Global Industrial Mainboards Market - Key Trends & Drivers Summarized

Why Are Industrial Mainboards Essential in Mission-Critical Applications Across Modern Industries?

Industrial mainboards - also referred to as industrial motherboards - serve as the central hub for processing and communication in rugged, mission-critical systems deployed across manufacturing, transportation, energy, defense, and healthcare. Unlike consumer-grade PC motherboards, industrial mainboards are engineered for long lifecycle support, extended temperature ranges, high vibration tolerance, and 24/7 operational reliability. They are the backbone of embedded systems that drive factory automation, robotics, human-machine interfaces (HMIs), point-of-sale terminals, surveillance systems, and industrial Internet of Things (IIoT) devices.These mainboards are designed with standardized form factors (such as Mini-ITX, ATX, microATX, and 3.5-inch SBCs) to enable seamless integration into compact enclosures and panel PCs. They also feature enhanced connectivity options - ranging from legacy I/O (serial, parallel, PS/2) to high-speed modern interfaces like USB 3.x, PCIe, Gigabit Ethernet, and M.2 - enabling flexible interoperability with both old and new industrial equipment. As industries accelerate digital transformation and adopt smart technologies, industrial mainboards are becoming the nerve center for edge computing, real-time monitoring, and intelligent automation systems.

What Technological Advancements Are Reshaping the Design and Performance of Industrial Mainboards?

The industrial mainboards market is evolving rapidly due to advances in CPU architectures, integrated graphics, board-level ruggedization, and industrial communication protocols. One of the most notable trends is the adoption of high-performance yet energy-efficient processors - from Intel® Atom, Core™, and Xeon® to AMD Ryzen™ Embedded and ARM-based SoCs. These processors support complex workloads such as AI inference, real-time data analytics, and machine vision while maintaining low power consumption and fanless cooling capabilities.Thermal and environmental resilience is another area of innovation. Many industrial mainboards are now engineered for wide operating temperature ranges (-40°C to +85°C), high electromagnetic compatibility (EMC), and resistance to shock and vibration. Conformal coating, solid capacitors, and wide-voltage input support are becoming standard in applications involving harsh or mobile environments such as locomotives, mining equipment, or field-deployed military systems. Additionally, built-in TPM (Trusted Platform Module) chips and secure boot functions are enhancing cybersecurity for IIoT deployments. The integration of AI accelerators, FPGA modules, and 5G modems is also expanding mainboard functionality in edge AI and remote connectivity scenarios.

Which Industrial Segments Are Driving Demand for Advanced Mainboard Solutions?

A wide array of industrial sectors is fueling demand for robust and application-specific mainboards. In manufacturing and factory automation, mainboards power machine controllers, industrial PCs, and HMIs that manage production lines, SCADA systems, and robotics. In transportation and logistics, they are deployed in vehicle control units, digital signage, automated ticketing, and fleet management systems. The energy and utilities sectors rely on industrial mainboards for monitoring and control systems in substations, smart grids, wind farms, and solar installations, where reliability under extreme conditions is essential.In medical equipment, mainboards support diagnostic imaging, patient monitoring, and laboratory automation systems where real-time data processing and fail-safe operation are critical. Defense and aerospace applications use rugged mainboards in command-and-control systems, radar units, and unmanned vehicles, where environmental hardening and data security are paramount. The rise of AI-based inspection systems, autonomous mobile robots, and smart retail kiosks is further broadening the adoption of industrial-grade mainboards that can handle edge analytics, high-speed networking, and real-time video processing.

The Growth in the Industrial Mainboards Market Is Driven by Several Factors…

The growth in the industrial mainboards market is driven by several factors related to automation expansion, edge computing adoption, and the evolution of connected industrial systems. The increasing demand for real-time data collection, machine intelligence, and digital control in operational environments is fueling the need for mainboards with high processing power, long product lifecycles, and broad connectivity options. The shift from centralized computing to edge-based processing in smart factories and critical infrastructure is further accelerating mainboard integration into autonomous systems and distributed control networks.Standardization and modularization of industrial computing platforms are also enabling easier system upgrades and reducing design-to-deployment time, making mainboards more appealing for OEMs and system integrators. The growth of IIoT ecosystems, combined with the availability of AI-optimized embedded chipsets, is enhancing the value proposition of mainboards capable of supporting predictive maintenance, quality assurance, and safety automation. Additionally, regulatory compliance with industry-specific standards (EN 50155 for railways, IEC 60601-1 for medical devices, MIL-STD-810 for defense) is driving demand for ruggedized and certified mainboards. As industrial digitization continues to advance, the market for industrial mainboards will remain a foundational element of the smart, connected industrial future.

Report Scope

The report analyzes the Industrial Mainboards market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (ATX, Mini ITX, Micro ATX, Other Types); Component (CPU, GPU, Chipset, Memory); Application (Building Automation, Manufacturing, Military Application, Security & Surveillance, Factory Automation, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the ATX segment, which is expected to reach US$1.3 Billion by 2030 with a CAGR of a 4.9%. The Mini ITX segment is also set to grow at 2.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $529.5 Million in 2024, and China, forecasted to grow at an impressive 7.4% CAGR to reach $499.6 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Industrial Mainboards Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Industrial Mainboards Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Industrial Mainboards Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

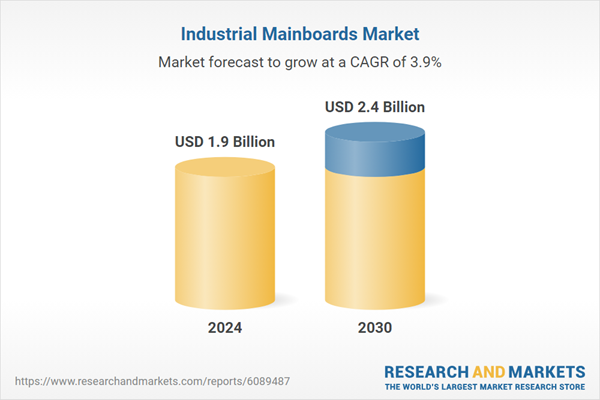

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Air Liquide, Air Products and Chemicals, Inc., Airgas, Inc., BelGas (Marsh Bellofram), Burkert Fluid Control Systems and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Industrial Mainboards market report include:

- AAEON Technology Inc.

- Advantech Co., Ltd.

- ASRock Industrial Computer Corporation

- ASUS IoT

- Avalue Technology Inc.

- Biostar Group

- Contec Co., Ltd.

- DFI Inc.

- Fujitsu Technology Solutions Ltd.

- Gigabyte Technology Co., Ltd.

- Intel Corporation

- Kontron AG

- Lanner Electronics Inc.

- MSI Technology Inc.

- Portwell Inc.

- Shenzhen Piesia Electronic Technology Co., Ltd.

- Super Micro Computer, Inc.

- Tyan Computer Corporation

- ZOTAC Technology Limited

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AAEON Technology Inc.

- Advantech Co., Ltd.

- ASRock Industrial Computer Corporation

- ASUS IoT

- Avalue Technology Inc.

- Biostar Group

- Contec Co., Ltd.

- DFI Inc.

- Fujitsu Technology Solutions Ltd.

- Gigabyte Technology Co., Ltd.

- Intel Corporation

- Kontron AG

- Lanner Electronics Inc.

- MSI Technology Inc.

- Portwell Inc.

- Shenzhen Piesia Electronic Technology Co., Ltd.

- Super Micro Computer, Inc.

- Tyan Computer Corporation

- ZOTAC Technology Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 384 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.9 Billion |

| Forecasted Market Value ( USD | $ 2.4 Billion |

| Compound Annual Growth Rate | 3.9% |

| Regions Covered | Global |