Global Intake Filter Media Market - Key Trends & Drivers Summarized

Why Is Intake Filter Media a Critical Component in Engine and HVAC System Performance?

Intake filter media plays a pivotal role in protecting mechanical and air-handling systems by filtering out dust, debris, pollutants, and other airborne particles before they enter sensitive components. These media are used in automotive air intake systems, industrial machinery, HVAC systems, air compressors, and gas turbines, ensuring optimal airflow while safeguarding internal parts from contamination and wear. Without effective intake filtration, systems become vulnerable to reduced efficiency, increased maintenance needs, and premature failure.In automotive applications, intake filter media contributes directly to engine health and fuel efficiency by ensuring clean air delivery to combustion chambers. In HVAC and industrial ventilation, these media support air quality compliance, energy savings, and protection of internal ductwork and heat exchangers. The shift toward higher-efficiency, longer-life, and low-restriction filter media has made their selection a key performance parameter in both consumer and industrial equipment design. As regulatory standards for emissions, indoor air quality, and equipment durability grow more stringent, intake filter media is becoming more integral to system design and compliance strategies.

What Innovations Are Advancing the Capabilities of Intake Filter Media?

The intake filter media market is witnessing rapid innovation in material science, multilayer design, and surface treatment technologies. Traditional cellulose-based media are increasingly being replaced or enhanced with synthetic fibers such as polyester, polypropylene, and fiberglass, which offer superior filtration efficiency, moisture resistance, and durability. Advanced media types now incorporate nanofibers, melt-blown layers, and electrostatically charged structures to capture finer particles while maintaining low airflow resistance.Multilayer composites with gradient density designs are becoming popular for their ability to trap a broader range of particle sizes, extending service life and reducing pressure drop. Anti-microbial treatments, self-cleaning coatings, and hydrophobic properties are also being introduced to improve hygiene, longevity, and resistance to harsh operating conditions. In automotive applications, pleatable high-flow filter media with low restriction and high dust-holding capacity are helping meet increasing demands for fuel economy and low emissions. Additionally, the integration of smart sensors and predictive maintenance tools is enabling performance monitoring and timely replacement, further increasing system reliability and operational uptime.

Which Sectors and Applications Are Driving Demand for Advanced Intake Filter Media?

The automotive industry is the largest consumer of intake filter media, particularly in internal combustion engine vehicles, where engine air filters are critical to performance and emission control. As vehicle emission standards tighten globally, OEMs and aftermarket suppliers are investing in higher-efficiency media to meet evolving particulate filtration requirements. The rise of hybrid and plug-in hybrid vehicles - many of which still use internal combustion engines - continues to support demand for automotive air intake filtration.Beyond automotive, industrial sectors such as manufacturing, energy, and construction use intake filter media in compressors, blowers, turbines, and ventilation systems to prevent fouling, corrosion, and performance degradation. HVAC systems in commercial buildings, cleanrooms, and data centers require high-performance intake filters to maintain indoor air quality and protect downstream systems. The agricultural, marine, and mining industries also rely on rugged, high-dust-capacity filter media to operate reliably in extreme environments. The growth of distributed power generation and remote microgrids is further increasing demand for compact and efficient intake filtration in gas engines and generator sets.

The Growth in the Intake Filter Media Market Is Driven by Several Factors…

The growth in the intake filter media market is driven by several factors including increased focus on energy efficiency, emission control regulations, and rising equipment durability standards across industries. In the automotive sector, regulatory mandates to reduce particulate emissions and improve air-fuel ratios are fueling innovation in engine air filtration. As OEMs design vehicles for longer maintenance intervals and higher operational reliability, demand for long-life, high-efficiency filter media is accelerating.In industrial and HVAC applications, growing concerns around environmental air quality, occupational health, and system uptime are promoting the use of more advanced and sustainable filter materials. The transition to synthetic and composite media, along with digital monitoring for filter performance, is improving filtration outcomes while lowering operating costs. Furthermore, as infrastructure expands in emerging markets and energy-efficient building design becomes a priority worldwide, the role of intake filter media in protecting high-value assets and reducing energy consumption will continue to grow. This market is positioned for sustained demand as air quality, operational resilience, and regulatory compliance become core considerations in system design and lifecycle management.

Report Scope

The report analyzes the Intake Filter Media market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Filter Media (Cellulose Filter Media, Synthetic Filter Media); Mode (Off Road, On Road); Application (Automotive, Aerospace, Marine, Other Applications); End-Use (Passenger Cars, Commercial Vehicles, Construction Equipment, Marine Vessels, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Cellulose Filter Media segment, which is expected to reach US$3.7 Billion by 2030 with a CAGR of a 2.1%. The Synthetic Filter Media segment is also set to grow at 3.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.4 Billion in 2024, and China, forecasted to grow at an impressive 5.1% CAGR to reach $1.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Intake Filter Media Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Intake Filter Media Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Intake Filter Media Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Amsive, Bird Marketing, Blue Valley Marketing, Codedesign, Convirtue and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 33 companies featured in this Intake Filter Media market report include:

- Ahlstrom-Munksjö

- Air Filters, Inc.

- Americo Manufacturing Company

- Camfil

- Donaldson Company, Inc.

- EFS Media Wraps & Accessories

- Fibertex Nonwovens

- Filtura® by Freudenberg Performance Materials

- GESSNER Filtration

- Guangzhou Clair Filtech Co., Ltd.

- Hollingsworth & Vose Company

- Koch Filter

- MANN+HUMMEL

- Micronics, Inc.

- Permatron

- Precision Filtration Products

- Tex-Air Filters

- Vitto Filter (Zhongshan) Co., Ltd.

- Wuxi Yusheng Filter Media Co., Ltd.

- ZHONGSHAN VITTO FILTER CO., LTD.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ahlstrom-Munksjö

- Air Filters, Inc.

- Americo Manufacturing Company

- Camfil

- Donaldson Company, Inc.

- EFS Media Wraps & Accessories

- Fibertex Nonwovens

- Filtura® by Freudenberg Performance Materials

- GESSNER Filtration

- Guangzhou Clair Filtech Co., Ltd.

- Hollingsworth & Vose Company

- Koch Filter

- MANN+HUMMEL

- Micronics, Inc.

- Permatron

- Precision Filtration Products

- Tex-Air Filters

- Vitto Filter (Zhongshan) Co., Ltd.

- Wuxi Yusheng Filter Media Co., Ltd.

- ZHONGSHAN VITTO FILTER CO., LTD.

Table Information

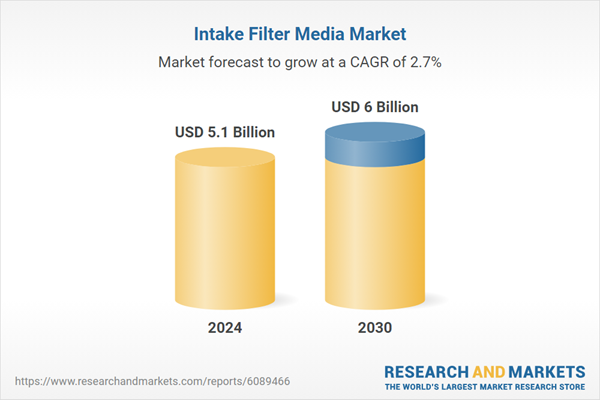

| Report Attribute | Details |

|---|---|

| No. of Pages | 465 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.1 Billion |

| Forecasted Market Value ( USD | $ 6 Billion |

| Compound Annual Growth Rate | 2.7% |

| Regions Covered | Global |