Speak directly to the analyst to clarify any post sales queries you may have.

The oral spray pump market is undergoing significant evolution as healthcare systems embrace noninvasive, patient-friendly drug delivery solutions. Senior leaders will find actionable insight here to support strategic planning and sustainable growth.

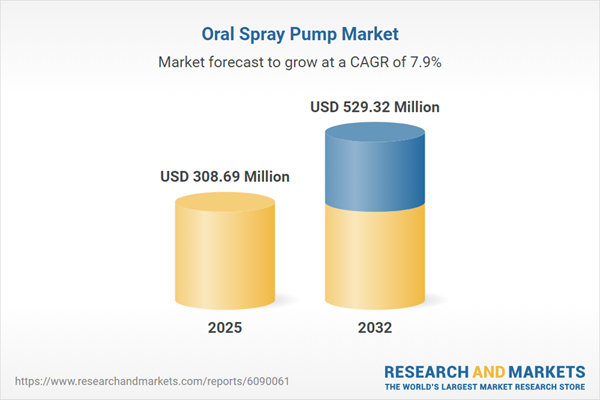

Oral Spray Pump Market Snapshot

The oral spray pump market grew from USD 287.45 million in 2024 to USD 308.69 million in 2025. Sustained by a robust CAGR of 7.93%, the market is projected to reach USD 529.32 million by 2032. This momentum reflects broadening use across self-administration and clinical needs, advanced materials, and integration with connected health technologies. The market continues to adapt to regulatory and supply chain complexities, driving performance improvements and innovation for end users worldwide.

Scope & Segmentation

- Product Types: Continuous spray, Metered dose (multi-dose, single-dose), Trigger spray

- Material Types: Glass (chemical stability), Metal (durability for rechargeable systems), Plastic (single-use and high-volume applications)

- Filling Volumes: Up to 5 ml (portable uses), 5 to 10 ml, Above 10 ml (extended applications)

- End Users: Home care settings, Hospitals and clinics, Pharmacies, Research and development organizations

- Distribution Channels: Offline, Online

- Geographic Coverage: Americas (United States, Canada, Mexico, Brazil, Argentina, Chile, Colombia, Peru), Europe (United Kingdom, Germany, France, Russia, Italy, Spain, Netherlands, Sweden, Poland, Switzerland), Middle East (United Arab Emirates, Saudi Arabia, Qatar, Turkey, Israel), Africa (South Africa, Nigeria, Egypt, Kenya), Asia-Pacific (China, India, Japan, Australia, South Korea, Indonesia, Thailand, Malaysia, Singapore, Taiwan)

- Leading Companies: AptarGroup, Silgan Dispensing Systems, Amway, Berry Global, Comvita, Dynarex, Gerresheimer, Life Extension, Ningbo Sender Medical Technology, Perrigo, Pfizer, Prestige Consumer Healthcare, Procter & Gamble, Schott, Shenzhen Bona Pharma Technology, Sunstar Group, Thera Breath, Wuxi Sunmart Science And Technology, Xinjitai, Xlear

Key Takeaways for Decision-Makers

- Precision dosing and user-centric ergonomics are shaping both clinical and consumer adoption, reflecting increased focus on patient engagement and compliance.

- Technological advances—such as metering accuracy and digital integration—enable consistent dosing, real-time monitoring, and data-driven therapies.

- Material diversification allows manufacturers to tailor products for chemical safety, durability, and sustainability criteria, addressing both regulatory demands and user preferences.

- Device customization—including color-coding and ergonomic refinements—supports brand differentiation and user satisfaction in diverse end-use segments.

- Partnerships with digital health and materials innovators are accelerating paradigm-shifting solutions, building data connectivity and sustainability into new product development.

- Supply chain strategy, including local sourcing and resilient logistics, is becoming a core differentiator as companies recalibrate for policy and material cost changes.

Tariff Impact on Supply and Compliance

Recent United States tariffs have disrupted global supply chains for oral spray pumps, causing manufacturers to evaluate production location, partnerships, and materials to maintain competitiveness. Adaptive sourcing and closer ties with regional fabricators allow ongoing compliance and cost stability, while organizations that proactively address regulatory protocols gain a strategic edge in a shifting policy landscape.

Methodology & Data Sources

This research combines qualitative interviews with industry leaders, site visits to manufacturing facilities, secondary review of academic, patent, and regulatory sources, and a structured scoring model to analyze segment attractiveness and supply chain risks. Data triangulation assures robust, unbiased conclusions for strategic planning.

Why This Report Matters

- Provides actionable insights to identify opportunities in technology, materials, and regional markets for oral spray pump solutions.

- Supports risk mitigation and supply chain resilience planning in the context of ongoing regulatory and international trade shifts.

- Informs investment priorities with clear analysis of segment trends and innovation dynamics relevant to senior leadership.

Conclusion

Strategic agility and sustained innovation define future leaders in the oral spray pump market. Those who prioritize connectivity, user-centric design, and supply chain resilience will effectively advance organizational performance as the landscape evolves.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Oral Spray Pump market report include:- AptarGroup, Inc.

- Silgan Dispensing Systems, Inc.

- Amway Corp.

- Berry Global, Inc.

- Comvita Ltd.

- Dynarex Corporation

- Gerresheimer AG

- Life Extension

- Ningbo Sender Medical Technology CO., LTD

- Perrigo Company plc

- Pfizer Inc.

- Prestige Consumer Healthcare Inc.

- Procter & Gamble Co.

- Schott AG

- Shenzhen Bona Pharma Technology Co., Ltd.

- Sunstar Group

- Thera Breath.

- Wuxi Sunmart Science And Technology Co.,Ltd.

- Xinjitai Pte. Ltd.

- Xlear Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 189 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 308.69 Million |

| Forecasted Market Value ( USD | $ 529.32 Million |

| Compound Annual Growth Rate | 7.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |