Speak directly to the analyst to clarify any post sales queries you may have.

An In-Depth Introduction Highlighting the Current State and Strategic Drivers Shaping the Evolving Global Rain Jacket Industry Landscape

The rain jacket market stands at a pivotal crossroads as functionality, fashion, and sustainability converge to redefine consumer expectations and competitive dynamics. Leading apparel manufacturers and technology developers are pushing the envelope by integrating cutting-edge fabrics designed to deliver unparalleled waterproof performance while minimizing environmental impact. At the same time, heightened consumer awareness regarding ethical production practices fuels demand for transparent supply chains that uphold fair labor standards and reduce carbon footprints.Against this backdrop, industry participants must navigate a complex web of regulatory requirements governing materials and import duties, as well as evolving retail models that challenge traditional distribution hierarchies. Digital platforms continue to reshape the buyer journey, compelling established brands to recalibrate omnichannel strategies and capitalize on data-driven personalization. Moreover, collaborations with outdoor lifestyle influencers and specialized retailers are opening new avenues to engage niche segments seeking performance-driven yet stylish outerwear.

In this context, businesses that anticipate shifts in raw material availability and leverage emerging manufacturing processes will secure a competitive edge. By understanding the interplay between sourcing dynamics, consumer trends, and technological advancements, stakeholders can chart a course toward sustainable growth and market leadership in the global rain jacket arena.

Transformative Shifts Reshaping Growth Dynamics and Competitive Strategies in the Rain Jacket Market under Rapid Technological and Consumer Evolution

The landscape of the rain jacket industry is undergoing transformative shifts as sustainability imperatives, technological innovation, and shifting consumer behaviors intersect. Breakthrough developments in eco-friendly laminates and performance coatings are elevating product lifecycles while reducing ecological impact. Simultaneously, the proliferation of digital marketplaces is dismantling geographic barriers, enabling direct-to-consumer engagement that accelerates product feedback loops and drives rapid iteration.Furthermore, the rise of experiential retail concepts has prompted brands to reimagine brick-and-mortar environments, blending immersive storytelling with hands-on testing zones that reinforce functional claims. This fusion of technology and retail architecture not only enhances brand authenticity but also fosters deeper emotional connections with discerning urban and outdoor enthusiasts alike. In parallel, the integration of smart textiles equipped with sensor capabilities is laying the groundwork for garments that adapt dynamically to weather changes, thereby redefining consumer expectations of protective apparel.

As a result, market participants are compelled to reexamine conventional R&D roadmaps and prioritize cross-disciplinary partnerships. By embracing a holistic approach that aligns environmental stewardship with advanced material science and immersive consumer experiences, companies can seize first-mover advantages and shape the next generation of rain jackets.

Assessing the Cumulative Impact of Recent United States Tariffs on Production Chains and Cost Structures within the Rain Jacket Sector

In recent years, United States tariffs have introduced significant ripple effects across rain jacket supply chains, influencing both cost structures and sourcing decisions. Firms reliant on polymer substrates such as polyurethane faced immediate margin pressures as duty rates were adjusted, prompting procurement teams to diversify supplier networks and reassess sourcing locations. Meanwhile, brands sourcing nylon and polyester components from key Asian exporters have reevaluated inventory strategies to pre-empt further tariff escalations.Consequently, several manufacturers accelerated investments in regional production capacities to reduce exposure to transpacific trade tensions and shorten lead times. These strategic realignments have not only mitigated tariff-related cost increases but also enhanced supply chain resilience amid fluctuating global trade policies. At the same time, emerging collaborations between North American textile mills and eco-oriented finishers have begun to offset the financial impact of duties by introducing higher-margin sustainable offerings.

Looking forward, stakeholders are closely monitoring potential policy shifts that could revisit existing tariff frameworks. By maintaining agile trade compliance capabilities and fostering nearshoring initiatives, industry players can safeguard profitability and ensure consistent market access despite an unpredictable geopolitical environment.

Revealing Key Segmentation Insights by Material Type, Demographic Category, End-Use Application, and Evolving Distribution Channels

A nuanced examination of material segmentation reveals that premium segments anchored in nylon and polyurethane technologies lead the innovation curve, while cost-sensitive channels continue to rely on polyester and polyvinyl chloride variants. When considering demographic segmentation, children's outerwear combines playful aesthetics with robust weatherproofing, men's ranges emphasize technical performance, women's collections balance functionality and style preferences, and unisex lines cater to versatile lifestyle demands.End-use differentiation underscores that daily urban commuters prioritize lightweight breathability and packability, whereas outdoor and sports enthusiasts demand reinforced seams and advanced moisture management. In distribution channels, offline retail footprints extend through traditional retail stores, specialty shops, and supermarkets or hypermarkets, offering customers tactile experiences and immediate product availability. Parallel growth in brand websites and e-retailer platforms has democratized access to niche brands, enabling sophisticated recommendation engines to guide purchase decisions and facilitate seamless returns.

Integrating these segmentation layers empowers decision-makers to tailor R&D investments, marketing narratives, and distribution strategies to specific consumer profiles, thereby maximizing engagement and commercial impact.

Unpacking Critical Regional Insights to Understand Diverse Market Drivers across Americas, EMEA, and Asia-Pacific Landscapes

Regional analysis highlights that the Americas region continues to drive demand through urbanization trends and a rising affinity for athleisure-inspired protective wear. Within the United States and Canada, partnerships between rainwear brands and specialty outdoor retailers bolster credibility among enthusiast communities, while e-commerce platforms expand reach into secondary markets.In Europe, the Middle East, and Africa, variable weather patterns and cross-border tourism sustain a robust appetite for multifunctional rain jackets, with Western European consumers placing greater emphasis on environmental certifications and supply chain transparency. Meanwhile, manufacturers in Eastern Europe explore joint ventures that leverage cost-competitive labor pools and established textile clusters.

Across Asia-Pacific, a burgeoning middle class in China, Southeast Asia, and India fuels interest in aspirational performance wear, and domestic producers are stepping up capacity to meet regional demand. Concurrently, innovative co-development agreements between global brands and local fabric mills facilitate knowledge transfer and accelerate the rollout of climate-adaptive materials. By recognizing these distinct regional drivers, market leaders can align product portfolios and commercial models to capture targeted growth opportunities across diverse economic and cultural landscapes.

Profiling Leading Companies and Strategic Movements Dominating Innovation, Partnerships, and Competitive Positioning in the Rain Jacket Space

Leading companies in the rain jacket domain differentiate through strategic investments in fabric innovation, sustainability certifications, and consumer engagement initiatives. Several established outerwear brands have forged strategic alliances with technology startups to co-develop advanced membranes and eco-conscious textile treatments. These collaborations yield first-to-market product lines that set new benchmarks for durability and environmental performance.Moreover, forward-looking manufacturers are adopting circular design principles, instituting take-back schemes to repurpose used garments and reclaim high-value materials. This closed-loop approach not only enhances brand storytelling but also addresses regulatory pressures related to waste management and extended producer responsibility. In parallel, major players leverage omnichannel analytics to refine inventory allocation and forecast emerging style trends, thereby reducing markdown-related losses and elevating full-price sell-through rates.

Competitive differentiation also arises from exclusive partnerships with outdoor adventure initiatives and urban mobility services. By aligning with organizations that embody active, sustainability-oriented lifestyles, companies reinforce their brand ethos and unlock new distribution opportunities through co-branded events and limited-edition collaborations.

Actionable Recommendations for Industry Leaders to Navigate Market Complexities, Enhance Competitive Edge, and Drive Sustainable Growth

To remain at the forefront of market evolution, industry leaders should prioritize the adoption of sustainable fabric technologies while accelerating collaborations with material science innovators. Investing in circular economy initiatives that facilitate effective garment recycling will enhance brand equity and reduce regulatory exposure. Additionally, forming strategic alliances with digital retail platforms and outdoor lifestyle partners can amplify customer reach and enrich brand narratives.Simultaneously, companies must bolster supply chain agility by diversifying sourcing footprints and exploring regional manufacturing hubs to mitigate geopolitical risk. Integrating advanced data analytics across product development and inventory management functions will enable real-time demand sensing and support more precise production planning. Furthermore, crafting immersive consumer experiences through digital showrooms, virtual try-on tools, and interactive product storytelling will strengthen engagement and foster long-term loyalty.

By implementing these recommendations, decision-makers can optimize operational resilience, capture emerging consumer segments, and solidify their competitive positioning in an increasingly dynamic rain jacket market.

Detailing Research Methodology with Robust Data Collection, Rigorous Analysis, and Objective Validation to Ensure Comprehensive Rain Jacket Market Insights

This research leverages a multi-stage methodology encompassing comprehensive secondary research, expert consultations, and rigorous data triangulation. Initially, industry publications, regulatory filings, and patent databases were analyzed to map key technological innovations and regulatory shifts. Secondary insights were then validated through in-depth interviews with material scientists, supply chain executives, and retail strategists to contextualize emerging trends and confirm strategic implications.Subsequently, a matrix-based approach facilitated the cross-referencing of qualitative insights with quantitative indicators such as trade flow data and fabric production metrics. This triangulation ensures a balanced perspective that accounts for both macroeconomic forces and micro-level operational realities. In parallel, competitive benchmarking was conducted to evaluate leading companies' product portfolios, partnership models, and go-to-market strategies across diverse regional contexts.

Throughout the research process, stringent quality controls and peer reviews were applied to uphold analytical rigor and objectivity. The resulting framework delivers a holistic view of the rain jacket sector, equipping stakeholders with actionable intelligence and a clear understanding of emerging opportunities and industry challenges.

Concluding Perspectives on Future Opportunities, Anticipated Challenges, and Strategic Priorities for the Global Rain Jacket Industry

As the rain jacket sector continues to intersect with technological breakthroughs and sustainability imperatives, the path forward demands strategic foresight and adaptive execution. Companies that embed circular design philosophies and invest in next-generation materials will meet evolving consumer expectations and navigate tightening environmental regulations. Concurrently, harnessing data-driven insights to optimize product assortments and distribution frameworks will prove critical to sustaining revenue growth and customer loyalty.Looking ahead, the convergence of smart textiles and connected retail experiences promises to redefine protective apparel's functional boundaries. Early adopters that cultivate cross-industry partnerships and pilot sensor-enabled garment prototypes will unlock new value streams and differentiate through bespoke features. Moreover, an unwavering focus on supply chain transparency will fortify brand integrity and position market leaders to capitalize on rising demand for ethically produced outerwear.

Ultimately, the companies that successfully integrate innovation, sustainability, and customer-centric strategies will shape the future landscape of the rain jacket industry and secure long-term competitive advantage.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Material

- Nylon

- Polyester

- Polyurethane

- Polyvinyl Chloride

- Category

- Children

- Men

- Unisex

- Women

- End-use

- Daily/Urban Use

- Outdoor & Sports

- Distribution Channel

- Offline Retail

- Retail Stores

- Specialty shops

- Supermarkets/hypermarkets

- Online Retail

- Brand Websites

- E Retailers

- Offline Retail

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Columbia Sportswear Company

- Arc'teryx by Amer Sports

- Berghaus Limited

- Dollar Industries Ltd.

- Eddie Bauer LLC

- Fenix Outdoor E-Com AB

- Helly Hansen AS by by Kontoor Brands, Inc.

- JACK WOLFSKIN Retail GmbH by by ANTA Sports

- Jacobs & Turner Ltd.

- K-Way S.p.A.

- Mammut Sports Group AG

- Marmot by Newell Brands Inc.

- Nike, Inc.

- Norrøna Sport AS

- Outdoor Research, LLC

- Paramo by GearForm Holdings Ltd

- Parmi Lifewear

- Patagonia, Inc.

- Polartec, LLC

- Rab by Equip Outdoor Technologies UK LTD

- Regatta Ltd

- Reise Moto

- Royal Enfield by Eicher Motors Limited

- Salomon Group

- The North Face by VF Corporation

- W. L. Gore & Associates GmbH

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Rain Jackets market report include:- Columbia Sportswear Company

- Arc'teryx by Amer Sports

- Berghaus Limited

- Dollar Industries Ltd.

- Eddie Bauer LLC

- Fenix Outdoor E-Com AB

- Helly Hansen AS by by Kontoor Brands, Inc.

- JACK WOLFSKIN Retail GmbH by by ANTA Sports

- Jacobs & Turner Ltd.

- K-Way S.p.A.

- Mammut Sports Group AG

- Marmot by Newell Brands Inc.

- Nike, Inc.

- Norrøna Sport AS

- Outdoor Research, LLC

- Paramo by GearForm Holdings Ltd

- Parmi Lifewear

- Patagonia, Inc.

- Polartec, LLC

- Rab by Equip Outdoor Technologies UK LTD

- Regatta Ltd

- Reise Moto

- Royal Enfield by Eicher Motors Limited

- Salomon Group

- The North Face by VF Corporation

- W. L. Gore & Associates GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | November 2025 |

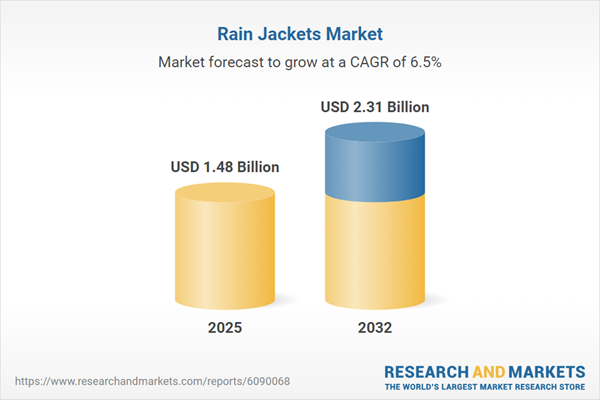

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 1.48 Billion |

| Forecasted Market Value ( USD | $ 2.31 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |