Speak directly to the analyst to clarify any post sales queries you may have.

The pharmaceutical squalene market is experiencing notable transformation, shaped by advances in drug delivery, a focus on ethical sourcing, and increasing demand from biopharma innovation pipelines. Squalene’s evolving role creates opportunities and challenges for companies seeking growth, compliance, and operational resilience in complex healthcare environments.

Market Snapshot: Pharmaceutical Squalene Market Overview

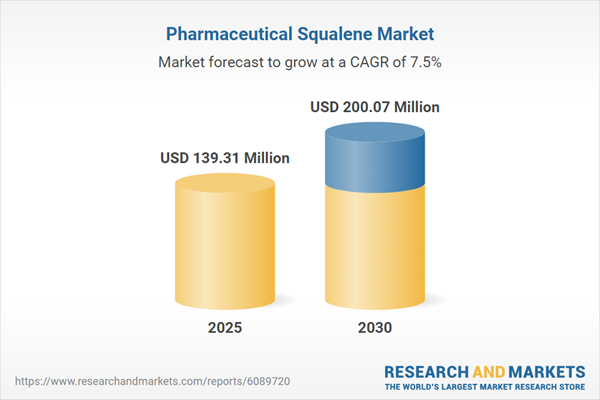

The pharmaceutical squalene market grew from USD 129.85 million in 2024 to USD 139.31 million in 2025 and is projected to reach USD 200.07 million by 2030, expanding at a CAGR of 7.47%. This growth is driven by sustained innovations in drug delivery systems, the need for advanced vaccine adjuvants, and a global focus on reliable and sustainable raw material sourcing.

Scope & Segmentation

This report delivers a comprehensive analysis of the pharmaceutical squalene ecosystem across sources, applications, disease categories, distribution channels, end-users, and regional markets. Key market segmentation includes:

- Source: Animal Derived, Plant Derived (Amaranth Oil, Olive Oil, Rice Bran Oil), Synthetic

- Application: Drug Delivery Emulsions, Vaccines

- Disease Indication: Cancer Therapy, Cardiovascular Agents, Infectious Diseases

- Distribution Channel: Offline, Online

- End-User: Biopharmaceutical Companies, Pharmaceutical Companies

- Region: Americas (United States, Canada, Mexico, Brazil, Argentina, Chile, Colombia, Peru), Europe, Middle East & Africa (United Kingdom, Germany, France, Russia, Italy, Spain, Netherlands, Sweden, Poland, Switzerland, United Arab Emirates, Saudi Arabia, Qatar, Turkey, Israel, South Africa, Nigeria, Egypt, Kenya), Asia-Pacific (China, India, Japan, Australia, South Korea, Indonesia, Thailand, Malaysia, Singapore, Taiwan)

- Companies Covered: Aasha Biochem, Alsiano A/S, Amyris, Inc., BioCatSyn (Shanghai) Biotechnology Co., Ltd., Conscientia Industrial Co., Ltd., Croda International PLC, Empresa Figueirense de Pesca, Lda, Evonik Industries AG, Kishimoto Special Liver Oil Co., Ltd., Kuraray Co., Ltd., Merck KGaA, Otto Chemie Private Limited, Seppic S.A., SOPHIM IBERIA S.L., Spectrum Chemical Mfg. Corp., SynShark, Tokyo Chemical Industry Co., Ltd.

Key Takeaways for Senior Decision-Makers

- Transitioning to plant-derived and synthetic squalene is strengthening supply chain resilience and supporting sustainability goals as the pharmaceutical sector addresses ethical sourcing and regulatory pressure.

- Rising use of advanced technologies, including green chemistry and microbial fermentation, is enhancing purity, traceability, and biocompatibility, setting new standards for quality and consistency.

- Squalene’s expanding utility in drug delivery emulsions and adjuvant systems is making it central to innovative therapies and vaccines, positioning manufacturers for greater relevance in global health initiatives.

- Collaboration among biopharmaceutical firms, supply partners, and ingredient specialists is accelerating market responsiveness and supporting joint advancements in cancer, cardiovascular, and infectious disease treatments.

- Shifts in procurement and sourcing strategies are being guided by evolving tariff landscapes, prompting companies to diversify partnerships and invest in domestic and regional capabilities.

- Diversification across source types and geographic regions remains essential to mitigate disruption risks and meet stringent quality and compliance demands worldwide.

Tariff Impact: Navigating Policy and Supply Chain Adaptation

Adjustments to United States tariff rates have significantly influenced business costs and supplier selection in squalene procurement. Higher duties on animal-derived imports prompted companies to accelerate moves toward alternative sources and form supply agreements with regional and domestic partners. This realignment has led to optimized trade flows and increased upstream investment, safeguarding continuity for pharmaceutical pipelines and fulfilling compliance with sustainability and traceability mandates.

Methodology & Data Sources

Insight was gathered through direct interviews with industry leaders, scientists, and procurement specialists, complemented by a critical review of scientific literature, patents, regulatory reports, and trade data. Triangulating multiple data points ensured accuracy and relevance, while scenario-based analysis assessed policy, technology, and supply trends impacting the market.

Why This Report Matters

- Supports strategic sourcing and innovation by detailing source, application, and regional drivers relevant to pharmaceutical squalene adoption.

- Offers senior leaders actionable intelligence for risk mitigation, technology investment, and partnership selection in a dynamic regulatory environment.

- Facilitates robust planning by mapping changes in supply chain structures, competitive strategies, and compliance obligations.

Conclusion

With demand for pharmaceutical squalene rising, leaders who embrace sustainable sourcing, technological innovation, and supply resilience will secure a strong market position. This report delivers the clarity and direction required to navigate evolving industry complexities and advance strategic objectives.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Pharmaceutical Squalene market report include:- Aasha Biochem

- Alsiano A/S

- Amyris, Inc.

- BioCatSyn (Shanghai) Biotechnology Co., Ltd.

- Conscientia Industrial Co., Ltd.

- Croda International PLC

- Empresa Figueirense de Pesca, Lda

- Evonik Industries AG

- Kishimoto Special Liver Oil Co., Ltd.

- Kuraray Co., Ltd.

- Merck KGaA

- Otto Chemie Private Limited

- Seppic S.A.

- SOPHIM IBERIA S.L.

- Spectrum Chemical Mfg. Corp.

- SynShark

- Tokyo Chemical Industry Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 195 |

| Published | November 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 139.31 Million |

| Forecasted Market Value ( USD | $ 200.07 Million |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 18 |