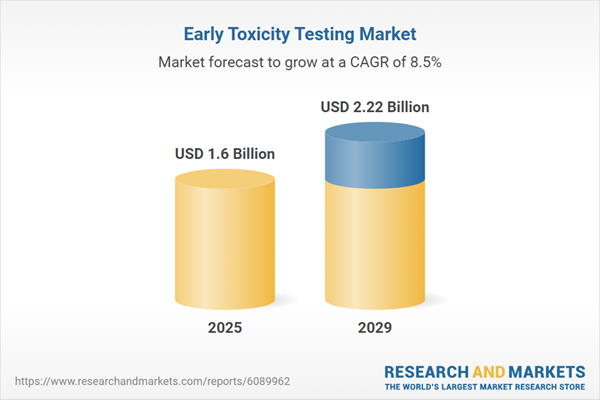

The early toxicity testing market size is expected to see strong growth in the next few years. It will grow to $2.22 billion in 2029 at a compound annual growth rate (CAGR) of 8.5%. The projected growth during the forecast period can be attributed to factors such as increasing regulatory pressure for drug safety, a rising incidence of adverse drug reactions, greater aesthetic consciousness, an increase in early toxicity testing, and heightened awareness of toxicity issues. Key trends expected in this period include the use of in-silico toxicity prediction models, advancements in organ-on-a-chip technology, high-throughput screening (HTS), developments in molecular toxicology, and the use of stem cells in toxicity testing.

The growing emphasis on personalized medicine is expected to drive the growth of the early toxicity testing market. Personalized medicine tailors treatments and healthcare strategies to individual patients based on their unique genetic, environmental, and lifestyle factors. This approach is gaining traction because it allows treatments to be customized to each person’s genetic makeup, which can enhance effectiveness and reduce side effects by ensuring the right drug is given at the right dose. Personalized medicine supports early toxicity testing by using genetic, biomarker, and patient-specific data to predict how individuals will respond to drugs, reducing adverse effects and improving safety assessments. For example, a report from the Personalized Medicine Coalition in February 2024 noted that in 2023, the U.S. FDA approved 16 new personalized treatments for rare diseases, an increase from six in 2022. These new approvals included seven cancer drugs and three treatments for other conditions. Therefore, the rise in personalized medicine is helping drive the growth of the early toxicity testing market.

Companies in the early toxicity testing market are focusing on technological advancements such as ZBEScreen. ZBEScreen utilizes zebrafish embryos for high-throughput early toxicity testing to detect potential harmful effects of substances. For instance, in March 2025, AsedaSciences, a Ghana-based contract research organization, introduced an advanced zebrafish screening service in collaboration with the Tanguay Lab, a U.S.-based research lab specializing in zebrafish toxicology and developmental health. This service uses cutting-edge high-throughput technologies to assess toxicity in real time, offering precise, efficient, and ethical testing of drug and chemical safety while monitoring developmental and behavioral changes.

In September 2024, Scantox Group, a Denmark-based preclinical contract research organization, acquired Gentronix for an undisclosed amount. This acquisition will help Scantox expand its early toxicity testing capabilities by incorporating Gentronix’s expertise in genetic toxicology and predictive safety assessment, which will enhance its services for the pharmaceutical and chemical industries. Gentronix, a UK-based organization, specializes in genetic toxicology testing, with a focus on mutagenicity and genotoxicity.

Major players in the early toxicity testing market are Merck KGaA, Thermo Fisher Scientific, Danaher Corporation, BD bioscience, ICON plc, SGS S.A., Agilent Technologies, Eurofins Scientific, WuXi AppTec., Charles River Laboratories, Charles River Laboratories Edinburgh Ltd., Sigma Aldrich, Bio-rad, Bruker Corporation, Medpace Inc., Evotec AG, PerkinElmer Inc., QPS LLC, Ocimum Biosolutions, Enzo Biochem Inc.

North America was the largest region in the early toxicity testing market in 2024. Aisa-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in early toxicity testing report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa. The countries covered in the early toxicity testing market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Early toxicity testing refers to the initial assessment of a substance’s potential harmful effects before it advances to later stages of development, such as clinical trials or commercial use. This testing is primarily conducted in drug development, chemical safety evaluation, and environmental health studies.

The main types of early toxicity testing include in-vivo, in-vitro, and in-silico. In-vivo testing involves experiments conducted within a living organism, such as animals or humans, to observe biological effects in a natural setting. The various types of toxicity include cytotoxicity, genotoxicity, carcinogenicity, reproductive toxicity, and ecotoxicity, with technologies such as microfluidics, bioinformatics, high-content screening, and 3D cell cultures being used in these evaluations. These tests have diverse applications in drug development, environmental monitoring, cancer research, material testing, and regulatory compliance, and are employed by industries such as pharmaceuticals, food, chemicals, cosmetics, and others.

The early toxicity testing market research report is one of a series of new reports that provides early toxicity testing market statistics, including early toxicity testing industry global market size, regional shares, competitors with an early toxicity testing market share, detailed early toxicity testing market segments, market trends and opportunities, and any further data you may need to thrive in the early toxicity testing industry. This early toxicity testing market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The early toxicity testing market entities by providing services such as hepatotoxicity testing, neurotoxicity testing, and cardiotoxicity testing. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Early Toxicity Testing Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on early toxicity testing market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for early toxicity testing ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The early toxicity testing market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- the market characteristics section of the report defines and explains the market.

- the market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- the forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- the regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- the competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- the trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Type: in-Vivo; in-Vitro; in-Silico2) by Toxicity Type: Cytotoxicity; Genotoxicity; Carcinogenicity; Reproductive Toxicity; Ecotoxicity

3) by Technology: Microfluidics Technology; Bioinformatics; High-Content Screening; 3D Cell Cultures

4) by Application: Drug Development; Environmental Monitoring; Cancer Research; Material Testing; Regulatory Compliance

5) by End User: Pharmaceuticals Industry; Food Industry; Chemicals Industry; Cosmetics Industry; Other End-Users

Sub Segments:

1) by in-Vivo Type: Acute Toxicity Testing; Chronic Toxicity Testing; Carcinogenicity Testing; Developmental & Reproductive Toxicity (DART) Testing; Neurotoxicity Testing2) by in-Vitro Type: Cell-Based Assays; Biochemical Assays; High-Throughput Screening (HTS); 3D Cell Culture Systems; Organ-on-a-Chip Models

3) by in-Silico Type: Computational Toxicology; Predictive Modeling; Quantitative Structure-Activity Relationship (QSAR) Models; Machine Learning-Based Toxicity Prediction; Physiologically Based Pharmacokinetic (PBPK) Modeling

Key Companies Profiled: Merck KGaA; Thermo Fisher Scientific; Danaher Corporation; BD bioscience; ICON plc

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Early Toxicity Testing market report include:- Merck KGaA

- Thermo Fisher Scientific

- Danaher Corporation

- BD bioscience

- ICON plc

- SGS S.A.

- Agilent Technologies

- Eurofins Scientific

- WuXi AppTec.

- Charles River Laboratories

- Charles River Laboratories Edinburgh Ltd.

- Sigma Aldrich

- Bio-rad

- Bruker Corporation

- Medpace Inc.

- Evotec AG

- PerkinElmer Inc.

- QPS LLC

- Ocimum Biosolutions

- Enzo Biochem Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | May 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.6 Billion |

| Forecasted Market Value ( USD | $ 2.22 Billion |

| Compound Annual Growth Rate | 8.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |