Speak directly to the analyst to clarify any post sales queries you may have.

Setting the Stage for Graphene Battery Adoption by Outlining Core Concepts, Market Drivers, and Technological Foundations Shaping the Industry

Graphene batteries represent a paradigm shift in energy storage technologies and promise to address long-standing performance constraints of conventional lithium-ion and lead-acid systems. By leveraging the exceptional electrical conductivity, high surface area, and mechanical flexibility of graphene nanomaterials, these next-generation solutions unlock faster charging cycles, extended life spans, and improved thermal stability. As a result, industry stakeholders from material suppliers to original equipment manufacturers are intensifying their focus on integrating graphene enhancements into existing production lines and emerging pilot facilities.Consequently, a growing ecosystem of research institutions, startups, and established battery producers is coalescing around graphene innovation. Technological advances in scalable synthesis methods, such as chemical vapor deposition and liquid exfoliation, are expanding raw material availability and lowering entry barriers. At the same time, heightened investment in advanced electrode architectures and nanocomposite electrolytes is pushing the envelope of energy density and safety performance.

Despite these promising developments, challenges persist around cost optimization, quality control, and seamless integration with legacy manufacturing infrastructure. Regulatory frameworks and industry standards are still evolving to accommodate novel materials, and establishing robust supply chains for high-purity graphene remains critical. Transitioning from laboratory breakthroughs to commercial viability demands coordinated strategies that bridge research, pilot demonstration, and full-scale deployment.

This executive summary provides a concise yet comprehensive overview of key drivers, technological foundations, and market dynamics shaping the graphene battery landscape. It lays a groundwork for informed decision-making and strategic planning, ensuring that stakeholders are equipped to navigate complexities and capitalize on emerging opportunities.

Revolutionary Developments Reshaping Graphene Battery Innovation and Commercialization Driven by Breakthroughs in Material Science, Manufacturing Processes, and Performance Metrics

Over the past several years, transformative shifts in the graphene battery domain have accelerated commercialization pathways and reshaped competitive dynamics. Breakthroughs in material engineering have enabled the integration of graphene-enhanced electrodes that deliver unprecedented charge-discharge rates, while novel electrolyte formulations incorporating graphene additives are bolstering thermal stability and extending cycle life.Meanwhile, manufacturing innovations such as roll-to-roll coating processes and high-throughput exfoliation techniques have dramatically improved scalability. These advances are empowering producers to transition from pilot-scale operations to large-volume production, meeting surging demand from automotive, consumer electronics, and energy storage sectors. Simultaneously, strategic partnerships between battery developers and tier-one automotive OEMs have catalyzed application-specific validation, accelerating time-to-market for electric vehicle programs.

In parallel, sustainability considerations are elevating graphene batteries as part of broader decarbonization strategies. Reduced reliance on critical raw materials, decreased weight, and improved efficiency are aligning with environmental, social, and governance objectives across industries. Furthermore, emerging regulatory frameworks that incentivize energy-dense and low-emission solutions are reinforcing adoption trajectories.

Collectively, these interwoven developments are redefining performance benchmarks and market expectations. Stakeholders that monitor these shifts and adapt their R&D investments, partnership models, and production roadmaps will be best positioned to lead in the evolving graphene battery ecosystem.

Assessing the Implications of United States Tariff Adjustments on Graphene Battery Supply Chains, Global Trade Relations, and Cost Structures in the 2025 Economic Climate

The introduction of new tariff measures by the United States in 2025 has introduced both challenges and strategic considerations for stakeholders in the graphene battery supply chain. With adjustments to import duties on precursor materials, nanofillers, and finished cell components, cost structures have been impacted across multiple tiers of the value chain. As a result, raw material suppliers and battery manufacturers are reassessing procurement strategies and exploring alternative sourcing to mitigate margin pressures.In response, many organizations are actively diversifying their supplier base, forging partnerships with producers in regions offering preferential trade terms or lower duty regimes. Concurrently, nearshoring initiatives and regional production hubs are gaining traction as companies seek to insulate themselves from tariff volatility. These shifts are not purely cost-driven; they also reflect a broader imperative to enhance supply chain resilience and reduce logistical complexity.

Moreover, the tariff landscape has catalyzed renewed engagement with policymakers and industry associations to advocate for harmonized standards, duty relief programs, and investment incentives. Companies that proactively navigate these regulatory dynamics are better equipped to secure preferential treatment and maintain competitive pricing in key markets.

Despite short-term headwinds, the cumulative impact of tariffs has accelerated strategic realignments that may strengthen the overall ecosystem in the long run. By embracing diversified sourcing, localized manufacturing, and proactive policy engagement, stakeholders can turn tariff challenges into opportunities for innovation and sustainable growth.

Unveiling Critical Segmentation Insights Demonstrating How Type, Component, Application, and Distribution Dimensions Drive Diverse Use Cases and Competitive Strategies

The graphene battery ecosystem can be dissected through multiple segmentation lenses, each revealing distinct value pools and competitive dynamics that inform strategic decision-making. Based on Type the landscape spans Graphene-Metal Oxide Hybrids, Lead-acid Batteries, Li-ion Batteries, and Li-Sulfur Batteries, with each architecture offering unique trade-offs between legacy reliability and next-generation performance characteristics. The Hybrid configurations blend graphene with metal oxides to enhance energy density, whereas the Li-Sulfur variants leverage graphene's conductive network to stabilize sulfur cathodes and extend cycle life.Based on Component the analysis encompasses Current Collectors, Electrodes, Electrolytes, and Separators, illustrating how graphene enhancements are transforming each cell layer. Incorporating graphene into current collectors reduces internal resistance, while graphene-augmented electrodes facilitate faster ion diffusion. Novel graphene-infused electrolytes improve ionic conductivity and safety, and graphene-reinforced separators offer superior mechanical strength and thermal tolerance.

Examination based on Application Type highlights the breadth of graphene battery adoption across Aerospace & Defense, Automotive, Consumer Electronics, Energy Storage, and Medical Devices. In Aerospace & Defense, performance demands drive use in Drones and Space Equipment where weight savings and rapid cycling are critical. The Automotive segment features Electric Vehicles and Hybrid Vehicles, capitalizing on graphene's energy density and fast-charge capabilities. Within Consumer Electronics, Laptops, Smartphones, Tablets, and Wearables benefit from thinner form factors and extended runtimes. The Energy Storage domain includes Grid Storage and Residential Storage systems that leverage graphene for improved efficiency and lifespan, while Medical Devices integrate graphene-enhanced cells into Portable Medical Equipment and Wearable Medical Devices to ensure reliability and compactness.

Finally, segmentation by Distribution Channel distinguishes Offline Retail through Direct Sales and Distributor's Network alongside burgeoning Online Retail platforms, underscoring evolving procurement behaviors and channel strategies.

Evaluating Regional Dynamics Across the Americas, Europe Middle East and Africa, and Asia-Pacific to Highlight Strategic Hubs and Emerging Growth Hotspots for Graphene Batteries

Regional dynamics are playing a defining role in shaping the trajectory of graphene battery development and commercialization. In the Americas, robust R&D funding streams from government agencies and private investors are catalyzing pilot programs and collaborative innovation hubs. The United States and Canada are particularly active in establishing demonstration facilities, accelerating the translation of laboratory breakthroughs into field-tested prototypes.Transitioning to Europe, Middle East and Africa, regulatory alignment and sustainability mandates are driving adoption within energy storage and automotive sectors. The European Union's stringent emissions targets and incentive structures for advanced energy materials have encouraged both established incumbents and new entrants to pursue graphene battery applications. Meanwhile, manufacturing clusters in Germany, France, and the United Kingdom are emerging as strategic centers for high-purity graphene production and cell assembly.

In the Asia-Pacific region, rapid commercial scaling and cost efficiencies are enabling large-volume integration in consumer electronics, electric mobility, and grid stabilization projects. Major economies such as China, Japan, and South Korea are investing heavily in domestic supply chain development, leveraging economies of scale to reduce unit costs and accelerate market penetration.

By understanding these distinct regional priorities-technological innovation in the Americas, regulatory leadership across EMEA, and manufacturing scale in Asia-Pacific-organizations can refine their geographic strategies, allocate resources effectively, and form partnerships that capitalize on localized strengths.

Highlighting the Strategies, Innovations, and Collaborative Efforts of Leading Corporations Accelerating Graphene Battery Research, Production Scalability, and Market Penetration Worldwide

Key industry participants are driving the graphene battery landscape forward through strategic investments, collaborative research, and production capacity expansions. Tesla has initiated exploratory programs integrating graphene additives into its next-generation cell formulations, aiming to accelerate charging times and boost vehicle range. Similarly, Samsung SDI has forged partnerships with leading academic institutions to refine graphene exfoliation techniques and enhance electrode manufacturing yields.Applied Graphene Materials is focusing on scalable synthesis processes designed to ensure consistent quality and supply for downstream battery producers. The company's proprietary functionalization methods are being validated in joint test programs, underscoring a commitment to industrial-scale viability. Skeleton Technologies, a pioneering ultracapacitor developer, is exploring hybrid configurations that combine ultracapacitors with graphene-enhanced lithium cells to meet high-power application demands.

Graphene Manufacturing Group has announced plans to increase production capacity at its pilot facility, reflecting rising demand from both energy storage integrators and electronics manufacturers. Collaborative consortia involving government agencies, research institutes, and private firms are also emerging, aimed at establishing standardized performance metrics and regulatory guidelines.

These concerted efforts underscore a broader industry trend toward cross-sector partnerships and co-innovation models. By leveraging complementary capabilities in materials science, cell engineering, and system integration, leading players are accelerating commercialization timelines and strengthening their competitive positioning in the evolving graphene battery market.

Formulating Actionable Recommendations Empowering Industry Leaders to Navigate Technological Complexities, Enhance Collaboration, and Capitalize on Graphene Battery Market Opportunities

To capitalize on the transformative potential of graphene batteries, industry leaders must pursue a holistic set of strategic initiatives that encompass technology, partnerships, and market engagement. First, organizations should dedicate resources to pilot-scale production lines that validate manufacturing processes under real-world conditions, ensuring seamless transition to high-volume operations. Simultaneously, establishing cross-industry consortia with automotive, aerospace, and energy storage stakeholders will facilitate shared infrastructure investments and accelerate performance benchmarking.Next, companies should engage proactively with regulatory authorities to shape standards for material certification, safety testing, and environmental compliance. Early alignment with emerging guidelines will reduce approval timelines and foster trust among end users. Furthermore, securing long-term agreements with upstream graphene suppliers through joint ventures or off-take contracts will mitigate raw material volatility and support cost optimization.

On the technology front, targeted R&D programs should focus on application-specific cell designs, including optimized electrode architectures for electric vehicles and specialized electrolyte formulations for grid-scale deployments. Complementing this, advanced analytics techniques such as digital twin simulations and in-line quality monitoring can uncover process inefficiencies and drive continuous improvement.

By integrating these actionable steps into a cohesive roadmap, industry leaders can navigate technological complexities, de-risk critical supply chains, and capture first-mover advantages in the rapidly evolving landscape of graphene batteries.

Detailing the Rigorous and Transparent Research Methodology Underpinning Data Collection, Validation Practices, and Analytical Frameworks Employed in This Study

This research employs a multi-faceted methodology designed to ensure rigor, transparency, and reproducibility. Primary research activities include in-depth interviews with executives and technical experts from battery manufacturers, graphene producers, and end-use integrators. These conversations are complemented by structured surveys targeting R&D leads and supply chain managers to capture nuanced perspectives on performance requirements and market drivers.Secondary research draws on peer-reviewed journals, patent filings, conference proceedings, and publicly available corporate disclosures. Detailed analyses of material synthesis patents provide insight into emerging trends in graphene functionalization, while regulatory filings and white papers offer context on evolving compliance frameworks. Industry association reports and technical symposium materials further enrich the data set.

Data triangulation ensures consistency across diverse sources, with cross-validation performed using both top-down and bottom-up analytical frameworks. Qualitative insights are mapped against quantitative indicators such as production capacity and adoption milestones. Analytical tools, including SWOT and PESTLE analyses, are employed to assess strategic risks and opportunities. Finally, all findings undergo iterative expert review, incorporating feedback from industry advisors to refine conclusions and recommendations.

Drawing Conclusive Perspectives on the Strategic Imperatives, Technological Milestones, and Collaborative Pathways That Will Define the Future of Graphene Batteries

In conclusion, graphene batteries stand at the cusp of redefining energy storage paradigms through their unique combination of high conductivity, mechanical robustness, and thermal resilience. As breakthroughs in scalable production and material integration continue to evolve, the industry is poised for accelerated adoption across sectors ranging from electric mobility to grid stabilization and beyond.Strategic imperatives have emerged around forming symbiotic partnerships, securing resilient supply chains, and aligning with regulatory bodies to expedite market entry. Concurrently, targeted investments in pilot-scale manufacturing and advanced quality management systems will differentiate market leaders from followers. The interplay between technological innovation and strategic execution will determine which organizations capture lasting competitive advantages.

Forward-looking stakeholders should embrace an integrated approach, coupling deep technical expertise with agile business models and proactive policy engagement. By doing so, they will not only meet rising performance expectations but also contribute to broader sustainability objectives and global decarbonization goals.

Ultimately, the organizations that master these critical dynamics will shape the future of the graphene battery ecosystem, unlock new application frontiers, and generate transformative value for end users worldwide.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Type

- Graphene-Metal Oxide Hybrids

- Lead-acid Batteries

- Li-ion Batteries

- Li-Sulfur Batteries

- Component

- Current Collectors

- Electrodes

- Electrolytes

- Separators

- Application Type

- Aerospace & Defense

- Drones

- Space Equipment

- Automotive

- Electric Vehicles

- Hybrid Vehicles

- Consumer Electronics

- Laptops

- Smartphones

- Tablets

- Wearables

- Energy Storage

- Grid Storage

- Residential Storage

- Medical Devices

- Portable Medical Equipment

- Wearable Medical Devices

- Aerospace & Defense

- Distribution Channel

- Offline Retail

- Direct Sales

- Distributor's Network

- Online Retail

- Offline Retail

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Cabot Corporation

- Directa Plus PLC

- Global Graphene Group

- Graphene Manufacturing Group

- Graphex Group Limited

- Huawei Technologies Co., Ltd.

- Nanotech Energy, Inc.

- NanoXplore Inc.

- Panasonic Corporation

- Skeleton Technologies OÜ

- Talga Group Ltd

- Zentek Ltd

- Graphenea S.A.

- Vorbeck Materials Corp.

- Hybrid Kinetic Group Ltd.

- Elcora Advanced Materials Corp.

- G6 Materials Corp

- Samsung Electronics Co., Ltd.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Graphene Batteries Market report include:- Cabot Corporation

- Directa Plus PLC

- Global Graphene Group

- Graphene Manufacturing Group

- Graphex Group Limited

- Huawei Technologies Co., Ltd.

- Nanotech Energy, Inc.

- NanoXplore Inc.

- Panasonic Corporation

- Skeleton Technologies OÜ

- Talga Group Ltd

- Zentek Ltd

- Graphenea S.A.

- Vorbeck Materials Corp.

- Hybrid Kinetic Group Ltd.

- Elcora Advanced Materials Corp.

- G6 Materials Corp

- Samsung Electronics Co., Ltd.

Table Information

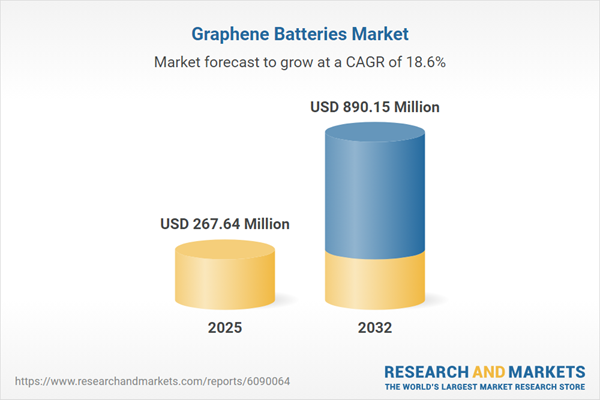

| Report Attribute | Details |

|---|---|

| No. of Pages | 195 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 267.64 Million |

| Forecasted Market Value ( USD | $ 890.15 Million |

| Compound Annual Growth Rate | 18.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 19 |