Global Industrial Static Equipment Market - Key Trends & Drivers Summarized

Why Is Static Equipment Indispensable in Industrial Processing and Infrastructure?

Industrial static equipment refers to non-moving, fixed mechanical components that are fundamental to the operation of plants and systems in sectors such as oil & gas, power generation, chemical processing, water treatment, and manufacturing. These include pressure vessels, heat exchangers, storage tanks, boilers, columns, separators, and piping systems. Despite the absence of moving parts, static equipment performs critical roles in containing, transferring, or transforming substances under extreme pressure, temperature, and chemical conditions.The reliability and structural integrity of static equipment are vital for process continuity, safety, and regulatory compliance. These components are typically custom-engineered based on fluid properties, environmental conditions, and process requirements. Their long operational life and high capital value make maintenance, inspection, and performance monitoring integral to plant efficiency. As industries modernize and expand into harsher operating environments, the strategic importance of advanced, corrosion-resistant, and high-pressure-rated static equipment continues to rise.

What Technological Advancements Are Enhancing the Design and Functionality of Static Equipment?

Static equipment design has undergone significant innovation driven by materials science, fabrication techniques, and digital engineering tools. The use of advanced alloys, such as duplex stainless steel, Inconel, and titanium, is enabling longer service life and higher resistance to corrosion, hydrogen embrittlement, and high-temperature creep. These materials are increasingly deployed in refineries, offshore rigs, and chemical plants where conventional steels fail under prolonged exposure to aggressive substances.Finite element analysis (FEA), computational fluid dynamics (CFD), and 3D modeling are now standard in equipment design, allowing for optimized geometry, better stress distribution, and efficient thermal management. Weld overlay cladding, robotic welding, and automated surface treatment technologies are improving the manufacturing precision and durability of pressure-bound components. On the operational side, smart sensors and condition-monitoring systems are being integrated into static equipment for real-time performance tracking, early failure detection, and predictive maintenance - marking a shift toward digitalized asset management.

Which Industrial Sectors Are Driving Demand for Advanced Static Equipment?

Oil & gas remains one of the largest consumers of static equipment, with upstream, midstream, and downstream operations relying heavily on vessels, heat exchangers, and separators for fluid handling, refining, and petrochemical conversion. Power generation - particularly in thermal, nuclear, and renewable plants - utilizes boilers, condensers, steam drums, and auxiliary vessels to maintain energy flow and heat recovery. The chemical and fertilizer industries depend on corrosion-resistant reactors, columns, and storage tanks for continuous processing under aggressive chemical loads.The water and wastewater treatment sectors also represent a growing market for static equipment, including clarifiers, digesters, and membrane housings. Additionally, food and beverage manufacturing, pharmaceuticals, and pulp & paper industries use custom-fabricated static equipment for sterilization, mixing, and containment of process fluids. Infrastructure development projects, such as LNG terminals, desalination plants, and hydrogen production facilities, are further boosting demand for high-performance static equipment that complies with stringent safety and environmental regulations.

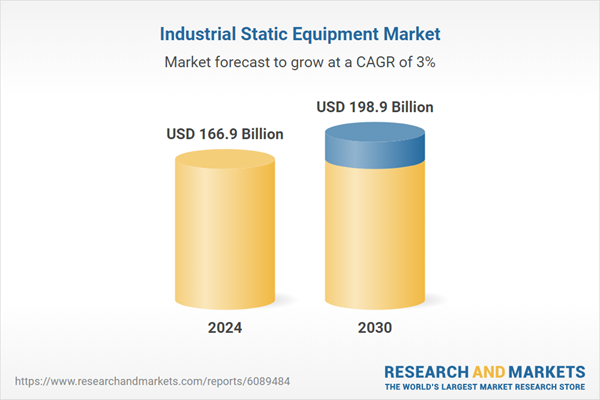

The Growth in the Industrial Static Equipment Market Is Driven by Several Factors…

The growth in the industrial static equipment market is driven by several factors, including the global expansion of energy infrastructure, modernization of process plants, and rising emphasis on operational reliability. As developing regions invest in refining capacity, petrochemical complexes, and power generation, the demand for large-diameter vessels, heat exchangers, and high-capacity tanks is increasing. Simultaneously, aging infrastructure in mature economies is undergoing replacement and retrofitting, requiring next-generation materials and digital asset management systems.Stricter safety, emission, and performance standards are compelling industries to adopt advanced static equipment that meets international codes and certifications. Innovations in modular construction, skid-mounted units, and pre-fabricated assemblies are shortening installation times and enhancing scalability in remote or space-constrained environments. The rising focus on sustainability and circular design is also encouraging the use of recyclable materials, energy-efficient insulation, and equipment lifecycle monitoring. As industries continue to balance cost control, asset durability, and environmental stewardship, static equipment will remain a foundational pillar in global industrial operations.

Report Scope

The report analyzes the Industrial Static Equipment market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Valves, Furnaces / Boilers, Heat Exchangers, Pressure Vessels); End-Use (Oil & Gas, Power Generation, Chemicals & Petrochemicals, Water & Wastewater, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Valves segment, which is expected to reach US$95.5 Billion by 2030 with a CAGR of a 4%. The Furnaces / Boilers segment is also set to grow at 2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $45.5 Billion in 2024, and China, forecasted to grow at an impressive 5.8% CAGR to reach $39.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Industrial Static Equipment Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Industrial Static Equipment Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Industrial Static Equipment Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Canfor Corporation, Collins Companies, Deltic Timber Corporation, Georgia-Pacific LLC, Green Diamond Resource Company and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 39 companies featured in this Industrial Static Equipment market report include:

- Alfa Laval AB

- Atlas Copco AB

- Baker Hughes

- Doosan Group

- Emerson Electric Co.

- Flowserve Corporation

- Fraser Anti-Static Techniques Ltd.

- General Electric Company (GE)

- Henkel AG & Co. KGaA

- Hyosung Heavy Industries Corporation

- IDEX Corporation

- Ingersoll Rand Inc.

- KSB SE & Co. KGaA

- Mitsubishi Heavy Industries, Ltd.

- Pentair plc

- Sulzer Ltd.

- TechnipFMC

- Wartsila Oyj Abp

- Weir Group PLC

- Ziegler Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alfa Laval AB

- Atlas Copco AB

- Baker Hughes

- Doosan Group

- Emerson Electric Co.

- Flowserve Corporation

- Fraser Anti-Static Techniques Ltd.

- General Electric Company (GE)

- Henkel AG & Co. KGaA

- Hyosung Heavy Industries Corporation

- IDEX Corporation

- Ingersoll Rand Inc.

- KSB SE & Co. KGaA

- Mitsubishi Heavy Industries, Ltd.

- Pentair plc

- Sulzer Ltd.

- TechnipFMC

- Wartsila Oyj Abp

- Weir Group PLC

- Ziegler Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 285 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 166.9 Billion |

| Forecasted Market Value ( USD | $ 198.9 Billion |

| Compound Annual Growth Rate | 3.0% |

| Regions Covered | Global |