global LED Tube Lights Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global LED Tube Lights Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M, American Sealants Inc. (ASI), Arkema S.A. (Bostik), Chemence Inc., DAP Global Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this LED Tube Lights market report include:

- Acuity Brands Inc.

- ams OSRAM AG

- Cree Lighting USA LLC

- Eaton Corporation PLC

- Fagerhult Group

- Foshan Electrical and Lighting Co., Ltd.

- GE Lighting (a Savant company)

- Hubbell Incorporated

- Iris Ohyama Inc.

- Jaquar Group

- LEDVANCE GmbH

- LG Electronics Inc.

- Nichia Corporation

- NVC International Holdings Ltd.

- Opple Lighting

- Panasonic Corporation

- Philips Lighting (Signify)

- Surya Roshni Ltd.

- Toggled (Altair Engineering Inc.)

- Zumtobel Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Acuity Brands Inc.

- ams OSRAM AG

- Cree Lighting USA LLC

- Eaton Corporation PLC

- Fagerhult Group

- Foshan Electrical and Lighting Co., Ltd.

- GE Lighting (a Savant company)

- Hubbell Incorporated

- Iris Ohyama Inc.

- Jaquar Group

- LEDVANCE GmbH

- LG Electronics Inc.

- Nichia Corporation

- NVC International Holdings Ltd.

- Opple Lighting

- Panasonic Corporation

- Philips Lighting (Signify)

- Surya Roshni Ltd.

- Toggled (Altair Engineering Inc.)

- Zumtobel Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 281 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

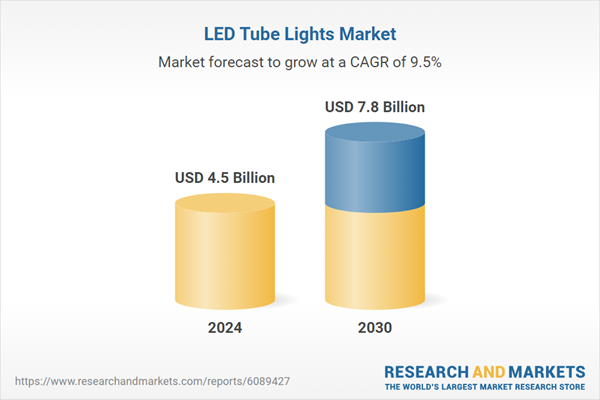

| Estimated Market Value ( USD | $ 4.5 Billion |

| Forecasted Market Value ( USD | $ 7.8 Billion |

| Compound Annual Growth Rate | 9.5% |

| Regions Covered | Global |