Global Industrial Tank Cleaning Market - Key Trends & Drivers Summarized

Why Is Industrial Tank Cleaning Critical to Operational Safety and Product Quality?

Industrial tank cleaning is a vital process for ensuring the safety, efficiency, and longevity of storage and process tanks used across a broad spectrum of industries including oil & gas, chemicals, food & beverage, pharmaceuticals, water treatment, and power generation. Tanks often hold volatile, corrosive, or sensitive materials - ranging from crude oil and acids to dairy and pharmaceuticals - that leave behind residues, sediments, or biofilms over time. Regular cleaning is essential to prevent contamination, microbial growth, corrosion, product degradation, and safety hazards such as vapor ignition or tank wall weakening.Failure to clean tanks periodically can lead to serious operational risks including product cross-contamination, equipment failure, inaccurate volume measurements, and regulatory violations. In industries such as food production or pharma manufacturing, where hygiene and purity are critical, tank cleaning is tightly governed by stringent compliance standards. In energy and petrochemical sectors, cleaning is a prerequisite for tank inspection, maintenance, or turnaround shutdowns. This widespread and recurring need positions tank cleaning services and technologies as indispensable elements of industrial maintenance programs.

What Technological Innovations Are Optimizing Efficiency and Safety in Tank Cleaning?

The industrial tank cleaning landscape has been transformed by innovations focused on automation, safety, and waste minimization. A significant trend is the increased adoption of non-entry or “manless” cleaning systems, which eliminate the need for human entry into confined spaces - thereby reducing labor risk and improving turnaround times. These systems include automated spray balls, rotating jet heads, and robotic tank cleaners that deliver high-pressure cleaning fluids in precisely targeted spray patterns to remove stubborn residues from tank walls and floors.Advanced monitoring and control systems are also being integrated to track cleaning effectiveness in real time, optimizing water usage, cleaning cycle durations, and chemical dosing. Programmable logic controllers (PLCs), wireless sensors, and digital analytics tools now allow operators to adjust flow rates, pressure levels, and nozzle angles for specific tank geometries and residue types. In sectors handling hazardous substances, closed-loop cleaning systems are increasingly used to recover and treat wash fluids, reducing environmental discharge and chemical exposure. Additionally, new cleaning chemistries - such as biodegradable solvents and foam-based agents - are gaining traction for their environmental compatibility and efficacy in degreasing and decontamination.

Which Industries Are Driving the Expansion of Specialized Tank Cleaning Services?

The demand for industrial tank cleaning services is expanding rapidly across industries where bulk storage and processing tanks are integral to daily operations. In the oil & gas industry, tank cleaning is essential for crude oil storage, fuel terminals, sludge removal, and tank decommissioning. Turnarounds and refinery maintenance cycles often involve extensive tank cleaning operations under strict timelines and safety protocols. Chemical manufacturers rely on high-precision tank cleaning to prevent cross-contamination, especially when switching between reactive or hazardous compounds.The food and beverage sector uses tank cleaning extensively in dairy plants, breweries, and edible oil refineries, where hygienic conditions must be continuously maintained. Similarly, pharmaceutical producers operate under rigorous regulatory scrutiny and require cleaning validation to maintain Good Manufacturing Practice (GMP) compliance. Power plants, wastewater treatment facilities, and pulp & paper operations also require routine tank cleaning for ash slurry tanks, chemical feed tanks, and black liquor tanks to maintain system integrity and performance. Increasing demand from agriculture, marine transport, and storage terminal operators is further diversifying the tank cleaning market's end-user base.

The Growth in the Industrial Tank Cleaning Market Is Driven by Several Factors…

The growth in the industrial tank cleaning market is driven by several factors tied to regulatory compliance, environmental sustainability, and operational risk reduction. Increasing enforcement of worker safety laws and environmental regulations is compelling industries to adopt automated and closed-loop cleaning systems that minimize manual entry and wastewater discharge. Rising concerns over product quality, contamination, and equipment failure are pushing asset owners to invest in preventive cleaning and maintenance as part of broader asset management strategies.Technological advancements in robotics, nozzle design, and process automation are making tank cleaning faster, safer, and more cost-effective - supporting adoption in high-throughput, time-sensitive operations. The trend toward digital plant management and smart maintenance is also boosting demand for sensor-enabled systems that allow condition-based cleaning rather than fixed schedules, reducing water, energy, and chemical consumption. Moreover, the growth of industries reliant on bulk liquid storage - such as biofuels, specialty chemicals, and beverages - is steadily expanding the addressable market. As industries strive to improve efficiency, uptime, and sustainability, industrial tank cleaning is poised to remain a critical service area with rising strategic importance.

Report Scope

The report analyzes the Industrial Tank Cleaning market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Service Type (Wet Cleaning, Dry Cleaning, Chemical Cleaning, Vacuum Cleaning); Operation Mode (Manual Cleaning, Automated Cleaning, Semi-Automated Cleaning); Tank Type (Aboveground Storage Tanks, Underground Storage Tanks, Tank Trucks, Railcars, ISO Containers); End-Use (Oil & Gas, Chemicals, Pharmaceuticals, Food & Beverages, Manufacturing, Transportation).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Wet Cleaning segment, which is expected to reach US$609.9 Million by 2030 with a CAGR of a 2.8%. The Dry Cleaning segment is also set to grow at 1.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $324.4 Million in 2024, and China, forecasted to grow at an impressive 4.5% CAGR to reach $259.9 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Industrial Tank Cleaning Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Industrial Tank Cleaning Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Industrial Tank Cleaning Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alfa Laval AB, Atlas Copco AB, Baker Hughes, Doosan Group, Emerson Electric Co. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Industrial Tank Cleaning market report include:

- Al Barr Facilities Management

- Alfa Laval

- ARKOIL Technologies

- Bioclean Jetting Ltd

- China Oil HBP

- Clean Harbors

- Dulsco LLC

- Ecolab Inc.

- GEA Group

- GFL Environmental

- Harbors

- HydroChemPSC

- Jereh Group

- K2 Industrial Services

- Mantank Environmental Services

- National Response Corporation

- Orbijet

- Republic Services

- Scanjet Group

- Tradebe Environmental Services

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Al Barr Facilities Management

- Alfa Laval

- ARKOIL Technologies

- Bioclean Jetting Ltd

- China Oil HBP

- Clean Harbors

- Dulsco LLC

- Ecolab Inc.

- GEA Group

- GFL Environmental

- Harbors

- HydroChemPSC

- Jereh Group

- K2 Industrial Services

- Mantank Environmental Services

- National Response Corporation

- Orbijet

- Republic Services

- Scanjet Group

- Tradebe Environmental Services

Table Information

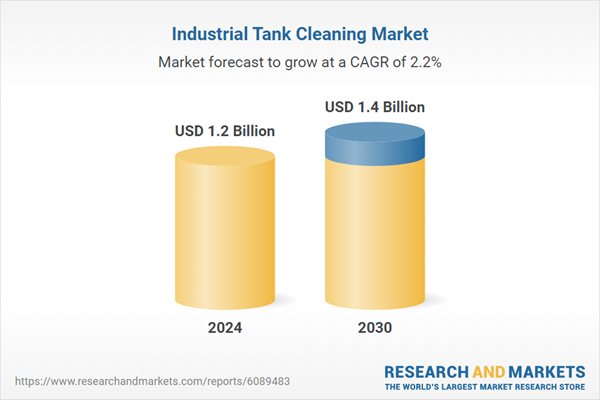

| Report Attribute | Details |

|---|---|

| No. of Pages | 481 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.2 Billion |

| Forecasted Market Value ( USD | $ 1.4 Billion |

| Compound Annual Growth Rate | 2.2% |

| Regions Covered | Global |