Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Rising Energy Demand Across Asia-Pacific

Accelerated economic growth, expanding urban populations, and rapid industrialization are significantly increasing energy consumption across the Asia-Pacific region. Nations such as China and India lead the global growth in energy demand, which necessitates extensive midstream infrastructure to facilitate reliable fuel transport and storage. Countries are actively expanding gas pipeline networks and LNG regasification terminals to meet domestic and industrial needs. China’s expanding pipeline grid and India’s national gas grid and strategic reserves exemplify the regional push to strengthen midstream logistics and ensure uninterrupted fuel supply. This demand is directly translating into heightened investment and development across midstream systems to support energy accessibility and long-term sustainability.Key Market Challenges

High Capital and Operational Costs

The construction and maintenance of midstream infrastructure - such as pipelines and LNG terminals - require high capital expenditure, particularly in geographically diverse or remote regions. Developing economies in the region often face difficulties securing financing for such large-scale projects. Offshore projects and advanced LNG storage facilities further inflate costs due to complex engineering requirements and safety standards. Cost overruns and funding shortfalls have led to delays or cancellations of midstream projects in Southeast Asia, impeding regional energy integration and limiting access to cleaner fuel alternatives. Additionally, long project timelines and uncertain returns on investment, compounded by commodity price fluctuations, deter private investment and slow infrastructure growth.Key Market Trends

Expansion of Cross-Border and Regional Energy Connectivity

Governments across Asia-Pacific are emphasizing interconnected midstream systems through cross-border pipeline networks and LNG infrastructure to boost energy trade and regional cooperation. Projects like the Trans ASEAN Gas Pipeline (TAGP) and China-Myanmar Oil and Gas Pipeline exemplify this trend, offering strategic bypasses and improved fuel flow across multiple countries. This integration enhances regional energy security, allows smaller economies to access diversified energy sources, and promotes collaborative resilience to global supply chain disruptions. Additionally, joint ventures and regional agreements are emerging to support shared pipeline infrastructure and regasification capacity, creating new opportunities for midstream service providers and investors.Key Market Players

- Kinder Morgan Inc.

- Enbridge Inc.

- Enterprise Products Partners L.P.

- TransCanada Corporation (now TC Energy)

- Magellan Midstream Partners L.P.

- Plains All American Pipeline L.P.

- Williams Companies Inc.

- Energy Transfer LP

- Phillips 66 Partners L.P.

- ONEOK Inc.

Report Scope

In this report, the Asia-Pacific Oil and Gas Midstream Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Asia-Pacific Oil and Gas Midstream Market, By Technology:

- Pipeline Monitoring Systems

- SCADA Systems

- Control Valves and Actuators

- Leak Detection Systems

- Advanced Metering Infrastructure

Asia-Pacific Oil and Gas Midstream Market, By Product:

- Crude Oil

- Natural Gas

- Liquefied Natural Gas (LNG)

- Refined Petroleum Products

Asia-Pacific Oil and Gas Midstream Market, By Operation:

- Gathering

- Processing

- Transportation

- Storage

- Distribution

Asia-Pacific Oil and Gas Midstream Market, By Country:

- China

- Japan

- India

- South Korea

- Australia

- Singapore

- Thailand

- Malaysia

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Asia-Pacific Oil and Gas Midstream Market.Available Customizations

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Kinder Morgan Inc.

- Enbridge Inc.

- Enterprise Products Partners L.P.

- TransCanada Corporation (now TC Energy)

- Magellan Midstream Partners L.P.

- Plains All American Pipeline L.P.

- Williams Companies Inc.

- Energy Transfer LP

- Phillips 66 Partners L.P

- ONEOK Inc

Table Information

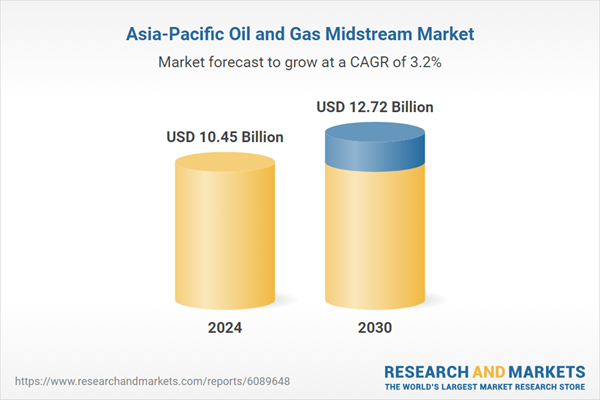

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | May 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 10.45 Billion |

| Forecasted Market Value ( USD | $ 12.72 Billion |

| Compound Annual Growth Rate | 3.1% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 10 |